Approvals for owner occupier loans dip: Matthew Hassan

GUEST OBSERVER

The March housing finance approvals report was largely in line with expectations.

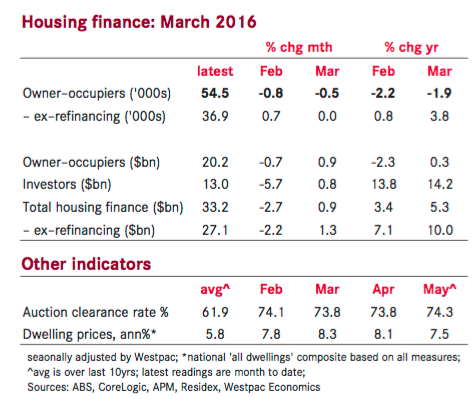

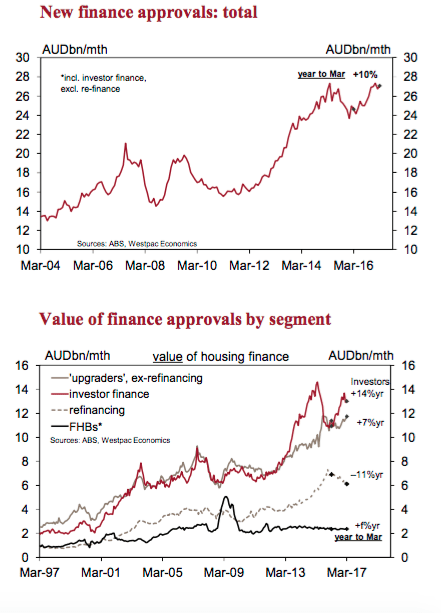

The number of approvals for owner occupier loans dipped 0.5 percent/mth but were flat ex refi. The consensus forecast was for a flat result. Approvals ex refi were up 3.8 percent yr. The value of investor loans rose 0.8 percent after a sharp 5.7 percent pull back in Feb, annual growth coming in at 14.2 percent/yr.

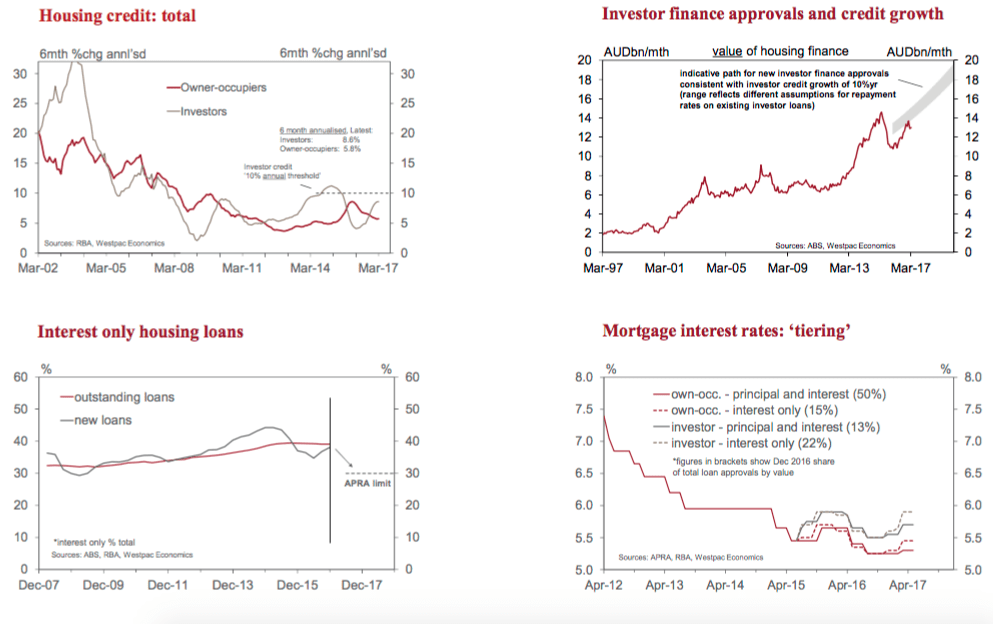

All up the data was largely as expected – note that the latest round of macro prudential tightening was only announced in late March with impacts likely to come through in Apr-Sep. That said, the more moderate reads on investor loans in Feb-Mar suggest lenders were already reining activity in this segment to keep within APRA’s existing 10 percent limit on investor credit growth (i.e. growth in the total stock of loans).

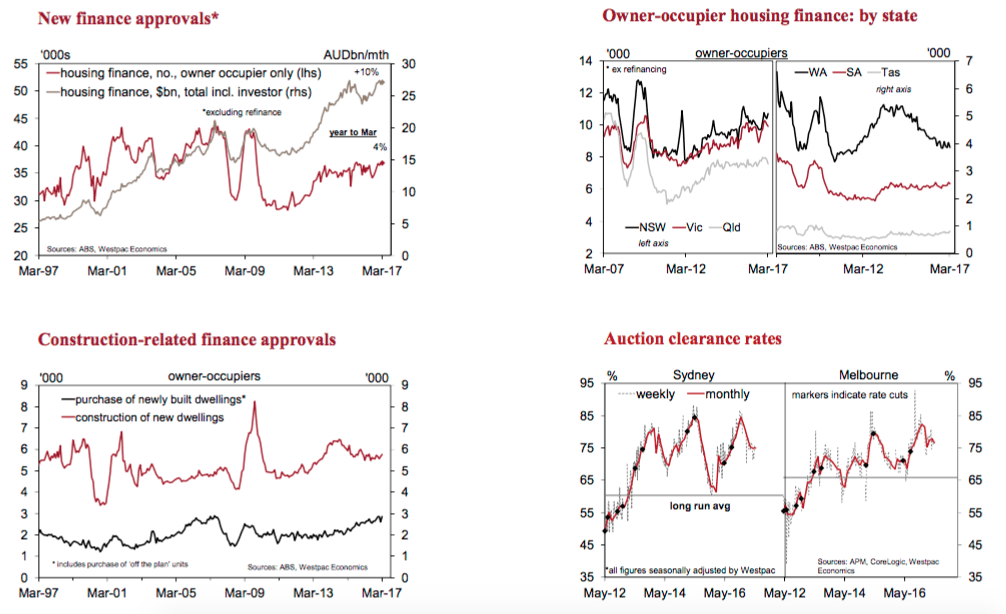

The detail showed, ex refi, a solid gain in owner occupier approvals in NSW (+2.9 percent/mth) offset by falls in the other major states ranging from –1.3 percent/mth in Vic and –1.8 percent/mth in SA to –3.4 percent/mth in Qld and –4.4 percent/mth in WA. Annual growth remains positive for all states except WA.

Construction-related finance approvals posted a solid 4.3 percent/mth rise led by a 10 percent bounce in finance for the purchase of newly built dwellings (which includes apartments and ‘off the plan’ purchases). This segment showed a similar sized fall in Feb.

The total value of loans ex refi rose 1.3 percent, partially reversing Feb's 2.2 percent fall. Annual growth edged up to 10 percent.

More recent data from weekly auction activity suggests housing market conditions steadied a touch in Apr-May after cooling off earlier in the year from a very strong finish to 2016. Auction volumes remain high although turnover via other channels looks to be very weak. Note that these measures only provide meaningful gauges for the Sydney and Melbourne markets.

Looking ahead, the exact impact of new regulatory guidelines is unclear. The specific limit for investor credit growth was unchanged at 10 percent although lenders were instructed to keep growth 'comfortably below' the target. The main new measure was a 30 percent limit on the 'interest only' share of new loans (currently running at 38 percent overall and 65 percent of investor loans), particularly those with high LVRs.

Lenders have responded with increased rates on both investor and owner occupier loans with larger increases for 'interest only' products (+30bps on average for investor loans, +15bps for owner occupier loans). It remains to be seen how borrowers react but the mix suggests both owner occupier and investor finance approvals will be impacted, perhaps with some 'product switching' refinance flows in the mix as well.

Matthew Hassan is senior economist with Westpac.