Remarkable for being unremarkable: CommSec

GUEST OBSERVER

The 2016/17 financial year is now complete and it is an opportune time to see how investments, financial markets and economies have performed over the past year.

Overall, the year was remarkable for being unremarkable. At least as far as the economy and financial markets performed. The year started with the fall-out from Brexit.

There was a domestic election and the US Presidential election. In 2017 there has been a raft of elections in Europe. And there was the OPEC production agreement.

But despite the challenges, returns on shares and residential property lifted over the past year while interest rates are lower and the Aussie dollar is little changed from a year ago. In fact the Aussie dollar has tracked a range of US6.25 cents – the least volatile year in 27 years. The sharemarket has had the least volatile year in 16 years. And the record (and world-leading) Australian economic expansion continues.

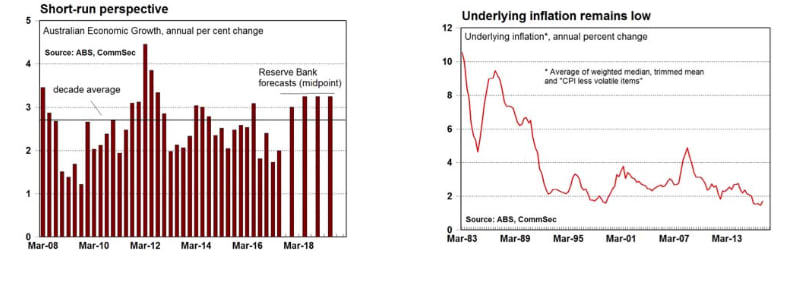

The economy has grown by around 1.75-2.00 per cent in 2016/17 and we expect growth of around 3.0 per cent in 2017/18. Infrastructure will be a key driver of growth in 2017/18 alongside exports, while home building continues, especially in Sydney, Melbourne & Brisbane. Underlying inflation may lift from 1.7 per cent to 2.0 per cent over the coming financial year while unemployment may ease modestly from 4-year lows of 5.5 per cent currently to the 5.0-5.5 per cent range. Official interest rates may remain on hold for another year.

It is clear that Australia is well placed. Inflation is under control; interest rates are at record lows, the Aussie dollar is supportive and the record expansion continues

What does the data show?

Interest rates

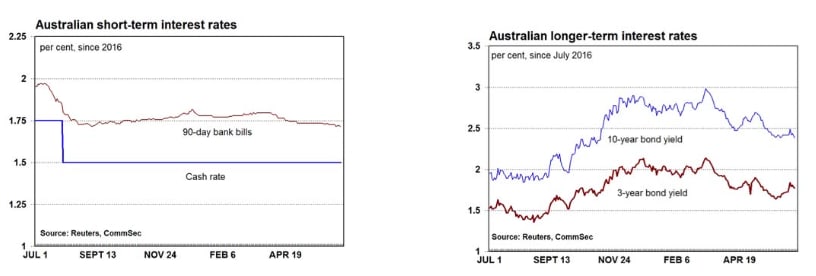

The cash rate stands at a record low of 1.50 per cent, down from 1.75 per cent in June 2016, and courtesy of a quarter per cent rate cut in August 2016.

The market-determined 90-day bank bill rate has fallen from 1.97 per cent to 1.72 per cent over 2016/17. Yields on the long bond – 10-year government bonds – have held between 1.85 per cent and 2.99 per cent. Long-bond yields hit record lows on August 11 2016 and now stand at 2.39 per cent.

Currencies

The Aussie dollar has risen around 3.6 per cent over 2016/17. The Aussie started the year around US74.26 cents and ended the year at US76.92 cents. We have calculated that the Aussie is 22nd strongest against the US dollar of 117 currencies tracked. The strongest currencies have been the Icelandic króna (up 17 per cent), Swazilabnd lilangeni (up 11.3 per cent), South African rand (up 11.1 per cent), and Israeli shekel (up almost 10 per cent). Weakest currencies have been Syrian pound (down 138 per cent), Egyptian pound (down 104 per cent) and Turkish lira (down 22 per cent).

In the six months of 2017, the Aussie dollar is rose just over 6 per cent against the US dollar, making it the 25th strongest of 117 currencies tracked. The strongest currencies have been the Mozambique metical (up 16 per cent), Mexican peso (up 13 per cent), and Poland zloty (up 11 per cent). Weakest currencies have been the Tunisian dinar (down 5 per cent), Ethiopian birr (down 4 percent) and Agentinian lec (down 3.9 per cent).

The high for the Aussie dollar in 2016/17 was US77.77 cents in November 2016 and the low was US71.52 cents in December 2016. The US6.25 cent range for the Aussie dollar is the smallest in 27 years.

Commodities

Commodity prices have been decidedly mixed over 2016/17. The Commodity Research Bureau futures index has fallen 9 per cent over the year, under-performing the Aussie dollar (up 3.6 per cent)

The price of oil is down almost 5 per cent, gold is down 6 per cent and sugar is lower by 32 per cent. But iron ore prices have lifted 15 per cent, thermal coal has risen by 36 per cent, beef is up 10 per cent and base metal prices have generally firmed over the period with lead, zinc and copper up between 22-31 per cent.

Sharemarket

The Australian sharemarket started 2016/17 with the All Ordinaries at 5,327.0 and the ASX200 at 5,246.6. The All Ords ended the financial year at 5,764.0 points (up 8.5 per cent) with the ASX200 at 5,721.5 (up 9.3 per cent). We estimate that Australia is 55th of 73 global bourses and only five bourses recorded declines in 2016/17. The best performer has been hyperinflation-affected Venezuela (up 860 per cent) but notably Greece is up 52 per cent and Austria is up 48 per cent. The worst performers have been West Africa, Oman, Qatar and South Africa.

In the six months of 2017, the All Ordinaries has risen by 0.8 per cent, ranking Australia 61st of 73 nations. Commodity producers have recorded the weakest performances such as Qatar, Canada, South Africa, Saudi Arabia and Brazil. Best performers include Greece, Austria, Argentina, Nigeria and Turkey.

Investment returns

Total returns on Australian shares (All Ordinaries Accumulation index) rose 13.1 per cent over 2016/17. Returns on dwellings are up 13.2 per cent while returns on government bonds have fallen by 0.8 per cent. The returns on bonds, was the weakest result in 23 years.

Sectors & size groupings

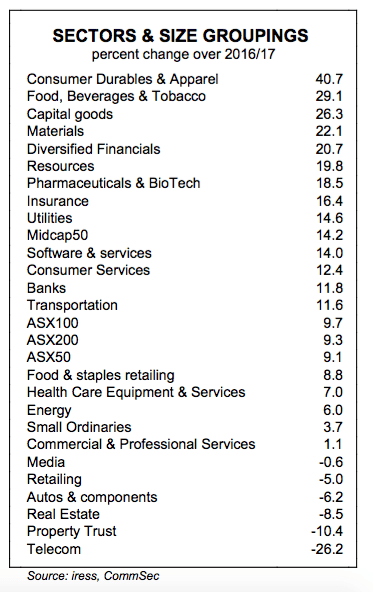

Of the 21 identified industry sub-sectors, only five recorded declines in 2016/17.

Leading the gains has been Consumer Durables & Apparel (up by over 40 per cent) followed by Food, Beverages & Tobacco (up 29.1 per cent) and Capital Goods (up 26.3 per cent)

At the other end of the scale, Telecom has fallen by over 26 per cent, followed by the Real estate sector (down almost 9 per cent) and Autos & Components (down 6 per cent).

Of the size categories, the MidCap 50 index has again out- performed, (up 14.2 per cent), from the ASX100 (up 9.7 per cent), ASX 50 (up 9.1 per cent) and Small Ordinaries (up 3.7 per cent).

What are the implications for investors?

Returns on shares are set to record the best gain in three years. And that means that sharemarket returns have only fallen once in the past seven years. So an investor that has employed a diversified strategy across asset classes would be well pleased with the performance over the past year.

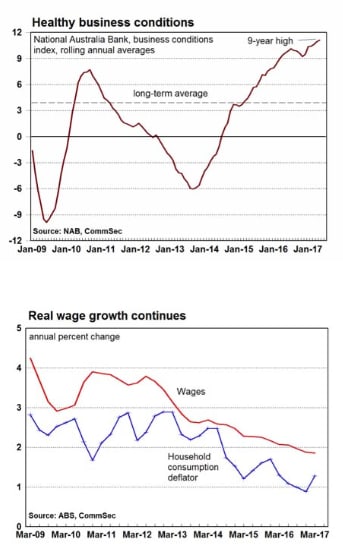

The economic and financial metrics remain encouraging. Australia has underlying inflation below the Reserve Bank’s 2- 3 per cent target band at 1.7 per cent. Economic growth is low at 1.7 per cent but that reflects a raft of elections in 2016/17 as well as bad weather. Business conditions are near 9-year highs. The cash rate is at record lows. And unemployment is at a 4-year low of 5.5 per cent,

Housing is providing the momentum for the economy with home building and purchase especially driving the NSW, Victorian and ACT economies. Over the coming year, infrastructure will be a key driver of economic activity.

Over the coming year more and more apartments will be completed with more stock hitting the market. It has taken a little longer than expected, but supply and demand for homes are likely to prove more balanced in 2017/18, restraining growth in home prices.

Last year we noted: “CommSec expects the All Ordinaries index to be near 5,500-5,700 points at end-December 2016 and 5,700- 5,900 points in June 2017.” The December forecasts was realised and similarly the June forecast should has been realised.

Over the coming year CommSec expects the All Ordinaries index to be near 5,900-6,100 points at end-December 2017 and 6,000-6,200 points in June 2018.

Home prices nationally are likely to grow by 5-7 per cent in 2017/18 with inflation around 2.0 per cent. The Aussie dollar is expected to remain in the mid 70s against the US dollar over most of the coming year.

The low inflation/low interest rate environment is entrenched, meaning that lower nominal investment returns are also here to stay. So investors will need to remain flexible and alert to the returns achieved across sharemarket sectors and across asset classes to ensure that their savings are keeping pace with the cost of living.

The issues to watch over the coming year include Donald Trump; Oil prices; Australian home prices; Wages & Jobs; and Geopolitics.

US President Trump was elected vowing to cut taxes, repeal the Obamacare health reforms and spend more on infrastructure. Global sharemarkets have rallied on the expectation that extra stimulus in the US will boost revenues and profits.

But we are still waiting for the tax cuts. Infrastructure spending has been announced – now it is a case of gauging the impact on the economy. The Federal Reserve will take its time lifting interest rates back to more “normal” levels for the simple fact that inflation is well contained.

A soft landing for Australian housing is possible. But there is also the risk of indigestion if too much supply comes onto the market at one time. Overall, regulators and banks have done well in restraining buyer effervescence.

We assume that Aussie households will gradually get used to the new reality of 2 per cent wage growth, especially as wages are still out-pacing prices and the job market is lifting in line with strong business conditions.

There are all manner of geopolitical risks. But these can never be adequately factored into forecasts. As always investors need to be alert, not alarmed.

Craig James is the chief economist at CommSec.

Savanth Sebastian is an economist for CommSec.