The Brisbane market recovery: Where to next?

As many readers know, Brisbane City is well into a residential recovery.

This recovery started late last year. It followed a long stagnation period, which was needed, as the market had overheated during the 2001 to 2008 upturn.

Brisbane values appreciated something in the order of 230% over that seven year period.

Where to next?

This time around, values are expected to lift, but mildly in comparison.

Potentially, house values could rise by another 11% and attached property values – especially in Brisbane’s middle-ring suburbs – by as much as 19%. This takes into account the current low interest rate setting.

The meaning of recovery

Yet this recovery is more about being able to sell your property, rather than how much will it appreciate. Our borrowing capacity analysis suggest that once interest rates normalise (increase) in coming years, dwelling appreciation across Brisbane will slowdown and even potentially see price falls if home loan rates rise to over 7%.

Like many areas across the country, Brisbane’s current recovery and pending upturn is likely to be short in duration this cycle, with the market peaking in late 2015/early 2016, depending on interest rate movements; employment trends and dwelling supply.

Future housing demand

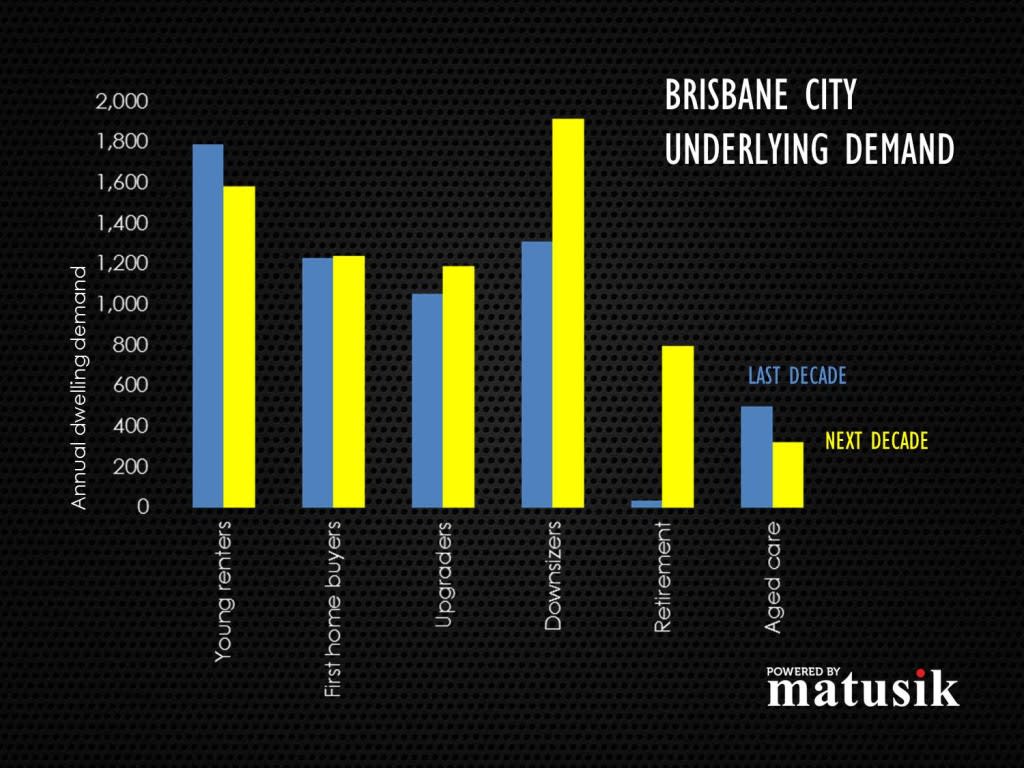

Brisbane City has an aging demographic profile. Increasingly, much of the housing market across the Brisbane City area will be looking to downsize and/or retire. This will fuel the need for more attached homes; often smaller in size than traditional detached housing. The catch-cry is “place for space”, meaning that buyers will be looking to live in quality projects, in established urban areas.

c Interestingly, the first home buyer segment and even the upgrader market is unlikely to grow as much in size as those downsizing, suggesting that resale supply of baby boomer-first generation homes may exceed demand (first time buyers and those upgrading).

Prices and rental growth

Prices for second-hand stock could fall post 2016; and/or many looking to downsize will choose (reluctantly) to not sell and continue to age in place. More affordable infill stock would alleviate this potential market segment mismatch.

Whilst remaining a large demographic group, with a 24% market share, the young rental market (tenants mostly of inner city apartments) is expected to contract in coming years.

This comes at a time when record numbers of new apartments are being built across Brisbane’s inner city.

Prices and rental growth for new apartments are likely to be subdued until the excess new supply is absorbed. This may take several years and is likely to take place between 2016 and 2018. The second-hand apartment market is likely to be hit the hardest, especially when it comes to rents.

Property DNA

Many of the market fundamentals – the city’s property DNA so to speak – look quite healthy over the next decade. These include population growth; job creation; household incomes; relative affordability; renovation activity and infrastructure delivery.

Matusik Property Pulse™

It may be best, if viewing Brisbane for residential investment, to buy something that would suit an aging demographic. Something attached maybe, rather than a traditional detached home.

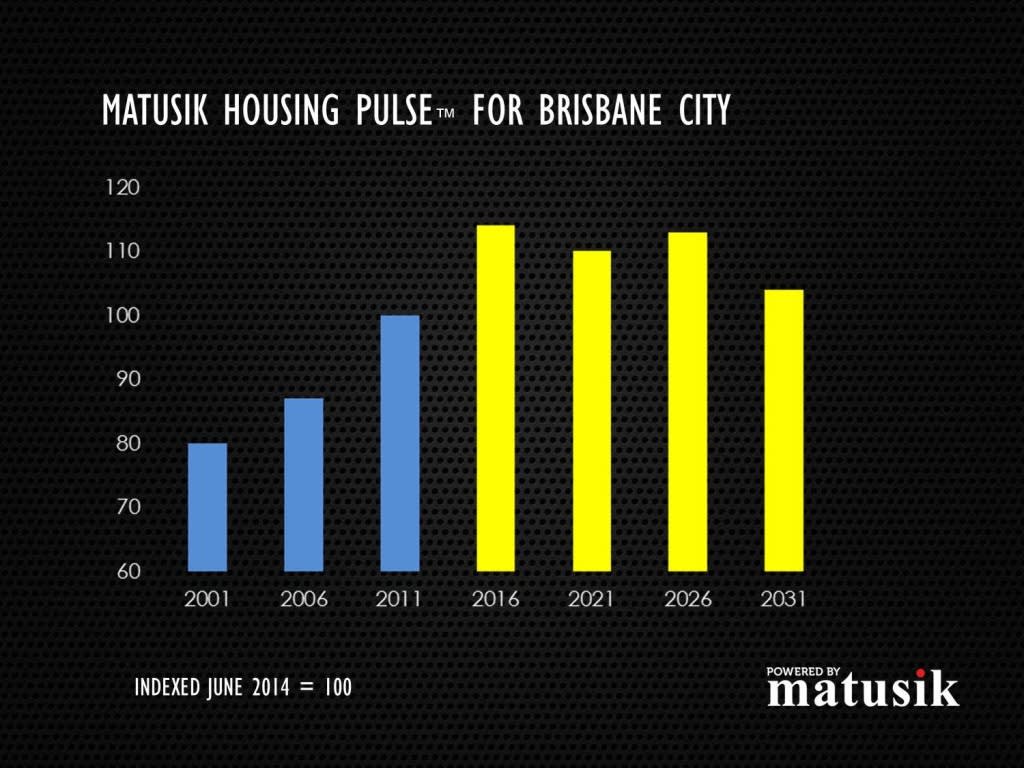

Also, given the aging demographic profile, our Property Pulse™ reading suggests that Brisbane’s net housing demand is close to peaking and will settle back (at a high level) in coming years. This means subdued, not accelerating, price growth.

The Matusik Property Pulse™ measures the size and direction of the largest (in terms of money spent) home buyer segment in the Australian real estate market, being the 40 to 44 year age group. There is a very strong correlation between the size and direction of this market segment and property sales; price and rental growth.

Final word

Increasingly, Brisbane should attract high rents. Rental returns are likely to be the major driver behind Brisbane residential investments in the coming decade.

Visit Michael's website, read his blog, follow him on Facebook and Twitter, or connect via LinkedIn.