Ongoing improvement within the Australian housing market: Cameron Kusher

The Australian Bureau of Statistics (ABS) housing finance data released earlier this week provided further indication of an ongoing improvement in overall housing market conditions across Australia.

The data to July 2013 showed an ongoing improvement in demand for housing finance throughout the country. Given the recent rise in home values and a lift in sales transactions off the back of low mortgage rates, I am anticipating that the increase in finance commitments will continue over the coming months as the housing market enters one of its busiest periods.

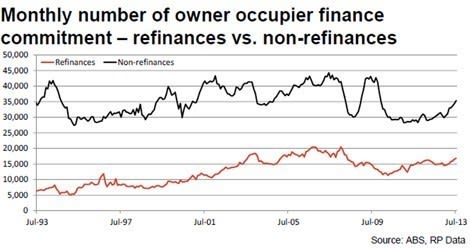

Click to enlargeHousing finance data over the month showed a continued improvement in demand for mortgages with owner occupier finance commitments increasing by 2.4%. Finance commitments for loans that weren’t refinanced increased by 2.7% over the month and refinance commitments rose by 1.7%. There were 35,356 commitments for non-refinanced loans in July 2013 which was the highest monthly figure since November 2009. There were 16,848 refinance commitments over the month which was the highest number of refinances since April 2008.

The high volume of new loans to owner occupiers indicates growing demand for home loans across this sector of the market and the high volume of refinances would tend to suggest that many home owners are now shopping around for a better loan deal as the market becomes more competitive.

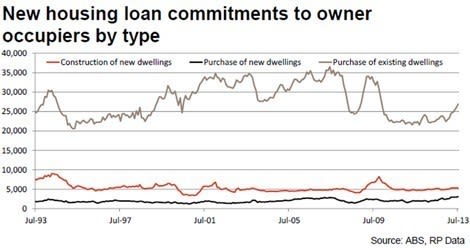

Click to enlargeWhen refinance commitments are removed and we look at the type of owner occupier finance commitment, the surge in demand is really being fuelled by an increase in demand for existing dwellings.

In July, there were 5,265 commitments for the construction of new dwellings, 3,131 commitments for the purchase of new dwellings and 26,961 commitments for existing dwellings. Over the month, more than three of every four owner occupier finance commitments were for the purchase of existing dwellings. Year-on-year, commitments for the construction of new dwellings has increased by 1.1%, commitments for the purchase of new dwellings is up 52.1% and commitments for the purchase of existing buildings has risen by 17.4%.

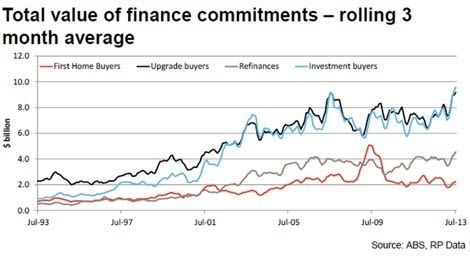

Click to enlargeInvestment purchases are also an important component of the overall market, unfortunately the ABS only publishes investment loan data based on value, nevertheless it still shows clear trends. Based on raw figures, there was $9.3 billion in housing finance commitments for investment purposes in July 2013. The total value was slightly down on its recent peak; however, the value of commitments was 30.6% higher than at the same time last year. The result indicates a high level of activity from investors in the housing market currently.

Value-based data for all sectors of the market revels that some very clear trends emerging. On a rolling three month average basis, there has been a clear trend of improvement across the four sectors analysed (first-home buyers, upgrade buyers, refinances and investment buyers). Based on the rolling three month average figures, investment buyers are currently accounting for 37.5% of purchasers, upgraders are accounting for 35.9% of the market, refinances are 17.8% of the market and first-home buyers are just 8.8% of the market. Based on the proportion of overall market activity, first-home buyers are sitting at around their lowest proportion of market activity since June 2004 while investors are at their highest proportion since June 2004.

The housing market is now largely driven by investors and upgraders.

The low mortgage rates are proving an attractive lure for those looking to upgrade into a slightly superior home. From an investor’s perspective, returns are low across most asset classes however, when you factor in gross rental returns and capital growth homes are returning fairly attractive yields of around 10% currently.

The surprising development has been the lack of response to low mortgage rates by first-time buyers. This may be due to the fact that in a number of states first-home buyers can now only receive a grant on brand new homes, these homes often tend to be more expensive than pre-existing homes. Also, a lot of first home buyer demand was probably pulled forward into 2009 when mortgage rates were at a similar level and first home buyers could buy pre-existing homes with an additional $7,000 in addition to the first-home owners grant.

Cameron Kusher is senior research analyst at RP Data.