Expect new house price inflation to remain strong: ANZ's Jo Masters

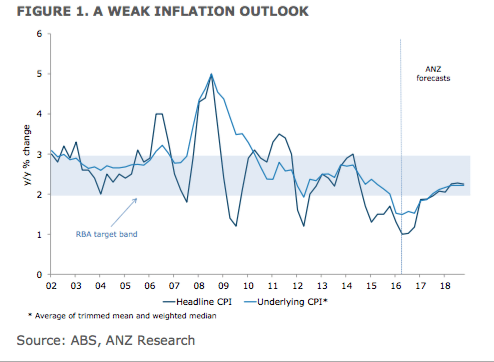

We expect Q3 CPI data (on 26 October) to show that underlying inflation has remained weak. On our forecasts, the data are unlikely to be enough to provide confirmation that disinflationary forces are fading.

We expect the trimmed mean to have risen by 0.3 percent q/q and the weighted median by 0.4 percent q/q. This would see the average of the two measures rise by 0.4 percent q/q and be steady at 1.5 percent y/y.

Importantly, the risks around this forecast seem tilted to the downside given still weak wage growth, low rental inflation, and ongoing pressure on a broad range of retail prices. A key uncertainty in the forecast is around new house prices. This is the largest item in the CPI at 9 percent of the basket and has been quite volatile over the past year.

In our view, an outcome for the average of the two underlying measures of 0.3 percent q/q or less would concern the RBA given it would be below the implied RBA forecast and likely trigger a downgrade to the RBA’s inflation profile.

That said, the backdrop is quite different from April when the weak Q1 CPI print was released: the RBA has two rate cuts in the pipeline and recent communication has sounded comfortable about policy settings; the domestic economy looks more robust; commodity prices have risen; the property market has re-energised; and the changes to the statement on the conduct of monetary policy have increased the RBA’s ability to tolerate below-target inflation on financial stability grounds.

Given this, the detail will be important in assessing any implications for monetary policy. There is little domestic monetary settings can do about global factors (notably competitive pressures weighing on tradable inflation), but the RBA would likely be concerned if there is broad-based weakness across non- tradable inflation.

Should the RBA be confronted with this scenario, we doubt there would be any urgency to respond. Indeed, in such a scenario, we would think it would be more appropriate for the risk of further easing in February to shift, rather than for November.

Apart from the more robust backdrop, waiting until February would provide the RBA the opportunity to see one more GDP print (on 7 December), one more inflation print (in late January), another round of wages data, as well as a few more months of data on both the housing and labour markets. In addition, the US Federal Reserve is likely to have tightened by that time, which could have consequences for the AUD.

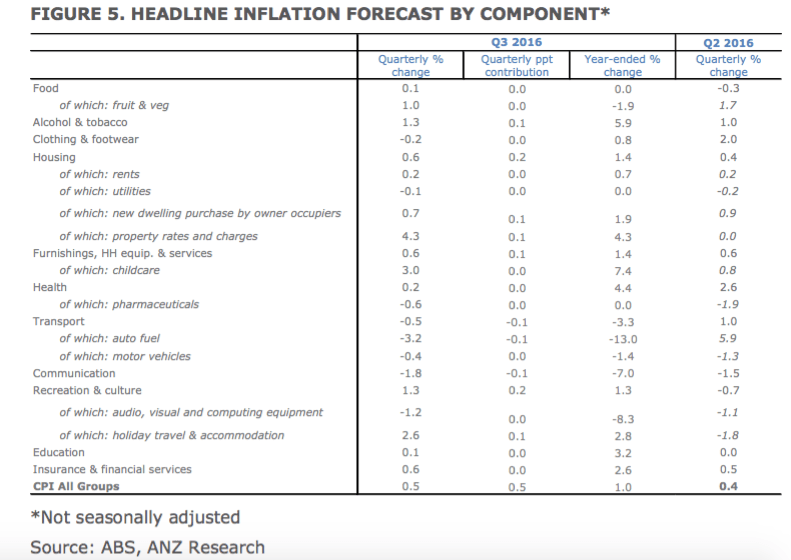

The headline CPI is forecast to have risen by 0.5 percent q/q in Q3, slightly higher than the 0.4 percent q/q Q2 outcome, leaving annual inflation steady at 1 percent y/y. Our daily tracking of petrol prices imply a 3.2 percent fall in the quarter.

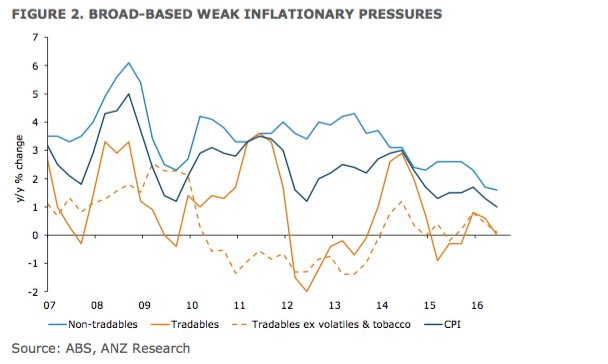

THE BROAD THEME REMAINS ONE OF WEAK INFLATIONARY PRESSURES

Retail price inflation is being restrained by global competitive pressures. Meanwhile, weak wage growth – which is showing only tentative signs of stabilising – and low inflation expectations are weighing on non-tradable inflationary pressures1. New house prices are the key exception to this, with inflation in this sector likely to have remained relatively solid given the high level of construction activity.

Consequently, we expect inflationary pressures to remain relatively subdued across a broad range of items, with both tradable and non-tradable inflation expected to remain soft. Indeed, we continue to see a weak inflation environment over the coming year (see Figure 1).

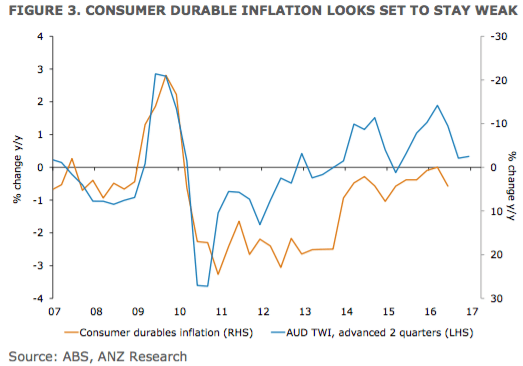

These competitive pressures likely have several years to run across both consumer staples and durables. Indeed, we continue to see weak inflationary pressures across supermarket prices, clothing & footwear, furnishings, and audio visual & computing equipment.

Meanwhile, weak wage pressure is likely to see market services inflation remain mild and continue to lean on administered inflation. Wage growth is showing tentative signs of bottoming, but any recovery is likely to be a slow process given a significant degree of underemployment.

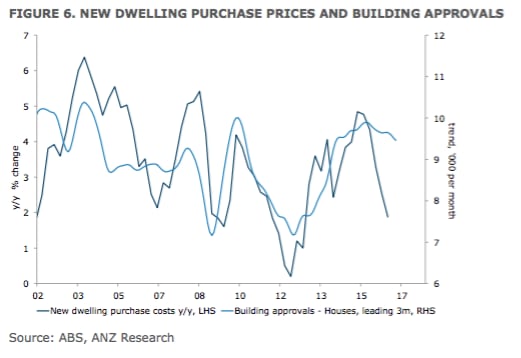

That said, there is a high degree of uncertainty around new house prices. This is the largest item in the CPI at 9 percent of the basket and has been quite volatile in the past year. Building approvals for houses have remained at elevated levels, but new house price inflation has weakened sharply on a y/y basis (see Figure 6). Given renewed strength in the housing market, we expect a reasonable rise of 0.7 percent q/q in Q3 (after 0.9% q/q in Q2 and 0.2% q/q in Q1).

While we expect new house price inflation to continue to remain relatively strong in the coming quarters, upside pressure from this component is likely to fade over 2017-18 as construction activity peaks and then moderates. Indeed, investor finance for new construction has weakened in recent months and suggests building approvals may be close to a peak.

Rental inflation (which accounts for 7 percent of the CPI basket) is forecast to remain very weak at +0.2 percent q/q, consistent with surging supply.

Given the supply of apartments coming on stream over the next year (Figure 7) and the investor-led nature of this property cycle, rental inflation is forecast to remain soft over the forecast period – a concern recently highlighted by the RBA.

The communications category is forecast to subtract 0.1ppt from CPI in Q3, with prices forecast to have fallen by 1.8 percent q/q in Q3. Prices for telecommunication and equipment items have been falling since late 2013 and the downward pressure shows no sign of abating.

Tobacco prices are forecast to add to headline CPI in Q3, with the annual 12.5% excise increase on 1 September 2016 pushing tobacco prices higher. That said, we note that most of the impact of this administered price rise comes through in the December quarter.

Holiday travel and accommodation is forecast to contribute 0.1ppt to quarterly CPI, reflecting a seasonal increase in international travel, while BITRE data points to a jump in domestic airfares.

Jo Masters is senior economist, ANZ and can be contacted here.