Subdued business investment: Savanth Sebastian

GUEST OBSERVER

The latest business investment report was certainly a mixed bag.

A sizeable drop in actual quarterly investment and expectations of future investment for 2016/17 and 2017/18 were weaker than a year ago. However the focus should be on the breakdown of investment, which was largely due to an ongoing slide in mining investment. In fact investment in the non-mining space rose by 1.9 percent in the December quarter. The improvement in commodity prices may help to soften the weakness in mining activity.

In addition investment rose in five of the eight states and territories, with the weakness more dominated in Queensland and Western Australia. In contrast the Northern Territory, ACT, and Tasmania recorded a double digit lift December quarter investment.

More importantly the near term shift in expected investment plans was also encouraging. The fifth estimate for investment in 2016/17 came in at $112.6 billion, up 4.6 percent on the fourth estimate and up almost 22 percent in the past nine months.

Encouragingly the lift in investment plans over the last couple of quarters, suggests that a shift in momentum is taking place. Certainly the lift in business conditions in recent months may be supportive of a lift in investment plans – especially in light of the surge in commodity prices and improvement in the global economy. No doubt the rebalancing across the economy is also being supported by the weaker Australian dollar – an outcome that should garner further traction in coming quarters. But as we have seen in the past, business may plan for future investment but then mothball projects if the economic landscape doesn’t improve.

Business spending looks like continuing to be a weight on Australia’s economic growth performance in the medium term. The Reserve Bank could cut rates again, but it is far from certain that this would have a measurable impact in further lifting business spending. The Reserve Bank is more forward-looking and is likely to maintain its neutral bias on a more upbeat medium term growth outlook.

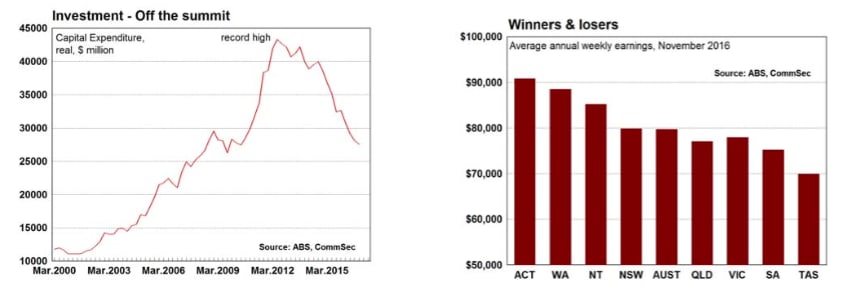

As highlighted yesterday by the wage price index, wage growth at present is modest. Wages are still growing, and out-pacing inflation. The “average worker” has an extra $1,711 in the pocket compared with a year ago, equating to almost an extra $33 week. Real wage growth exists, while higher home prices, subdued petrol prices and lower borrowing costs are also supporting spending power.

While modest real wage growth causes consumers to price-check more often, the modest growth in earnings restrains the wage bill of employers, leaving them inclined to maintain or boost employment – as indeed has been happening. Modest wage growth is one reason why the unemployment rate in at 26-month lows in trend terms.

Overall policymakers will keep a close eye on how business investment evolves over the coming year. The forward looking indicators suggest activity levels are lifting and we believe that interest rates are likely to remain unchanged.

What do the figures show?

Private business investment

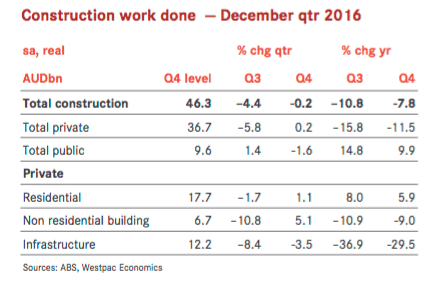

Overall: Business investment (spending on buildings and equipment) fell by 2.1 per cent in the December quarter after falling by 3.3 per cent in the September quarter. Spending on buildings fell by 4.1 per cent in the quarter while spending on equipment rose by 0.4 per cent. Investment is down 15.5 per cent over the year with buildings down by 25.5 per cent while equipment was up by 1.5 per cent.

Sectors: Mining investment fell by 9.3 per cent in the December quarter (tenth straight decline), while manufacturing spending rose by 3.2 per cent, spending by “other selected industries” rose by 1.8 per cent.

States: In seasonally adjusted terms investment fell in five of the eight states and territories in the December quarter. Investment rose the most in the Northern Territory (up 16.1 per cent), followed by the ACT (up 11.1 per cent), Tasmania (up 10.8 per cent), NSW (up 2.3 per cent), Victoria (up 2.0 per cent). Investment fell the most in Queensland (down 6.1 per cent) followed by Western Australia (down 3.7 per cent), and South Australia (down 2.9 per cent).

Prices: The overall deflator for investment goods rose by 0.3 per cent in the December quarter after falling by 0.2 per cent in the September. The cost of buildings and structures rose by 1.1 per cent while the cost of equipment fell by 0.7 per cent. Over the year, the cost of investment goods fell by 0.7 per cent – the largest fall in just shy of 5 years. The cost of buildings rose by 1.1 per cent while the cost of investment equipment fell by 3.4 per cent.

Forecasts: The fifth estimate for investment in 2016/17 is $112.55 billion, down 9 per cent on the fifth estimate for investment made for the previous (2015/16) financial year. However the investment expectation is up 4.6 percent on the fourth estimate made for the current 2016/17 financial year.

The first estimate of investment in 2017/18 is $80.625 billion and is 3.9 per cent lower than the first estimate for 2016/17 – the smallest decline for a first estimate reading in five years.

Average Weekly Earnings:

Average weekly ordinary time earnings rose by 1.1 per cent in the six months to November 2016 to be 2.2 per cent higher than a year ago. Male wages rose by 1.8 per cent over the year while female wages rose by 3.2 per cent.

Average weekly total earnings rose by 2.2 per cent over the year.

The average wage in November 2016 was $79,737.

Wages rose most over the year in Arts and Recreation services (up 5.8 per cent), Information, Media and Telecommunications (up 5 per cent), and Electricity, Gas, Water and Waste services (up 5.4 per cent).

Wages were weakest over the past year in Manufacturing (down 1.5 per cent), Retail trade (up 0.6 per cent), Public Administration & Safety (up 1.5 per cent) and Finance & Insurance (up 1.7 per cent).

Across states & territories, we have calculated average annual wages as follows: NSW $79,862, Victoria $78,005, Queensland $77,069, South Australia $75,192, Western Australia $88,566, Tasmania $69,945, Northern Territory $85,202 and ACT $90,844.

The highest average wage can still be found in the Mining sector at $133,765 per year. Next highest is Finance & insurance services ($95,706) followed by Information media & telecommunications ($95,082), and Professional, scientific & technical services ($92,851).

The lowest average wage is obtained by workers in the Accommodation and food services sector ($57,632), followed by Retail trade ($58,963), “Other services” ($63,554) and Administrative and Support Services ($67,844).

What is the importance of the economic data?

“Private New Capital Expenditure and Expected Expenditure” is released quarterly by the Bureau of Statistics. The figures show both actual and expected spending by businesses on tangible assets such as new buildings, machinery and office equipment. The figures are obtained after sampling 8,000 private business units.

The ABS publishes the Average Weekly Earnings (AWE) series on a six-monthly basis. While the Wage Cost Index allows analysis of wage movements from quarter-to-quarter, the AWE series is best seen as a measure of actual dollar figures for wages. But average weekly earnings figures can be distorted by changes such as the relative growth of high-paid to low-paid jobs and the cashing out of bonuses in ordinary earnings.

What are the implications for interest rates and investors?

The great unwinding of mining investment continues although the lift in commodity prices may result in more of a soft landing in coming quarters.

The latest data confirms that wages are only growing modestly. In broad terms, wages are modestly ahead of prices, with the simple conclusion that inflationary pressures are contained. The Reserve Bank should be in no rush to move interest rates in any direction.

Savanth Sebastian is an economist for CommSec.