Sydney market overvalued, with “bubble” potential: John Edwards

If Sydney’s growth continued at the high levels being seen before, then it could have been the beginning of bubble conditions and price drops, according to Residex’s John Edwards.

Discussing new research from Onthehouse that noted residential capital growth rates for May were at lower levels that expected, Edwards expressed his relief.

“With any luck, the statistics will continue on this new trend of lower rates of growth over the next few months. Housing markets, particularly Sydney, were moving to a “boom” like performance,” said Edwards.

“This was dangerous and could have led to a “bubble” and a severe correction if it continued. The slowing of the market at this point in time suggests that we are going to avoid this outcome. Having said this, the Sydney market is still overvalued and in reality too expensive,” he said.

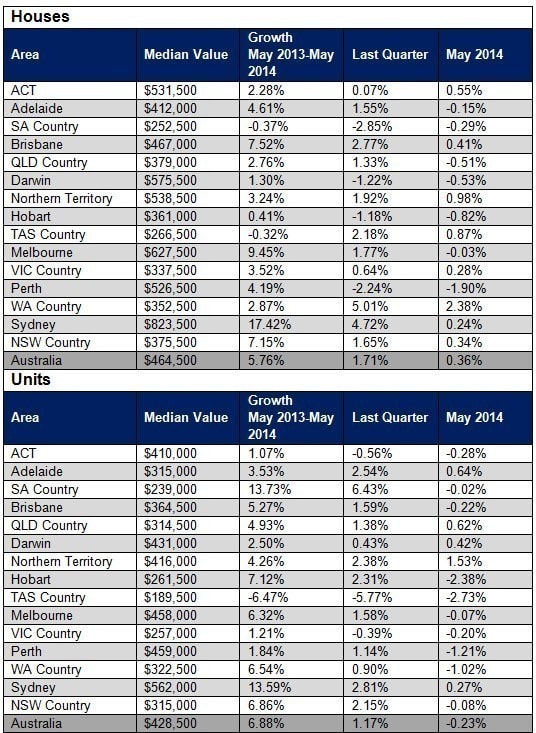

In many areas across Australia, houses and units experienced negative growth rates for the month – although overall national house growth was recorded at 0.36% in May. This compares to 1.71% in the last quarter. Units dropped nationally by 0.23%, compared to 1.17% growth over the quarter.

In Sydney, house growth was subdued at 0.24%, but remains 17.42% up over the last 12 months. House values in Melbourne dropped 0.03%, although still clocked in 9.45% growth over 12 months.

In fact, over the month, Country Western Australia recorded the highest house price growth rate with a 2.38% result. Perth, however, had the biggest house price decline, with a 1.9% fall.

In the Northern Territory, units grew the most by 1.53%, with unit values falling the most in Country Tasmania, by 2.73%.

These figures have Edwards a little more comfortable that growth rates will be subdued in the future.

“The data from May is not sufficient on its own to confirm that this lower rate of growth is about to be a new feature, but my best guess is that this will in fact be the case,” he said.

He also notes the Sydney unit market is likely passed its peak, with 2.81% growth for the quarter ending May.

House and land may not be quite at this point.

However, it is not as clear that the house and land market has arrived at the same position.

“The Sydney house and land assets are more often traded via the auction market and hence clearance rates are potentially a lead indicator for this sector. In recent weeks, auction clearance rates in Sydney have been softer – our calculations indicate that the Sydney clearance rate was 68% for the week ending 14 June. This figure suggests a market that is now slowing.”

Turn the page for the full details of house and unit price movements across Australia.

Source: Onthehouse.com.au