Margie Blok's SMH Title Deeds departure heralds further Domain brand diminishment: Robert Simeon

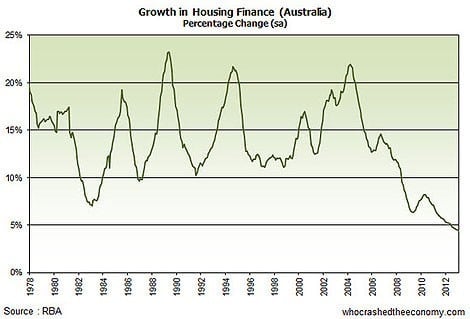

What an extraordinary week it has been with the majority of punters left absolutely gobsmacked following the Reserve Bank of Australia (RBA) decision to cut the cash rate to a 53-year-low. Confusion would be an understatement to say the least given last weekend in Sydney we observed clearance rates climbing to 78.1% (the highest since 2009) and the benchmark S&P/ASX200 breaking through the key 5200 threshold for the first time since 2008. Here is the Statement by Glenn Stevens, Governor: Monetary Policy Decision.

When the cash rate was at 3.00% this was otherwise known as “emergency” levels so what do you call the cash rate when it drops to the all-time low? As quick as a flash the “World’s Greatest Treasurer” announced “These rates are coming down because the (Labor) government has had a strong fiscal policy over a period of time, which gives the bank scope to make rate cuts.” Not only delusional the man is a complete fool given his very own fiscal policy is in a complete mess.

Two weeks ago, Wayne Swan advised Australia the budget would miss its revenue forecast by $7 billion. Last week, Prime Minister Julia Gillard revised that revenue forecast upwards to $12 billion – then on Tuesday Penny Wong drew the short straw to advise it was now out by a staggering $17 billion. That is definitely not strong fiscal policy but rather an embarrassment. After consultation his dialogue changed to “it is utterly irresponsible to call today’s 25 basis point cut to the official cash rate as a cut to ‘emergency’ levels.” Westpac tips June rate cut and cash rate to fall to 2% by March 2014 should the property markets kick – up another gear the RBA will be faced with a monumental headache.

Rose Bay secures third highest Sydney Harbour sale at $30 million or higher this year – What we are seeing at the top end is offshore money dominating these transactions.

The vast majority were of the opinion that the RBA would leave the cash rate unchanged given a cut would send a very clear message that the Australian economy is presently not in a good place. Despite low inflation numbers and respectable unemployment levels the RBA has sent a clear message that it will use monetary policy to invigorate the Australian economy – only time will tell how low the cash rate will have to go to achieve this outcome.

To put our 2.75% cash rate into perspective – the US is 0.25%, Bank of England 0.5%, Bank of Canada 1.00%, European Central Bank 0.5%, Japan 0.1% and China 6%.

Banks rushed to pass on the full official cash rate, which is an absolute first where we can expect some to actually cut lower than the official RBA cash rate. A cash rate at record ‘emergency’ lows combined with banks fighting hard to win new customers – these are fascinating times. A day after the RBA announcement the Australian stock market again broke the key 5200 psychological threshold before finishing short of a fresh 59 – month high as investors flocked to high – yielding shares. In 2011 term deposits were paying 6% where now they are close to 4%. With this bubbles start appearing albeit this time in both categories – property and shares.

A slight comeback with house listings this week which is a vast improvement on previous week’s data. Apartments in Mosman are having a slight rally although these results are certainly not being mirrored in Cremorne and Neutral Bay. Once upon a time Mosman and Neutral Bay apartments would be neck and neck when it came to listings – today Neutral Bay is offering less than half what it usually offers.

Source: Australian Property Monitors

MOSMAN – 2088

• Number of houses on the market this time 2012 – 111

• Number of houses on the market last week – 76

• Number of houses on the market this week – 83

• Number of apartments on the market this time 2012 – 104

• Number of apartments on the market last week – 75

• Number of apartments on the market this week – 85

CREMORNE – 2090

• Number of houses on the market this time 2012 – 14

• Number of houses on the market last week – 11

• Number of houses on the market this week – 17

• Number of apartments on the market this time 2012 – 35

• Number of apartments on the market last week – 19

• Number of apartments on the market this week – 17

NEUTRAL BAY – 2089

• Number of houses on the market this time 2012 – 19

• Number of houses on the market last week – 5

• Number of houses on the market this week – 7

• Number of apartments on the market this time 2012 – 66

• Number of apartments on the market last week – 32

• Number of apartments on the market this week – 29

Back to the Gillard Government’s failed fiscal policies which is now a train wreck – Labor abandons promised carbon price tax cuts which was inevitable given at the federal election on September 14 Australian employees will be voting to keep their jobs. How Gillard cooked the business goose which identifies exactly why the RBA has uncharacteristically stepped in to stimulate the Australian economy.

Not just governments making woeful decisions – Fairfax Media have decided not to renew Margie Blok’s contract so her finger prints will no longer be seen on Title Deeds. When you lose great property journalists like Jonathan Chancellor now at Property Observer and Margie your brand diminishes considerably. At the end of the day it is all about readership and given the current diabolical Saturday Domain layouts consumers may well return serve with their very own advertising – cost cutting?

Looking forward to delivering the Fudge–it edition next week. It turns out I will be attending a wedding in Phuket so I will be delivering my Thai budget expose. No doubt it will be hot with plenty of kick.

Robert Simeon is a director of Richardson Wrench Mosman and Neutral Bay and has been selling residential real estate in Sydney since 1985. He has also been writing a real estate blog Virtual Realty News since 2000 which is republished weekly on Property Observer. The RWM real estate model has sold in excess of $1 billion in database sales globally.