Housing market back in growth phase, despite subdued growth: Cameron Kusher

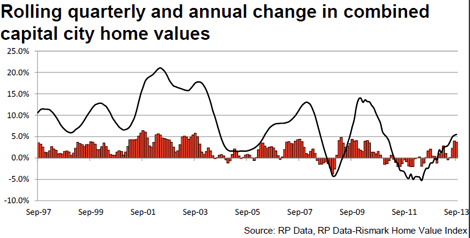

An increase of 8.7% in property values since the market trough in May 2012 indicates that the housing market is once again back in a growth phase, however, data out today indicates more subdued conditions than some may be expecting.

The current rate of value appreciation is nowhere near as strong as the growth in values over previous value growth phases.

Although there is some clear strengthening of values, the magnitude of the increase is less than what was recorded during previous growth cycles despite positive data released in the September RP Data-Rismark Home Value Index results earlier this week.

While the results showed that capital city home values increased by 5.5% over the past 12 months, and by 8.7% since their recent low point in May 2012, other recent growth periods in the housing market, specifically at the beginning of 2001, 2007 and 2009 show that the rise in values during the current cycle is significantly more modest when compared with these cycles.

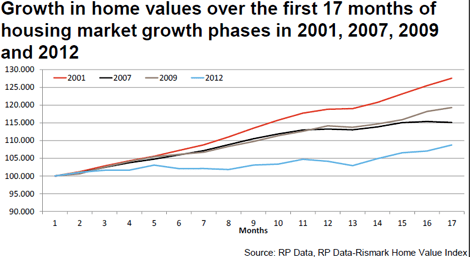

Home values across the combined capital cities have been rising since May last year and are now 8.7% higher over the 17 months (including May). Over the 17 months from December 2003 to April 2002, combined capital city home values had increased by 27.6%. The 2007 housing market recovery ran for exactly 17 months with home values rising by 15.1% over that period. Over the 17 months from December 2008 to April 2010 combined capital city home values increased by a total of 19.3%.

Value growth over the first 17 months from December 2001 was three times greater than value growth over the most recent growth phase. In 2007 growth was almost double that of the current period and over the same period post December 2008 values had grown at more than double the current rate of value growth.

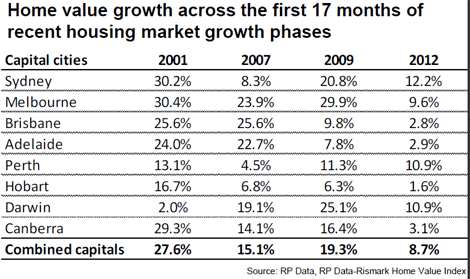

A further investigation into value growth data across each capital city over these three recent market growth phases shows some interesting findings.

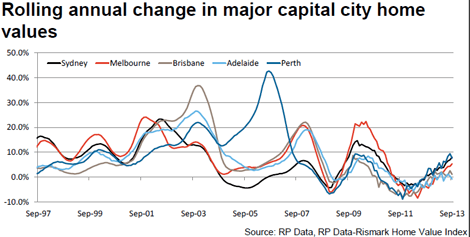

Over the three previous growth phases Melbourne’s housing market recorded the strongest level of capital growth followed by Sydney in 2001 and 2009, and by Brisbane in 2007. In the current recovery phase, the market has taken its lead from Sydney followed by Perth and Darwin (although capital gains in these latter two markets is now decelerating).

In 2001, Darwin showed an extremely muted response to the beginning of the market growth phase and Perth’s initial growth was lower compared with most other capital cities. In 2007, value growth through the recovery was comparatively weak in Perth, Hobart and Sydney. In the 2009 growth phase it was Hobart, Adelaide and Brisbane which experienced the weakest rebound in home values. Looking at the current growth phase, it has once again been Hobart, Adelaide and Brisbane that have experienced the most moderate response.

Based on this data it seems as if the national housing market tends to be led by the Melbourne and Sydney housing markets with the recovery across other capital cities generally lagging behind. Today’s results which are evidenced in the accompanying charts show that the remaining capital cities tend to lag the two largest cities.

Another point worth noting is that the periods of strong capital growth in Sydney and Melbourne have tended to not be as long as those in the other major capital cities. This was particularly noticeable in the 2001 growth phase where value growth had slowed in Sydney and Melbourne but continued for a much longer period in Brisbane, Adelaide and Perth.

With value growth typically commencing in Sydney and Melbourne where home values tend to be much higher than those in the other major capital cities, it is no surprise that growth phases tend to be shorter as affordability constraints arise.

Given that historically growth periods have tended to be shorter in Sydney and Melbourne than those in Brisbane, Adelaide and Perth it would be reasonable to anticipate that the current rate of value growth will not continue for an extended period of time.

It is also reasonable to expect that over the coming month’s value growth in Brisbane and Adelaide, where the recovery to-date has been quite dormant, we may start to see stronger value growth conditions as the affordability of these cities improves relative to the other major capital cities.

Cameron Kusher is senior research analyst at RP Data.