Construction work stabilised over the past half year: Andrew Hanlan

GUEST OBSERVER

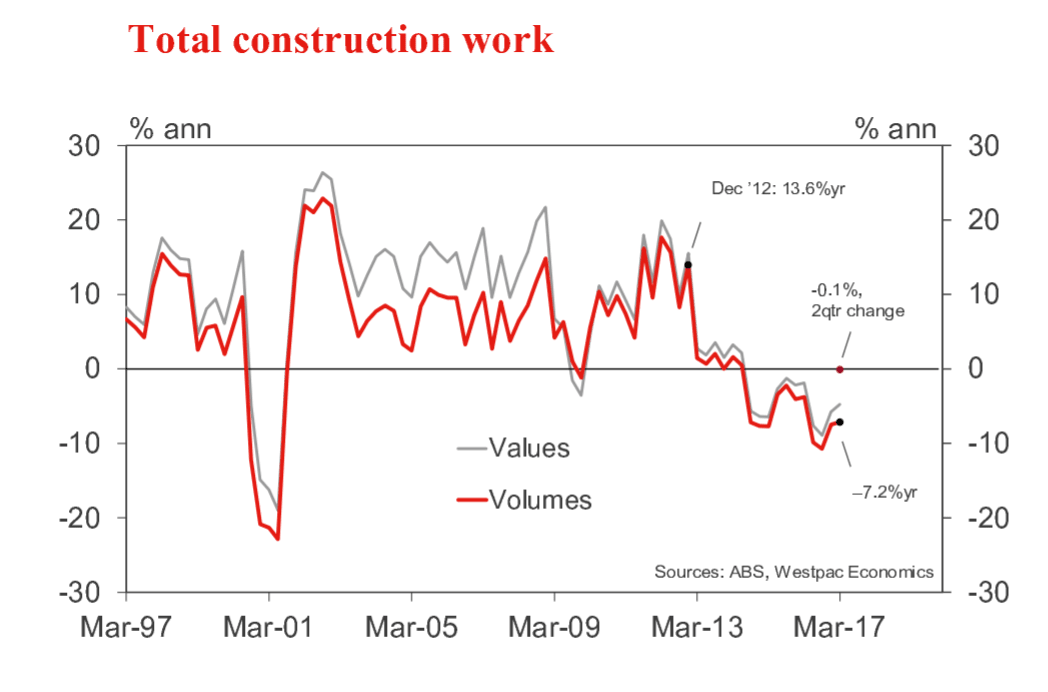

Construction work, having trended lower in recent years, stabilised over the past half year. The drag from the mining investment downturn has diminished and public works is providing a boost.

In the March quarter 2017, construction work declined by a relatively modest 0.7 percent, following a 0.6 percent gain in the final quarter of 2016 (revised up from -0.2 percent). By comparison, over the year to September 2016, construction work declined by 10.7 percent, to be $5.6bn below a year earlier.

The March quarter 2017 result broadly met expectations, (market median -0.5 percent and Westpac -0.2 percent).

In NSW and Qld, activity in the most recent quarter appears to have been disrupted by wet weather and flooding.

The wet weather impact is evident in the private home building segment, where work nationally on new dwellings fell by 4.8 percent and renovations were down by 6.3 percent. In NSW, total residential building activity fell by 4.9 percent in Q1, while Qld experienced a sharp 13.6 percent decline. These outcomes are weaker than suggested by earlier strength in approvals and the sizeable pipeline of work.

Home building activity is likely to rebound in the June quarter. Beyond that, there is a looming downturn in home building activity. Notably, private new dwelling approvals in Q1 2017 were 12 percent below the level of a year earlier.

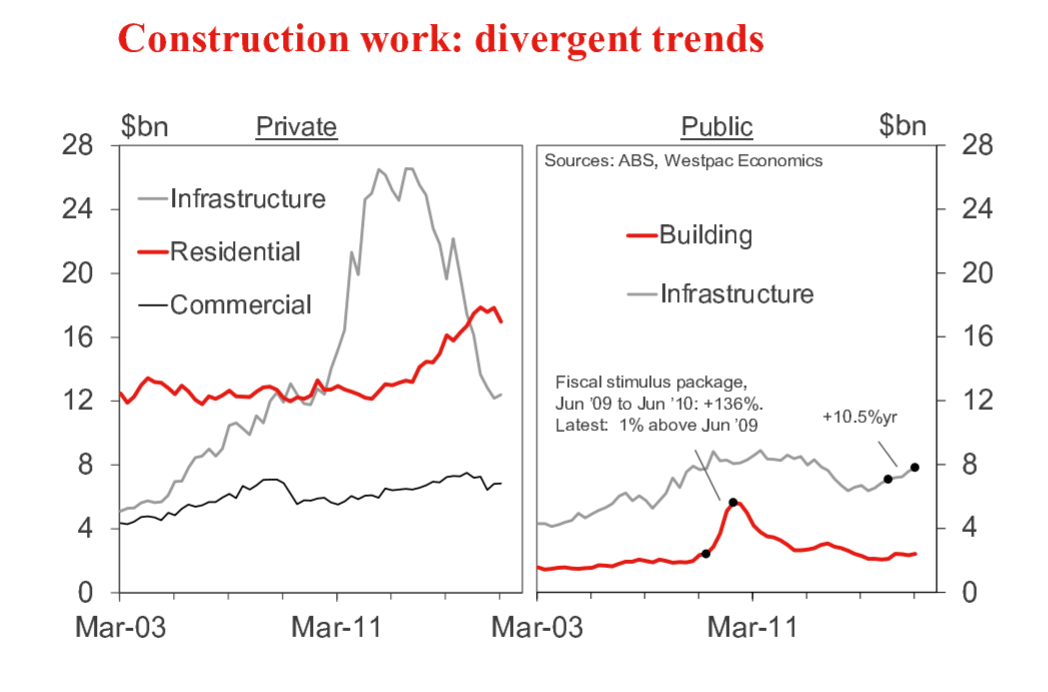

The drag from the mining investment downturn has clearly diminished. Private infrastructure activity surprisingly rose in the March quarter, up 1.8 percent. We still expect some further modest downside over coming quarters.

In the mining state of WA, where work on gas projects under construction is nearing completion, total infrastructure activity is declining at a slower rate. Over the past half year, work fell by 12 percent, down $0.7bn. For the year prior to that, work fell by 51 percent, a decline of $5.5bn.

Public works is a growth driver as governments commit to additional projects. Public works increased in each of the past seven quarters, up a cumulative 21 percent. That is the longest run of consecutive gains since 2008 to 2010, associated with the post GFC fiscal stimulus package.

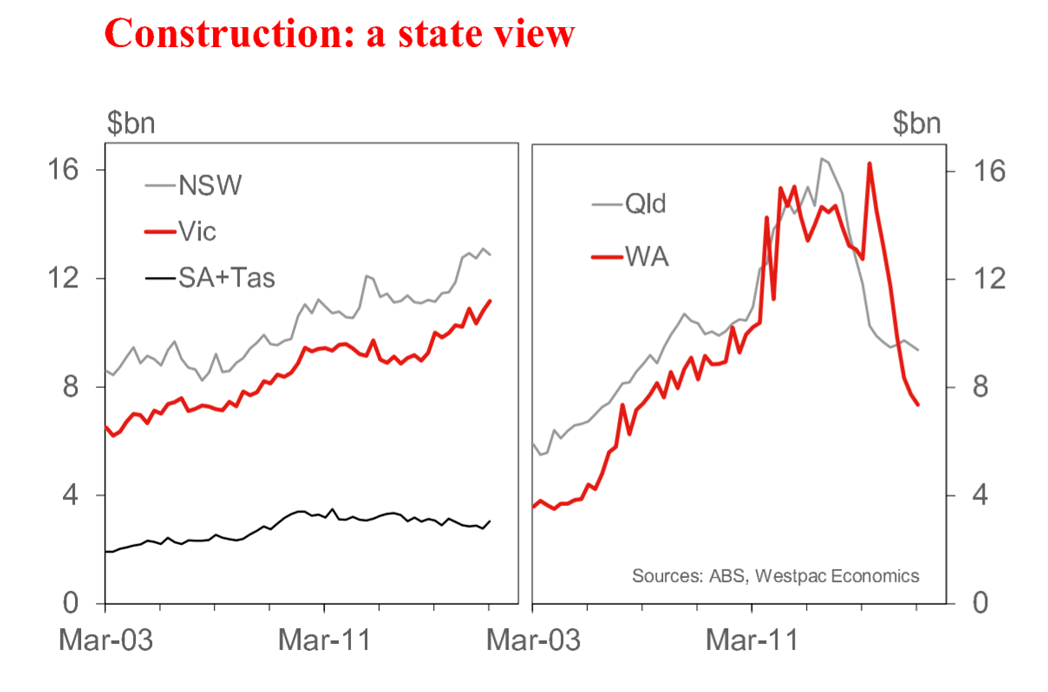

Victoria is performing strongly, with construction work in Q1 up 3.4 percent/qtr, 9.2 percent/yr. Strength is evident in building activity, +12 percent/yr, both residential and non-residential.

In NSW, construction work consolidated over the past year, with a Q1 outcome of -1.7 percent/qtr, +0.8 percent/yr. While infrastructure work moved higher, +6.6 percent/yr, building work eased, -2.2 percent/yr, led lower by a pull-back in commercial work.

In Qld, construction work has stabilised, printing at -1.9 percent/qtr, -1.0 percent/yr in Q1. This follows falls of 22 percent in 2014 and 24 percent in 2015 associated with the mining investment downturn. Over the past year, infrastructure work rebounded by almost 14 percent.

In WA, construction work fell by -4.8 percent/qtr, -37.4 percent/yr in Q1.

Andrew Hanlan is senior economist for Westpac and can be contacted here.