Quarterly distressed property listings fall to lowest in two years but fresh wave building: Knight Frank

The proportion of distressed property listings fell to its lowest level in two years over the second quarter of 2013, but a fresh wave of receivership and mortgagee sales is building, warns Knight Frank in its latest update.

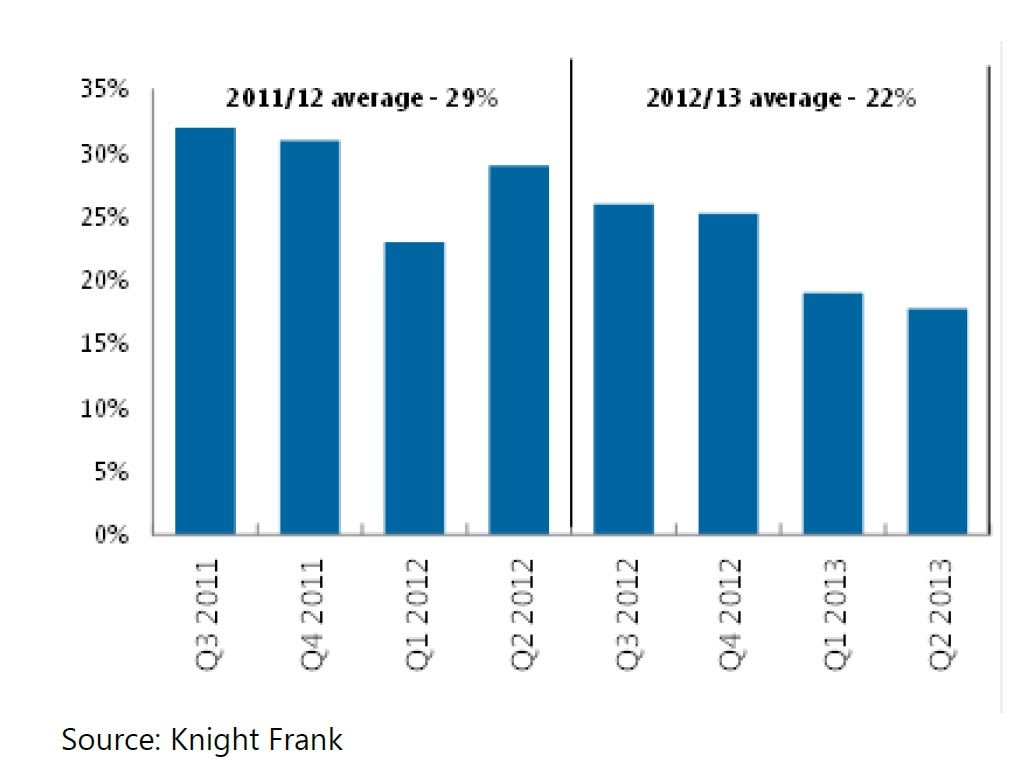

Less than one in five (18%) properties listed for sale over the June quarter were either mortgagee or receivership sales.

This compares with nearly 30% of properties being listed as distressed sales in the same quarter last year.

Quarterly distressed sales listings

The national profile of where distressed sales are most prevalent remains unchanged with Queensland continuing to represent over half (53%) of all distressed listings.

Knight Frank notes that Queensland receiver sales predominately included residential and industrial properties, most notably development sites which were in secondary locations and regional areas.

The collapse of debenture and mortgage funds such as Provident Capital and LM Investment Management has revealed exposures to struggling Queensland developments.

Knight Frank Queensland managing director Grant Whittaker warns that there appears to be another wave of distressed asset sales coming “with many receivers advising that the banks non-performing loans, or loans that are on 'watch', are not reducing”.

“It is expected that the market will start to see a flow through into a larger volume of receivership sales from the end of the third quarter.

“A lot of these assets will continue to be non-income producing, such as englobo residential sites (undeveloped lots or group of lots or vacant properties).

“There also seems to be some larger distressed assets coming through which the banks might have been trying to hold off on however no longer can afford to do so,” he says.

After Queensland, NSW has the second biggest exposure to distressed assets.

Knight Frank found that for the second quarter of 2013, almost one third (29%) of distressed listings were recorded in NSW.

Whilst this is the highest proportion recorded for NSW across the last year, in number value this is significantly down with only 35 distressed properties represented for sale.

However, in keeping with expectations of a fresh wave of distressed asset sales, the flow of distressed assets to the NSW market is expected to continue throughout the next financial year.

With only 11% of all listings noted as a mortgagee in possession, Victoria continues to be the best performing east coast state with industrial secondary assets or development sites making up almost half of these listings.

According to Knight Frank’s managing director of commercial sales, Paul Henley, more distressed assets are expected to come onto the market over the next six to 12 months due to tough leasing conditions and a general lack of business confidence.

“Due to the historically low cost of debt and investors chasing yield, it is expected the banks to become more willing to move on those ‘non performing’ loans and therefore take advantage of improved investor appetite.

“The major concern for banks with lending today is vacancy, hopefully we will see an improvement in leasing sentiment once we get past the election,” Henley says.