RBA's next move likely to be up but not for some time yet: HSBC's Paul Bloxham

GUEST OBSERVER

This month’s Q1 2017 CPI inflation numbers provided additional support for our long held view that the RBA is unlikely to cut its cash rate further.

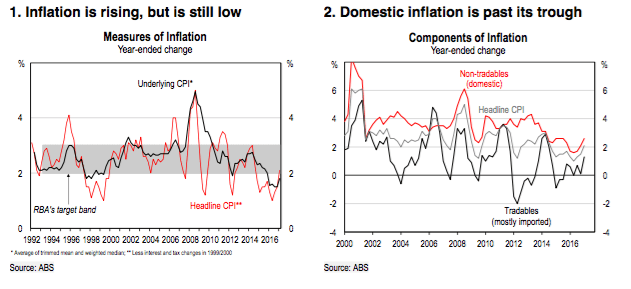

Underlying inflation, as measured by the average of the trimmed mean and weighted median, lifted to 1.8% y-o-y in Q1, which is up from its low point of 1.5% in Q3 and Q4 2016. Domestically produced, non-tradable inflation has also continued to pick up pace, rising by 2.6% y- o-y, up from 1.6% in Q2 2016. Although underlying inflation remains below the bottom edge of the RBA’s 2-3% target band, it does appear to be past its trough.

The RBA also has a high hurdle for considering further cash rate cuts, as it is more concerned about the Sydney and Melbourne housing price boom than low inflation expectations becoming embedded. RBA Governor, Phil Lowe, has stated that it would not be in the ‘public interest’ to cut the cash rate further, even if it got inflation back to target sooner, if it boosted housing prices and debt. In response to this concern, the prudential regulator has tightened its settings further in recent weeks.

If there are no cuts expected, the key question becomes: when will the RBA consider lifting its cash rate? On this, the Q1 CPI numbers also suggest that rate rises are not likely any time soon. Although inflation is rising, the pick-up has been gradual and inflation remains low. In our view, the timing of the next hike in the cash rate largely depends on the outlook for wages growth. Our central case sees the unemployment rate gradually falling in coming quarters and wages growth lifting in H2 2017, helped along by the boost to national incomes from the recent rise in commodity prices. We see the RBA lifting its cash rate in Q1 2018.

Given that we expect only gradual cash rate rises, that Australia’s household debt is high and recent prudential tightening is underway, our new onshore AU/NZ Rates/FX strategist, Tom Nash, is favouring curve flattening. We also see some modest near- term downside to the AUD to US72 cents, albeit back to US75 cents by end-2017.

CPI inflation picked up in Q1 and is back in the RBA’s 2-3% target band for the first time in nine quarters (Chart 1). More importantly, for the policy rate outlook, the underlying measures of inflation have edged higher and appear to be past the trough. The average of the RBA’s two preferred measures of underlying inflation – the trimmed mean and weighted median – lifted to 1.8% y-o-y in Q1, up from a recent low point of 1.5% in Q3 and Q4 2016. The momentum in inflation also appears to be more than just due to temporary factors, such as rising oil prices or the effect of previous falls in the AUD, with domestically produced, non-tradables inflation continuing to trend higher (Chart 2).

The lift in inflation supports the case that the RBA is unlikely to cut further. However, with inflation remaining low, we think the CPI numbers, on their own, provide little motivation for the RBA to consider lifting the cash rate any time soon.

Business conditions and confidence are lifting

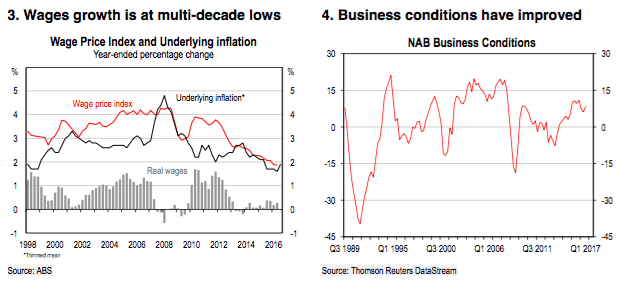

For the RBA to be convinced to lift its cash rate, the central bank is expected to need further evidence that underlying inflation is headed back to target. In our view, a key factor is the outlook for wages growth. Wages growth has been running at its slowest rate in multiple decades, which has been putting downward pressure on domestic inflation (Chart 3). Although there are some signs that wages growth is stabilising, as yet there is little evidence of a pick-up.

Surveyed business conditions imply growth should pick-up

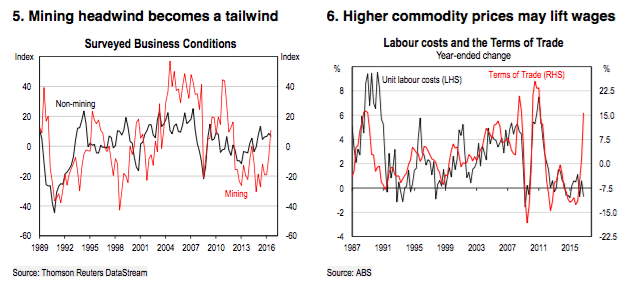

However, there are clear signs that business conditions have been improving recently. The NAB survey of business conditions rose in Q1 2017 and implies solid economic growth (Chart 4). This should, in turn, motivate increased hiring and some tightening of the labour market. This could deliver upward pressure on wages growth over time. The key driver of the improvement in business conditions has been a sharp lift in conditions in the mining industry, as higher commodity prices have boosted profitability (Chart 5).

As we have argued previously, we expect that some part of the lift in commodity prices will feed through to domestic wages, much as it has done in the past (see Downunder Digest: Show me the money, 20 April 2017). Historically, there is a strong positive correlation between unit labour costs (productivity-adjusted wages growth) and the terms of trade in Australia (Chart 6). Although we do not expect this relationship to be as strong as in the past, when the rise in commodity prices had motivated mining investment booms, we do expect it to feed through to a modest lift in wages growth in H2 2017.

Prudential settings have been tightened to cool housing

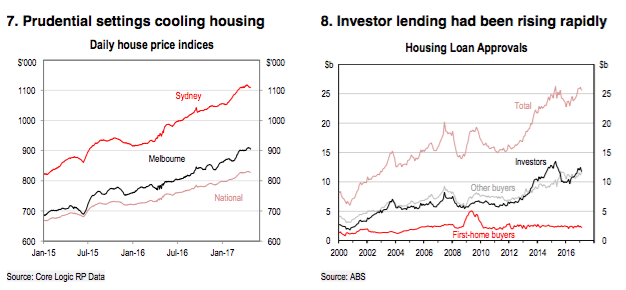

Concerns about the leverage-fuelled house price booms in Sydney and Melbourne have led the RBA’s Governor, Phil Lowe, to repeatedly note that it would not be in the ‘public interest’ to cut the cash rate again if it drove a further rise in housing prices and debt.

The Australian financial authorities backed this rhetoric with action by further tightening the prudential settings in the past few weeks. This included: reinforcing that banks should not grow their investor lending any faster than 10% a year; requiring that interest-only loans are no more than

30% of new lending (down from a current run rate of 40%); and that banks maintain appropriate loan serviceability tests in the face of heightened risks, amongst other measures. Tighter prudential settings had already seen effective rates for housing investors rise by 25bp in March.

There is some evidence that the tighter prudential settings are cooling the housing market, with the daily measures of Sydney and Melbourne house prices levelling out in April (Chart 7). However, it is worth noting that April is also typically a seasonally weak month for the housing market. Nonetheless, the tighter prudential settings and increased rates for investors are expected to see investor loan approvals pull back from their recent high levels in coming months (Chart 8).

However, it is worth keeping in mind that the international and local experience suggests that prudential tightening typically only has a short-lived cooling effect on housing markets, before fundamental factors, such as housing supply and demand and interest rates reassert themselves. The RBA will be aware of this evidence. On the margin, we see the exuberant housing market as likely to make the RBA a bit more hawkish on its cash rate settings, albeit only to the extent that its policy rate setting is still consistent with the outlook for inflation. The outlook for wages growth remains the focus.

RBA tactics and forecasts

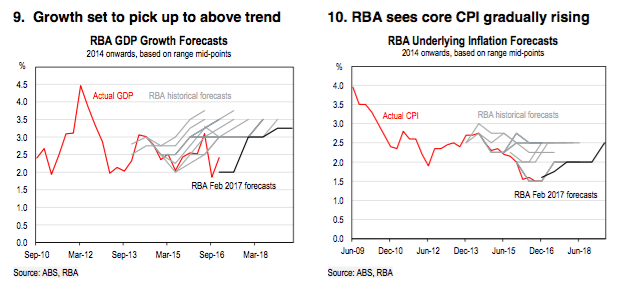

We expect the RBA to remain firmly on hold at its May meeting (2 May) and to give no suggestions that it would consider cutting further. At the same time, we do not expect any discussion about possible rate rises either. In its official statement, due to be published on 5 May, we expect the GDP and underlying inflation forecasts to be unchanged from the February 2017 statement (Charts 9 and 10). HSBC’s growth and inflation forecasts are slightly stronger than the RBA’s last published set of numbers.

Fixed Income and FX Strategy

AUD Rates: Front-end floored but lacking catalysts

This macroeconomic back-drop and RBA stance should place an implicit floor on money market rates. We think current OIS and cash rate future pricing is close to this floor – the market implies 0-5bp of cumulative cuts over the next six to nine months – skewing risk-reward towards paying/ steepening structures in the very front-end. However, such strategies should be tactical given the lack of near-term catalysts to re-price the RBA.

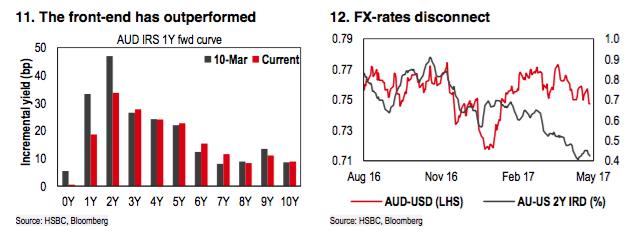

Beyond the RBA dates, yield pick-up is more attractive in forward starting swaps beyond one year but even then risk premium is still notably lower than in mid-March (Chart 11) and we see New Zealand as a better candidate for front-end receivers given the similar macro back-drop but considerably better roll-down profile.

More broadly, while the HSBC fixed income team also subscribes to the view that the next move in the cash rate is more likely to be a hike than a cut, investors should position against curve pricing that reflects an aggressive hiking cycle given a range of domestic structural factors that should constrain long-end rates (see AUD Rates: Cheap enough, 30 March 2017). We see ample room for the curve to flatten, given the swap curve is still 70bp steeper than 2016 lows between two and 10 years.

AUD-USD: prone to disappointment

The AUD’s buoyancy so far this year contrasts with interest rate differentials that have continued to grind lower (Chart 12). This disconnect between FX and rates could be observed in the aftermath of the April RBA meeting when the cash rate was left unchanged but AUD-USD immediately fell 0.5%. This occurred despite the RBA doing exactly as expected, with little ‘new news’ in the accompanying statement. In contrast, market interest rates, which already imply a broadly neutral path for the cash rate over the next 12 months, were largely unchanged.

The RBA’s lack of commentary that explicitly confirms reflationary themes, when compared to more hawkish commentary elsewhere, has put downward pressure on the AUD. With our economics team not expecting any changes to the RBA’s forecasts or rhetorical tone, we think the AUD-USD is likely still prone to disappointment. We forecast AUD-USD at 0.72 by end-Q2, before recovering to 0.75 by year-end.

PAUL BLOXHAM IS CHIEF ECONOMIST (AUSTRALIA AND NEW ZEALAND) FOR HSBC.