RBA on hold this month, waiting for Q3 CPI: Paul Bloxham

GUEST OBSERVER

Slowly and calmly the RBA appears to be setting the scene for the possibility of cash rate rises.

There is clearly no urgency, but the central bank will want to keep its options open. Keep in mind, unlike many other central banks, the RBA does not give explicit forward guidance (that is, it does not indicate cash rate movements ahead of time). Instead, the commentary will just gradually shift to greater optimism about growth and inflation before the first hike is delivered.

Two speeches by RBA officials this month both suggested a mild shift in tone. Assistant Governor, Luci Ellis, gave a speech making it clear that global growth is picking up and that the recovery was expected to persist.

A day later, Governor Phil Lowe, gave a speech entitled, ‘The Next Chapter’, in which he explained that the mining cycle, which has dominated the local growth story in recent years, is almost done. Although Dr. Lowe was cautious, he was generally positive about the outlook, with Australia set to benefit from rising Asian middle class incomes.

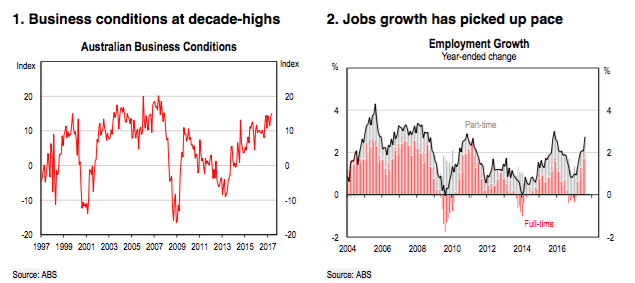

At the same time, the timely local growth indicators remain strong. Surveyed business conditions are around decade highs and job creation has accelerated to its fastest pace since 2000 over the past six months. The fast pace of job creation is expected to continue, given the marked improvement in job advertisements, job vacancies, and surveyed employment intentions.

Exports are also set to be strong in H2, partly reflecting a bounce-back in coal shipments after weather-related disruptions in H1. In addition, infrastructure investment is ramping up. We are sticking by our call that GDP growth will pick-up to 3.3% y-o-y by the Q3 print, which is due in early December.

The challenge remains as to whether this lift in growth and employment will deliver a pick-up in wages growth and inflation. The next CPI print, which is due to be published on 25 October, will be the next key number on this front. We expect the RBA to be firmly on hold next week as it awaits the next inflation print.

On fixed income strategy, the risk that the RBA hikes sooner argues for elevated money market risk premium but curves should flatten, especially beyond 10 years.

Rising activity and strong jobs growth

Growth is picking up pace, driven by a collection of factors. First, the sharp decline in mining investment is coming to its end: less drag from this source is net positive for growth. Second, growth in services exports remains solid, LNG exports are ramping up, as new capacity comes on-line and coal exports are bouncing back after weather-related disruptions in H1.

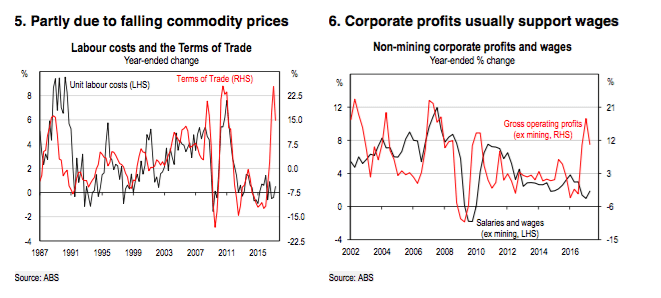

Third, infrastructure investment is ramping up, led by urban road and rail projects, mainly in the south- eastern states. Finally, corporate profitability has improved, partly due to higher commodity prices, which is supporting a lift in surveyed business investment intentions.

The pick-up in growth is being reflected in strong surveyed business conditions, which have been around decade-highs in recent months (Chart 1). The lift in growth is also driving a strong pick-up in hiring, with job creation running at its fastest pace in 17 years over the past six months. Most of the jobs that have been created have also been full-time positions (Chart 2).

The timely indicators, such as job advertisements and employment intentions, suggest jobs growth should continue in the coming months.

Wages growth is subdued, but for how long?

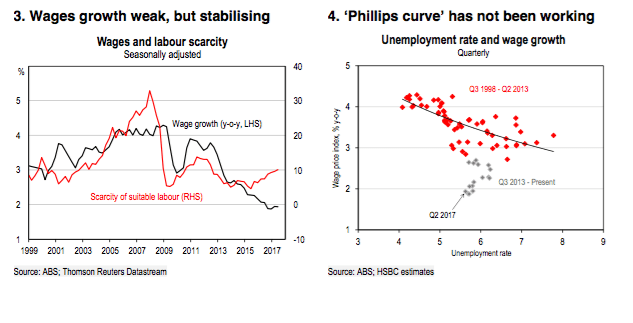

The challenge has been that, as yet, the improvement in the labour market has not driven a rise in wages growth (Chart 3). However, the wage price index has started to stabilise. Part of the explanation for weak wages growth may be factors that are also affecting other economies, such as: the changing nature of work due to technology; the continued effect of globalisation and offshoring; increased casualization of the workforce, and decreased unionisation (for more on these factors see Global Economics Quarterly: The Wage Conundrum, 22 June 2017). Much like in other countries, Australia’s Phillips curve – which suggests an inverse relationship between wages and unemployment – appears to have flattened (Chart 4).

However, in Australia’s case there may also be some idiosyncratic factors at play. In particular, the large fall in commodity prices from 2011 to 2016 weighed on national incomes, which, in turn, flowed through to weak growth in unit labour costs (Chart 5). If this explains even some part of the slowdown in wages growth then the recent lift in commodity prices and boost to mining sector profitability should flow through to some lift in wages growth. The rise in profitability has also moved beyond the mining industry, which should also imply a pick-up in wages growth over time (see Downunder Digest; Show me the money, 20 April 2017).

Next focus will be on the quarterly CPI print, as always

As is often the case, the October board meeting is expected to be rather dull, as it is only three weeks until we receive the all-important quarterly CPI print. The RBA is likely to flag that it is awaiting more information of prices to help firm up its view on how the economy is travelling.

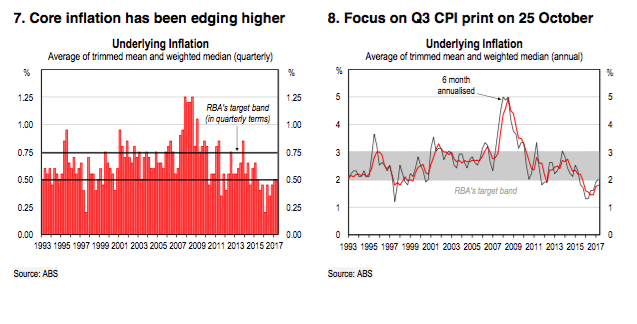

The key will be the underlying measures of inflation – the trimmed mean and weighted median. These have already been showing a modest lift from the very low levels reached in mid-2016, when the RBA was forced to cut the cash rate to its current record low (Charts 7 and 8). Even a repeat of a modest print for the trimmed mean, of 0.5% q-o-q, would see underlying inflation back in the RBA’s 2-3% target band on a y-o-y basis.

RBA speeches and commentary

As we reported last month, Governor Phil Lowe explicitly stated at a parliamentary testimony in August that it would be reasonable to assume that the ‘next rate move will be up rather than down’. This month brought another mild shift in tone from the RBA. Assistant Governor Luci Ellis gave a speech making it clear that the RBA expects the current recovery in global growth to continue. Governor Lowe then gave a speech suggest that Australia’s growth story is moving on to its ‘next chapter’, most of which was upbeat about Australia’s growth prospects while still acknowledging risks, such as Australia’s high household debt levels.

Governor Lowe has also been cautious about giving any indications on timing of any cash rate rise. He has noted repeatedly that it will be ‘some time’ before rates rise. We see this as typical RBA style. The RBA does not give explicit forward guidance. Instead it shifts the tone of its discussion about the outlook for growth and inflation and leaves it to the market to determine what it might mean for the cash rate setting.

Fixed income strategy: Earlier hikes equal flatter curves

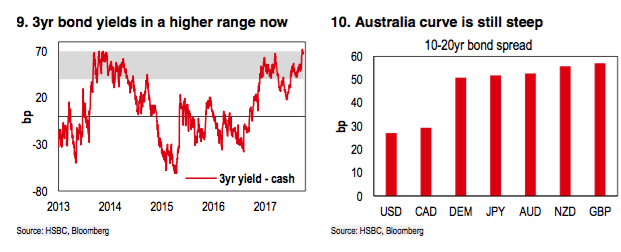

We hold on to our flattening bias. Recent upbeat communication from the RBA implies a bold reaction function. As a result, and assuming the data holds up as our economists expect, investors should consider February and May meetings as ‘live’ (currently just 6bp and 16bp of cumulative hikes priced, respectively). The sticky pricing of a risk premium into the money market should keep 3yr government bond yields elevated with the potential to re-test the top of the 1.92-2.22% Q3 range (Chart 9).

Yet, we are less concerned about a breakout at the long-end. In our view, 10yr yields close to the recent high of c.2.9% present a bullish signal given that level is consistent with 5yr5yr peaking around 3.5%, equal to neutral rate estimates. Also, the historic tendency for the curve to flatten sharply as the RBA hikes should be expected to repeat, especially given the rise in household’s leverage (see Little to fear for the long-end, 30 August). The potential for the curve to flatten is greatest beyond 10 years, where supply is supportive and the curve is steep, particularly vs. those markets that have already hiked rates (Chart 10).

PAUL BLOXHAM IS CHIEF ECONOMIST (AUSTRALIA AND NEW ZEALAND) FOR HSBC.