Is Ipswich the next Parramatta?

Parramatta has long been seen as one of the most significant growth areas in Sydney.

It’s on a major train line, has every amenity that can be thought of – serviced by a huge Westfield – and takes just 25 minutes to get to Sydney’s Central station.

Attracting big name developers, such as Crown Group with their recent V by Crown development, and many offshore developers taking their first steps into the Sydney market, it’s a behemoth.

The bullish growth-orientated council in July 2010 released a report called Parramatta – Australia’s next CBD, and many would agree that four years on they’ve achieved that aim or are close to it.

In fact, turning to their property prices a clear picture of growth emerges. In January 2010, RP Data recorded the median house price at $544,000 and the median unit price at $350,000. Those medians have now risen to $712,500 and $471,125 respectively. This is indicative of both increasing demand and willingness to buy in Parramatta, and high standard developments bringing prestige apartments to the market. Median weekly advertised rent sits at $460 for a house and $440 for an apartment.

It’s not even done yet – with several more billions of dollars to be poured into developing Parramatta, and the tallest residential tower in Australia slated for the city.

This wasn’t a surprise hotspot. While some were suspicious of the area 10 years ago, the last five years have seen many buying in, suggesting that it’s a worthwhile place to consider and many a property industry pundit has recommended it to their nearest and dearest in the past.

Yet, with prices becoming too high for the majority of investors, understandably, this has many turning elsewhere for opportunities – particularly as growth has already occurred and discussions of Sydney’s slowdown are being heard.

At the Sydney Home Buyer and Property Investor show, Property Queensland Pty Ltd had the slogan ‘Ipswich – Brisbane’s Parramatta’ on their stand, boasting strong yields and opportunities for investors.

Taking it to the data first, RP Data currently puts Ipswich’s median house price at $309,000. In 2010, this was $332,000. The data for units is statistically unreliable (across the statistical area of Ipswich, the latest available data from the Australian Bureau of Statistics notes that less than 2.5% of the dwellings are apartments).

It’s worth remembering the floods that ravaged the area in 2011, and are likely behind some of the subdued prices. Median weekly advertised rent sits at $280.

Todd Hunter, director and buyer’s agent for Cronulla, Sydney agency wHeregroup, has been buying in Ipswich for several years.

This property (pictured below) was purchased by Hunter for a client in 2012. It was bought at $274,000, settling in September of that year, and is currently rented at $340 per week – or 6.45% rental yield.

Unsurprisingly, he’s keen on the area for his clients as it fits his investing model – below $300,000, high yielding properties in his discovered growth areas.

“Ipswich offers the ability for those who live there to work in the Ipswich CBD as well as the new developing Springfield Lakes Business Park,” he explained to Property Observer.

“Now with the new train line opened in Springfield and Springfield Lakes, this will attract those access to travel into the are for work.”

Yet he concedes it’s not as big as Parramatta, despite both attracting more businesses caring for lifestyle, as well as business and corporate-type industries.

“NEC is one company that sees the benefits of what the area has to offer. And with Orion shopping centre across the road, it allows those working there to enjoy the benefits of having nice places to enjoy their lunch and shopping,” he explains.

Article continues on the next page. Please click below.

But can Ipswich really be equated to Parramatta?

Property Queensland Pty Ltd managing director Graeme Shiels provided Property Observer with the following points as to why he considers Ipswich equitable to Parramatta.

- Their CBDs are both "cities within their city"

- They are both in the western suburbs

- Decades ago, those who lived in Sydney's western suburbs were known as "westies" and lived in low-priced properties

- Parramatta CBD then emerged to what it is now and some dwelling are well over the $1m mark

- Ipswich CBD has commenced this emergence with new buildings going up and is the hub of this region which is about half the km2 of the ACT

- The Qld govt is transferring thousands of public servants from Brisbane to the Ipswich CBD

- North Ipswich now has the equivalent of a Westfield regional shopping centre

- Amberley has the RAAF's biggest air base in Australia

- A 188 hectare aerospace business park commences construction this year next to the RAAF base, to become the biggest maintenance facility in Australia

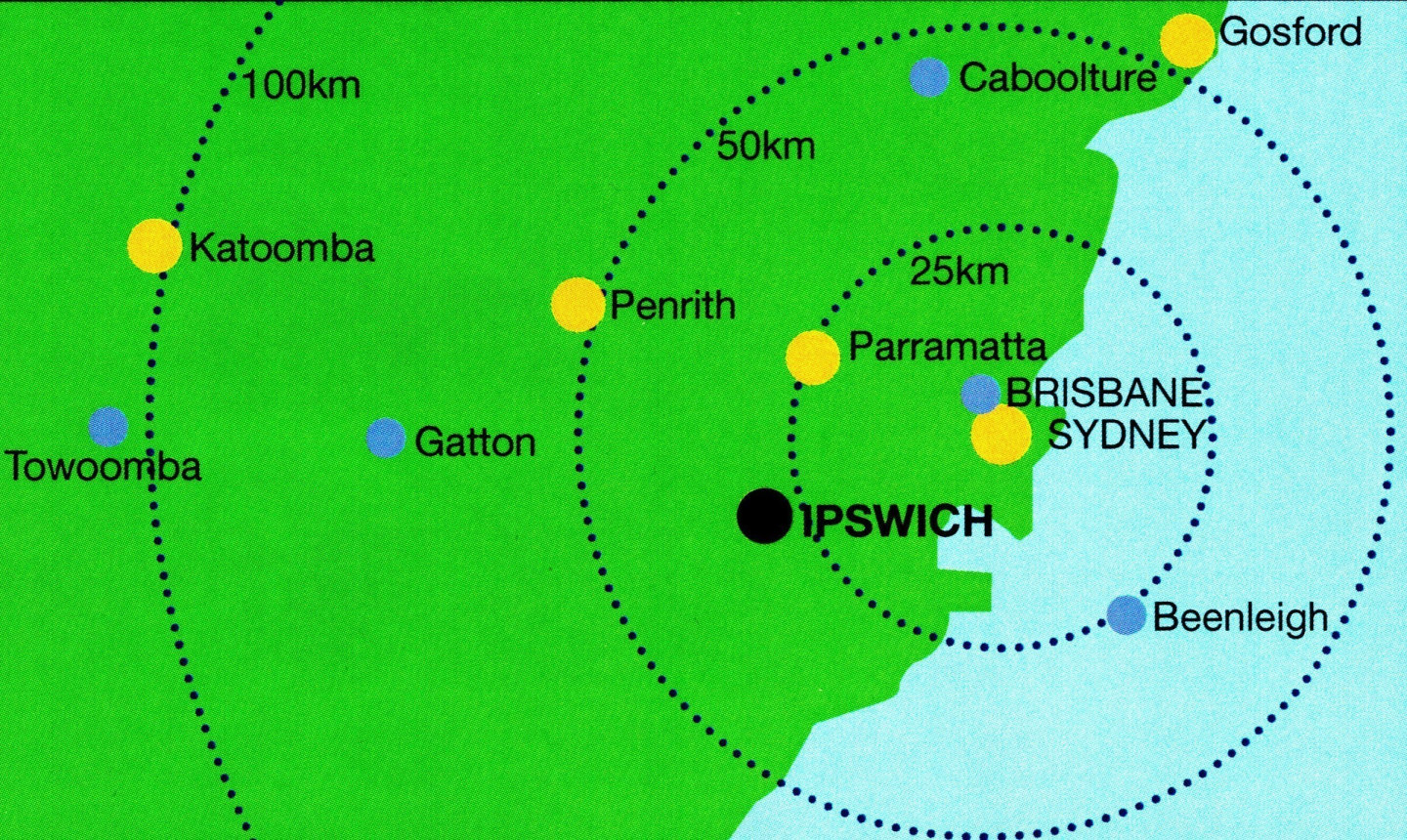

He also believes that the distance from Parramatta to Sydney, and that from Ipswich to Brisbane, is crucial – he provided the image below expressing this.

Shiels' research, which he notes has been his ongoing project for 10 years, also cites well-known property commentator Michael Matusik, as does the Ipswich council.

In 2003, Matusik's 'The Matusik Snapshot' said: "Ipswich has the capacity to be the Parramatta of SEQld ... has large tracts of relatively cheap land and now, with a pro-active local council and state government incentives, Ipswich looks set to deliver."

Ipswich's potential has clearly been on the radar of many for some time - despite 2003's Parramatta being vastly removed from that we see today.

However, Ipswich was recently seeing many people making a loss. RP Data’s Pain and Gain report saw no Brisbane municipalities escape losses, and in fact Ipswich saw the most loss making sales – with 19.2% of those sold in the March quarter doing so at a loss. The median loss was recorded at $21,000. Painful numbers indeed.

And yet, from previous research, it does seem the area is picking up.

Observer Terry Ryder has also put his thoughts to the area, some two years ago, suggesting growth would be strong.

“The Ipswich corridor is well-known around Australia as a growth region. It became popular with investors in the mid-noughties for its cheap prices and above-average yields, and prices rose strongly in the five years to 2010,” he explained in 2012.

“Big infrastructure developments like the $2.8 billion upgrade of the Ipswich Motorway (officially opened in May) and the $1.5 billion rail link to the Springfield master-planned community are adding to the area’s appeal, as is the ongoing emergence of major jobs nodes, such as the commercial components of Springfield, big industrial estates like Citiswich and the expanding RAAF Base at Amberley, just outside Ipswich,” he said.

Taking the debate to Twitter, it saw some warning of floods in the region. Certainly something to avoid, and easily done using these Council flood maps. It's also notable that there's a distinct lack of higher density dwellings than seen in Parramatta - something that has recently come to define Sydney's second CBD.

So does it offer potentially good investment prospects? If you buy well, it does seem to offer lower priced, higher yielding prospects.

But is it able to be equated to Parramatta just yet? The jury is out.

{module Do you think Ipswich has the potential to be Brisbane's Parramatta?}

Picture courtesy of Wikimedia Commons/Clarebear/ CC BY-SA 3.0.