More home loan refinancing, investors still active: Craig James

GUEST OBSERVER

Housing finance

Home loans: The number of loans (commitments) for budding home owners (owner-occupiers) rose by 0.5 percent in January, the third consecutive rise. But the increase was wholly due to a 5.0 percent lift in refinancing.

The value of loans (owner occupier and investment) rose by 1.5 percent in January. Owner-occupier loans fell by 0.2 percent but investment loans rose by 4.2 percent.

Non-bank lending up: The number of loans by non-bank lenders rose by 4.7 percent in January after a 6.2 percent lift in December – the strongest back-to-back gain in 32 months.

What does it all mean?

There is a lot of information contained in the Housing Finance publication. Actually so much information that it can prove confusing. In the latest month, budding home owners (owner-occupiers) took out fewer loans to build homes or buy new or existing homes. There were more loan commitments in the month, but only because more people chose to refinance existing loans.

Refinancing had fallen for three straight months, so the lift in loans was from 16-month lows. The lift in refinancing may serve to boost the purchasing power of consumers, and thus support growth of the broader economy.

There were actually fewer loans taken out by those looking to build their dream homes. Loans to budding home builders have fallen for four of the last five months. But once investors are added in, construction loans are still healthy, up almost 10 percent on a year ago. If these commitments are actually drawn down, then more new dwelling projects will be started in coming months.

Home building does appear to have peaked but the lift in construction loans suggests a soft landing lies ahead.

Investors remain active in the housing market with the value of loans at 20-month highs. Investor loans are actually up 27.5 percent on a year ago, the fastest growth in 29 months.

The risk is that regulators may seek to apply further measures to slow down the pace of investor home loans.

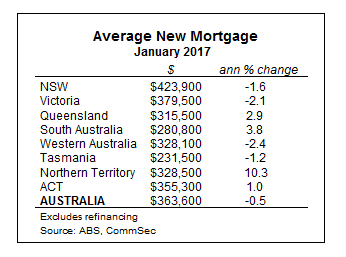

Borrowers in many states are taking out smaller home loans than a year ago. That is despite home prices still generally rising and despite interest rates being lower than a year ago. The more conservative lending posture will encourage the Reserve Bank.

What do the figures show?

Housing finance - number

The number of loans (commitments) for budding home owners (owner-occupiers) rose by 0.5 percent in January after rising 0.2 percent in December and rising by 1.4 per cent in November. Excluding the refinancing of dwellings, the number of loans was down by 1.7 percent.

The number of new home loans was up by 1.9 percent on a year ago (excluding refinancing, up 4.6 percent).

Loans by owner-occupiers for the construction of homes fell by 1.4 percent in January.

Loans to buy newly-erected dwellings fell by 2.3 percent.

Loans for the purchase of established dwellings (excluding refinancing) fell by 1.9 percent.

The number of refinancing transactions rose by 5.0 percent.

Lending across states/territories: NSW (+1.3 percent); Victoria (+1.6 percent); Queensland (+1.6 percent); South Australia (+4.4 percent), Western Australia (+0.3 percent); Tasmania (-2.5 percent); Northern Territory (-5.3 percent); ACT (+1.9 percent).

HOUSING FINANCE - VALUE

The value of new housing commitments (owner occupier and investment) rose by 1.5 percent in January – the fifth straight gain. Owner-occupier loans fell by 0.2 percent but investment loans rose by 4.2 percent.

The value of loans by owner-occupiers and investors to build new homes rose by 9.7 percent in January after falling by 10.2 percent in December and rising 15.4 percent in October. The value of loans stood at $3.04 billion, down from the record high of $3.32 billion in the year to March.

HOUSING FINANCE – OTHER STATISTICS

The proportion of first-time buyers in the home loan market eased from 13.8 percent to 13.4 percent in January (long-term average 19.4 percent).

The proportion of fixed rate loans rose from 14.6 percent to a 9-month high of 15.2 percent in January. And the average home loan across Australia stood at $363,600 in January, down 3.2 percent in the month and down 0.4 percent on a year ago.

WHAT IS THE IMPORTANCE OF THE ECONOMIC DATA?

Housing Finance data is produced monthly by the Bureau of Statistics and shows commitments by lenders, such as banks, to provide finance for housing purposes. The lending figures relate to those looking to buy or build homes to live in as well as those seeking to buy or build homes for investment purposes. Generally people get their finance organised first, so the figures are regarded as a leading indicator on the housing market.

WHAT ARE THE IMPLICATIONS FOR INTEREST RATES AND INVESTORS?

Regulators will keep a close eye on home loan trends. The revival of investor lending could lead to fresh controls over new lending. But it is also worth pointing out that non-bank lenders seem to have been more active in the past two months which may provide complications in containing investor exuberance.

While investors are more active in the housing market, budding home owners are more circumspect with the value of owner-occupier lending just 1.9 percent higher than a year ago.

The lift in home loan refinancing is positive for consumer-focussed companies.

Craig James is the chief economist at CommSec.