Slight fall in number of negatively geared property investors

Negative gearing, which allows expenses associated with investments to be off-set against income earnings, is repeatedly referenced in the 2011-2012 Taxation Statistics Report released recently by the Australian Taxation Office (ATO). Some of the most common deductions for residential property are: rental interest, capital works and other costs such as strata levies and depreciation.

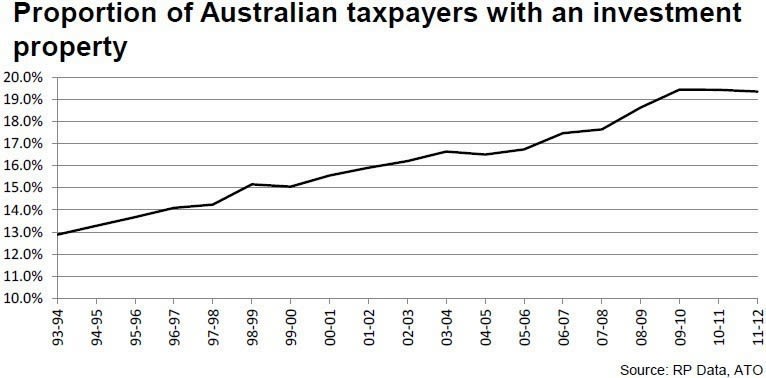

The ATO stated that over the 2011/12 financial year there were 9,799,820 million taxable individuals in Australia. Of these individuals, 19.3% or almost one in five owned investment properties.

The proportion of Australian’s that now own an investment property is currently trending higher although there was a slight fall over the most recent year; in 1993/94, 12.9% of taxpayers owned an investment property compared to 19.3%.

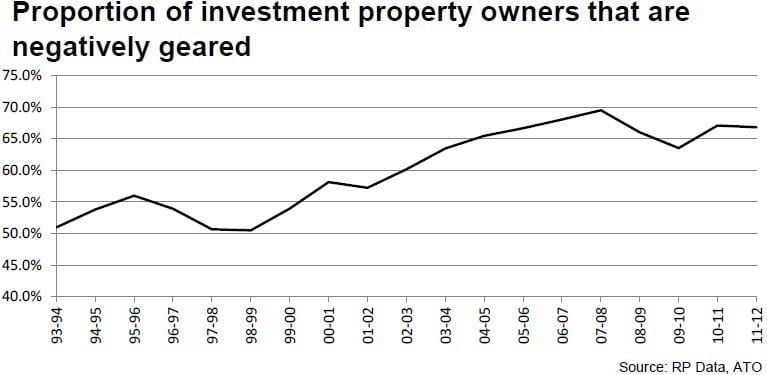

It was interesting to see the increase in the proportion of investment property owners that are negatively geared.

The proportion of investors reporting a net loss on investment property increased from just over half (51.0%) in 1993/94 to 66.8% in 2011/12.

Once again, the proportion of negatively geared investors has eased slightly over the most recent year however, less than one third of all owners of residential investment property are actually producing a net profit from that investment.

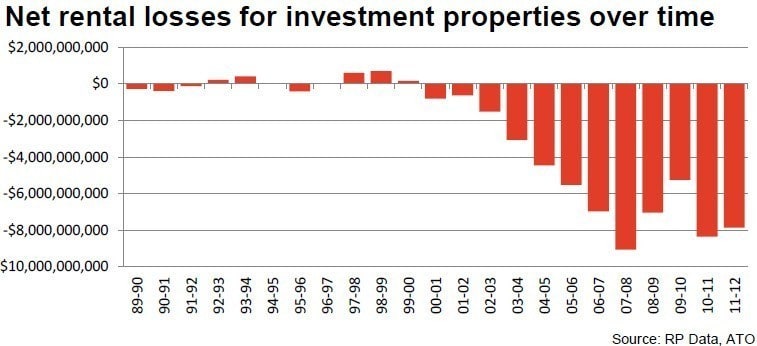

The 2011/12 taxation statistics show that gross rent from investment properties was recorded at a record high $33.999 billion. The analysis on the deductions claimed from this amount: $24.177 billion, was for rental interest deductions. $2.167 billion was claimed in rent capital works deductions and $15.351 billion was claimed in ‘other deductions’. As a result, the net rental losses on investment property over the 2011/12 financial year were recorded at $7.859 billion.

Although this is a large sum, it has reduced from its peak of $9.064 billion in 2007/08.

Over the 2011/12 financial year, 629,230 individuals recorded a gross profit from their investment properties with the total profit recorded at $5.939 billion or $9,439 per investor per annum. Conversely, 1,266,540 taxpayers claimed a loss, with total losses reaching $13.798 billion. On a per person basis, this equates to $10,895 per annum.

Negative gearing continues to be a contentious issue and feature of the tax system which is unique to Australia.

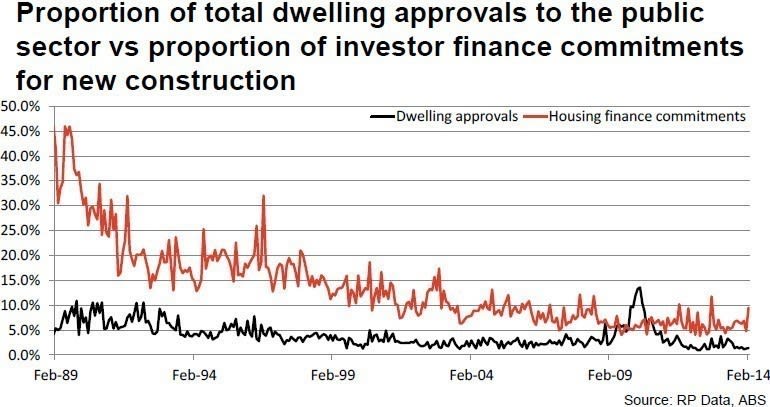

Another point worth noting is that the data in the 2011 Census shows that the government only owns and rents out around 4.1% of total housing stock; conversely dwelling approvals data shows that a very small proportion of new housing approvals are granted to the public sector.

Looking at these two individual results, it would suggest that the government has little interest in building or managing rental accommodation. This suggests that negative gearing is in place to encourage developers to build new rental accommodation and private individuals to act as landlord for those who aren’t in a position to own their own home.

While it would make sense to apply negative gearing only to newly constructed properties, politically it would likely be unpopular. Furthermore, if negative gearing was to be removed the government would likely have to play more of a role in constructing new homes and managing a portfolio of properties. On balance, they probably see that foregoing almost $8 billion in taxation revenue is more cost effective than developing and managing a greater proportion of new housing stock.