RBA tinkers with growth forecasts: Savanth Sebastian

GUEST OBSERVER

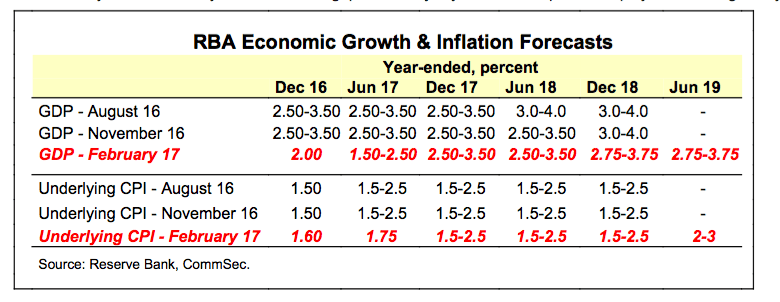

The Reserve Bank hasn’t materially changed inflation forecasts but it has trimmed economic forecasts over the near-term. Economic growth is now seen at 1.5-2.5 percent in June 2017, around one percentage point lower than previous forecasts.

Inflation is expected to hold between 1.5-2.5 percent over the forecast period – below or at the low end of the 2-3 percent target band.

Home loans: The number of loans (commitments) for budding home owners (owner-occupiers) rose by 0.4 percent in December after rising by 1.3 percent in November. The value of loans (owner occupier and investment) rose by 0.4 percent in December after rising by 2.2 percent in November.

Owner-occupier loans rose by 1.3 percent but investment loans fell by 1 percent.

What does it all mean?

The latest Monetary Policy statement has given the Reserve Bank the opportunity to flesh out how the economy is tracking. And it seems like the Central Bank is in the glass half-full camp. Policymakers have updated economic growth and inflation forecasts and it is clear that growth remains relatively sound.

Interestingly inflation is expected to remain below or at the low end of the Reserve Bank 2-3 percent target band over the next two years. Essentially the assumption of subdued inflation is despite the potential inflationary impact of higher commodity prices - which suggests a lack of inflation across the rest of the economy.

The assumption of low inflation and stronger economic growth over time suggests that interest rates remain on hold.

Importantly given that near-term growth forecasts have been downgraded and now expected to hold between 1.5- 2.5 percent, it is clear the central bank is prepared for a degree of softness across the domestic economy. Interestingly when coupled with subdued inflation it suggests policymakers will keep the door open to provide further stimulus. However it should be made clear that the central bank is essentially holding a neutral policy stance.

The economy was essentially lacklustre throughput the majority of 2016 despite unemployment drifting to 3-year lows. However the anecdotal evidence across the economy suggest that activity levels are now lifting.

In that context the latest housing finance data is encouraging. Not only did the number of overall housing finance commitments lift for the second straight month, but it was driven by owner-occupier loans rather than investment loans. Overall the Reserve Bank is correct in its view that conditions in the housing market are very mixed.

What do the figures show?

Housing finance - number

- The number of loans (commitments) for budding home owners (owner-occupiers) rose by 0.4 percent in December after rising by 1.3 percent in November.

- Excluding the refinancing of dwellings, the number of loans was up by 2.4 percent.

- The number of new home loans was down by 4.4 per cent on a year ago.

- Loans by owner-occupiers for the construction of homes fell by 0.3 per cent in December.

- Loans to buy newly-erected dwellings rose by 3.2 per cent.

- Loans for the purchase of established dwellings (excluding refinancing) rose by 0.3 per cent.

- The number of refinancing transactions fell by 3.5 per cent.

Lending across states/territories: NSW (+1.5 percent); Victoria (+0.8 percent); Queensland (-1.3 percent); South Australia (-1.9 percent), Western Australia (-2.7 percent); Tasmania (-2.7 percent); Northern Territory (+0.5 percent); ACT (6.3 percent).

Housing finance - value

The value of new housing commitments (owner occupier and investment) rose by 0.4 percent in December after rising by 2.2 percent in November. Owner-occupier loans rose by 1.3 percent but investment loans fell by 1 percent.The value of loans by owner-occupiers and investors to build new homes fell by 1 percent in December after rising by 5 percent in November. The value of loans to build new homes fell from $3.1 billion to $2.74 billion in December.

Housing finance – other statistics

The proportion of first-time buyers in the home loan market held steady at 13.8 percent in December (long-term average 19.4 percent).

The proportion of fixed rate loans rose from 12.5 percent to 14.6 percent in December – a seven month high. And the average home loan across Australia stood at $375,800 in December, down 0.8 percent in the month but up 0.5 percent on a year ago.

Key take-aways from the Reserve Bank report

Below are our key “take-aways” from the Reserve Bank’s latest quarterly review.

“Inflation is expected to increase as the effects of some factors that have been weighing on domestic cost pressures dissipate”(p3)“Headline inflation is expected to pick up to 2 per cent in early 2017. The increase in underlying inflation is likely to be gradual. These forecasts are little changed from those published in the November Statement on Monetary Policy” (p3)

“Wage growth is forecast to increase only gradually” (p3)

“ there has been some evidence from surveys and liaison with firms suggesting that wage growth is unlikely to ease further.” (p3)

“Overall conditions in the established housing market have strengthened further, although there is significant variation across the country.” (p2) “The global economy entered 2017 with more momentum than earlier expected.” (p1)

“Global inflationary pressures are somewhat stronger than they have been for some time,” (p1)

“ real GDP looks to have increased in the December quarter. Beyond that, the outlook for the domestic economy is little changed from three months ago and the ongoing adjustment to the end of the mining investment boom is expected to continue.” (p2)

“Real GDP declined in the September quarter, a significantly weaker outcome than was anticipated. Some of the decline can be attributed to disruptions to coal supply and bad weather affecting construction activity.” (p1)

“The forecast for consumption growth has been adjusted lower and implies a stable saving ratio over the forecast period, rather than declining, as previously assumed.” (p61)

“The unemployment rate is expected to edge lower over the forecast period, suggesting only a modest reduction in the degree of spare capacity in the labour market from current levels.” (p58)

“ exports of Australian goods and services in aggregate are forecast to continue growing at a solid pace.) (p58)

“Given the stronger tone of more recent indicators, consumption growth is expected to be a little stronger than in mid 2016 over the forecast period.” (p57)

“GDP growth is forecast to increase to 21⁄2–31⁄2 per cent in late 2017, and to be above potential for most of the forecast period.” (p57)

“Some of the factors weighing on reported GDP growth in the September quarter were temporary and have not materially affected the outlook for growth.” (p56)

“While considerable uncertainty remains about the economic policies of the new US administration, reductions in personal and corporate taxes are likely.”

“Much of the apartment construction is geographically concentrated, particularly in inner-city Melbourne and Brisbane. This increases the chance that (localised) oversupply could develop, and would exacerbate the effect on local area prices if that were to occur.” (p37)

What is the importance of the economic data?

Housing Finance data is produced monthly by the Bureau of Statistics and shows commitments by lenders, such as banks, to provide finance for housing purposes. The lending figures relate to those looking to buy or build homes to live in as well as those seeking to buy or build homes for investment purposes. Generally people get their finance organised first, so the figures are regarded as a leading indicator on the housing market.The Reserve Bank releases its Statement on Monetary Policy each quarter. The Statement is the Reserve Bank’s assessment of economic and financial conditions and also contains the latest inflation views. The Statement is crucial is assessing the short-term outlook for interest rates.

What are the implications for interest rates and investors?

The rebalancing of the domestic economy away from mining investment will remain the trigger for interest rates, especially given that inflation is subdued and expected to remain at the low end of the 2-3 per cent target band. However a number of indicators make rate cuts look less likely than even six months ago – improved Chinese activity levels, a stronger terms of trade, a modest lift in domestic activity and the Reserve Bank view that inflation has bottomed.