Upbeat Reserve Bank, wages ahead of prices: CommSec's Craig James

GUEST OBSERVER

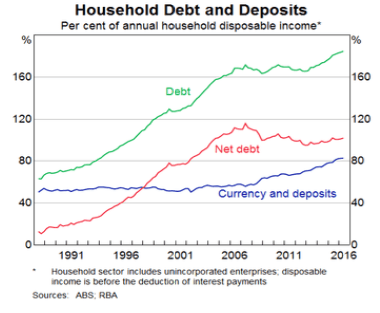

The Reserve Bank Governor appears an even more reluctant rate-cutter than the former Governor. Simply, Philip Lowe believes that there is no value in just cut, cut, cutting. The Reserve Bank believes that the economy will continue to grow faster than the ‘speed limit’ and that will serve to lift inflation. And despite the headlines, the Reserve Bank Governor is encouraged by the more prudent behaviour of consumers. There are no warnings on debt, just the conventional wisdom that higher debt means higher risks.

What do the figures show?

Wage price index

The wage price index rose by 0.4 percent in the September quarter after a 0.5 percent rise in the June quarter. Annual wage growth eased at a record (18-year) low of 1.9 percent (2 percent in original terms) although influenced by just 1 percent growth in mining wages.Private sector wages rose by 0.4 percent in the quarter while public sector wages rose by 0.6 percent. Annual growth of private sector wages eased to a record low of 2.0 percent in the quarter. Annual growth of public sector wages was 2.3 percent.

Including bonuses, wages rose by 0.6 percent in original terms in the September quarter to be up 1.7 percent on a year ago.

Private sector wages including bonuses rose by 0.6 percent in the quarter to be up 1.6 percent on a year ago. Public sector wages including bonuses rose by 0.9 percent in the quarter and by 2.3 percent over the year.

Annual wage growth across States & Territories:

NSW, 2.1 percent; Victoria, 2.0 percent; Queensland, 1.9 percent; South Australia, 2.3 percent; Western Australia, 1.7 percent; Tasmania, 2.2 percent; Northern Territory, 2.2 percent; and ACT, 1.9 percent.

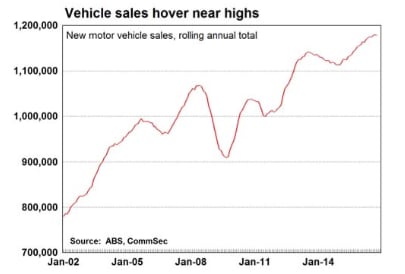

New vehicle sales:

According to the Australian Bureau of Statistics (ABS) new vehicle sales fell by 2.4 per cent in October after a 2.4 percent rise in September. Passenger car sales fell by 2.3 percent, while sales of sports utility vehicles fell by 1.2 percent and sales of “other” vehicles (includes utilities, panel vans, cab chassis, goods carrying vans, rigid trucks, prime movers, non-freight carrying trucks, and buses) fell by 4.7 percent.Across states/territories in September: NSW (-1.0 percent); Victoria (-1.3 percent); Queensland (-2.8 percent); South Australia (-9.1 percent); Western Australia (-4.2 percent); Tasmania (-2.6 percent); Northern Territory (- 10.9 percent); ACT (-4.4 percent).

In rolling annual terms, 1,178,688 new vehicles were sold over the year to October. Sales of SUVs (440,060) hit record highs in annual terms, while annual sales of “other” vehicles stood at a record high of 248,710. Sales of passenger vehicles fell to a 20-year low of 489,918 in the year to October.

What is the importance of the economic data?

The Wage Price Index has been compiled since September quarter 1997 and measures quarterly changes in wage and salary costs for employees. The index is based on a representative sample of employees, and includes measures of non-wage costs including superannuation, payroll tax, public holiday and workers compensation. The Wage Price Index is useful in measuring wage pressures in the economy. While strong growth in wages would boost domestic spending, it could also serve to lift employer costs and prices and add to economy-wide inflationary pressures. The wage price index is a measure of hourly pay rates (excluding bonuses).The Australian Bureau of Statistics provides seasonally adjusted and trend estimates of industry data. The Federal Chamber of Automotive Industries releases estimates of new vehicle sales on the third business day of the month. The figures highlight the strength of consumer spending as well as conditions facing auto & components companies.

What are the implications for interest rates and investors?

Wages continue to outpace prices. Add in the strong flow of dividends from companies, lower interest rates, cheaper petrol and higher home prices and there is plenty of latent spending power to boost sales at retailers.Craig James is the chief economist at CommSec.