Rental guarantees for units in Brisbane... too good to be true?

Buy an apartment in Brisbane and get guaranteed rental income for a year, 3 years or even more, scream ads by developers on various websites targeted to property investors.

Sounds like a good deal? But as the adage goes, if it's too good to be true, it probably isn't.

Promises of such guarantees are sometimes used by developers to lure investors to a weak market or masking an overpriced offer, warns a post on hotspotting.com.au.

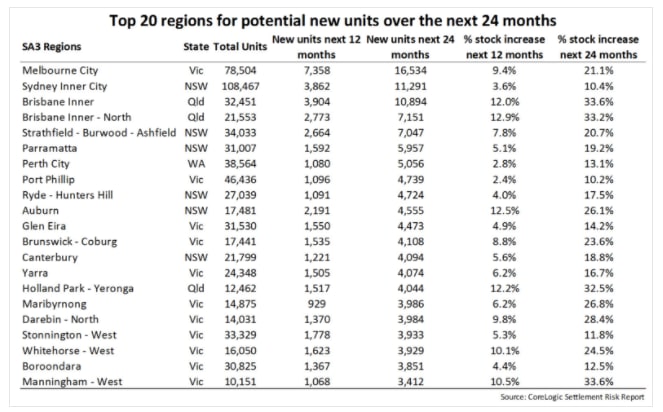

CoreLogic's Cameron Kusher noted in a blog post in October 2016 that "Brisbane is set to see the biggest uplift in total unit stock followed by Melbourne and clearly in more immature unit markets this carries a risk".

He highlighted inner-city locations in Melbourne and Brisbane as carrying the most risk from an oversupply of units. If everything is built over the next 24 months, unit stock in Brisbane Inner will increase by 33.6%, it will rise by 33.3% in Inner-North and by 32.5% in Holland Park-Yeronga.

This contrasts with 21.1 percent for Melbourne City and 10.4 percent for Inner-City Sydney.

Without passing judgement on the ads or the claims, Property Observer found a few offering rental guarantees in Brisbane.

Polo on Kingsley, a collection of three-bedroom townhouses starting from $699,000 in the Brisbane suburb of Yeronga promise a 5 percent rental guarantee for 12 months. The project is being undertaken by Polo Development Group and marketed by McGrath Projects.

Another builder, Dwyer Quality Homes, which has projects in Brisbane, the Sunshine Coast and Gold Coast, is offering three-year rental guarantees.

It also has an FAQ section that explains the scheme and lists all the positives. The website says the income “gives you guaranteed rental income and ensures peace of mind with your new investment.”

Sometime back, Domain reported that apartments were released in a 45-unit, nine-storey block The Woodstore with a 6 per cent rental guarantee for 12 months for the first five buyers… check status of that…

The two-bedroom apartments start at $450,000 in the development in Chermside, 9 km north of the city’s CBD.

“Chermside has such a strong rental market, with a lot of demand for properties – especially new ones! – that this sort of rental guarantee is no issue for us at all,” Murray Thornton, managing director of DevCorp, was cited as saying by Domain.

There are a number of rental-guarantee investment ads on Gumtree as well.

One such ad is for Skytower at 222 Margaret Street, which will be Brisbane’s tallest building when completed. Apartment prices start at $471,000 and comprise one, two and three bedroom apartments.

Another seller has advertised for the luxury Newstead project where apartments are available in one to three bedrooms. The advertised price is $450,000 and upwards, and there is a 5% rental guarantee upon settlement.

Rental guarantees or a trap?

Terry Ryder’s Hotspotting outlines a scenario of the trap behind rental guarantees.

“Developers offer them when they're struggling to sell apartments at the prices they want,” the post says.

This is how they work:

A developer has a block of 100 units and wants to sell them for $350,000. But because it’s an oversupplied market, their true value is only $300,000 and it will earn a rent of only $300 per week. At a sale price of $350,000, the investor's gross return is only 4.5%.

Investors won't be drawn in by those numbers.

So the developer offers rental guarantees to lure investors. He keeps the pricing at $350,000 and offers a rental guarantee $400 per week for two years. This provides a return of 6%.

For an investor, 6% is attractive and he also see two years of income security. However, the developer will lease the unit for $300 because it’s the market rate and pay the $100 shortfall to the investor. This costs the developer a little more than $10,000 over two years.

But the developer has been paid $350,000 for a unit that's worth only $300,000. He's $40,000 in front. For 100 units, he's made an extra $4 million by selling units for more than they're worth.

But the real pain for the investor starts after the two-year agreement expires. The investor has to find tenants in the open market which is oversupplied and he will in all likelihood not get more than $300 per week.

The investor's return falls to 4.5% from 6% overnight. Under the developer's guarantee, the investor was earning $21,000 a year. Now he's earning less than $16,000.

To compound the pain, the value of the unit has fallen because the income has fallen. If the investor decides to sell, he's competing with developers selling new units with deals guaranteeing a 6% return. The investor has to match that if he hopes to sell.

At $300 per week rent, the unit is worth only $260,000 in the open market (at 6%).

The investor’s annual income has fallen $5,000 ($21,000 - $16,000) while at the same time his unit is worth $90,000.