Property 101: Can equipment owned by the SMSF be leased to other members of the same SMSF?

An SMSF can lease an asset of the fund – such as business equipment or machinery – to a related party of the fund. This is known as an in-house asset.

An in-house asset is a loan to – or an investment in – a related party of your fund or an asset subject to a lease to a related party.

A related party of your fund can include fund members, trustees, their relatives and any companies and trusts these related parties control or influence. Employers who contribute member benefits for you or another member of your super fund are also related parties.

It’s important to remember that in-house assets can’t be more than 5 percent of the total market value of fund assets.

If your SMSF holds an in-house asset, the value of all of your funds’ assets needs to be determined at the end of the income year. The valuation enables you to test whether the market value of the in-house assets exceed 5% of the funds’ total assets at the end of a year of income.

Certain events will affect the percentage of in-house assets and there are also some exceptions to the in-house asset rules.

Your SMSF must also ensure that the lease of business equipment or machinery complies with the sole purpose test and is made on a commercial ‘arm’s length’ basis.

Can an SMSF sell a collectable or personal-use asset to a related party?

Yes – collectables and personal-use assets held in an SMSF can be sold to a related party. For items acquired:

- after 1 July 2011, the sale must be made at market price as determined by a qualified, independent valuer

- before 1 July 2011 and sold before 1 July 2016, an independent valuation is not required, however, the sale must be made on an arm's length basis.

All sales to related parties that occur on or after 1 July 2016 must be supported by an independent valuation.

What is the time limit for providing requested documents to my SMSF auditor?

You must provide requested relevant documents to your SMSF auditor within 14 days of the request being made.

If you fail to do so, you will be in breach of a statutory time period in section 35C (2) of the Superannuation Industry (Supervision) Act 1993.

Where a statutory time period is exceeded by more than 14 days, your SMSF auditor is required to report the contravention to the ATO via an Auditor Contravention Report.

What is my preservation age for accessing super benefits?

Your preservation age is the minimum age at which you can access your preserved super benefits without meeting another condition of release. It is based on your year of birth.

Your preservation age will be 55 if you were born before 1 July 1960.

If you were born after 30 June 1960, you will have a higher preservation age of:

- 56 – if you were born between 1 July 1960 and 30 June 1961

- 57 – if you were born between 1 July 1961 and 30 June 1962

- 58 – if you were born between 1 July 1962 and 30 June 1963

- 59 – if you were born between 1 July 1963 and 30 June 1964

- 60 – if you were born after 30 June 1964

To access your preserved super in the 2015-16 income year, you must have turned 55 before 1 July 2015.

Your preservation age is relevant to the following conditions of release:

- reaching preservation age and retired with no intention to work again in the future

- reaching preservation age and starting a transition-to-retirement income stream.

What happens if TRIS payments exceed the maximum annual payment limit?

A transition-to-retirement income stream (TRIS) can be paid to a member who has reached their preservation age even if they have not retired. However, strict annual payment conditions apply. The minimum annual payment amount depends on the member’s age and the maximum annual payment amount is 10 percent of the member’s account balance.

If payments are outside the allowable limits, the TRIS is automatically taken to have ceased for income tax purposes from the start of the financial year in question. This means your fund cannot claim a tax exemption on the income from the account supporting all the payments. It also means all payments made during the financial year will be treated as a lump sum and taxed at the individual’s marginal tax rate, unless the payments are unrestricted non-preserved benefits.

Can an SMSF purchase shares in a private company?

An SMSF is prohibited from acquiring assets from a related party. There are limited exceptions, including market listed shares, business real property or in-house assets (where the value of all in-house assets does not exceed 5% of total fund assets).

In recent communications, we have described situations where an SMSF purchases the shares of a private company for the purpose of channelling franked dividends to the SMSF instead of the company’s original shareholders.

If the private company is a related party of the SMSF, the purchase would be a prohibited acquisition and a breach of section 66 of the Superannuation Industry (Supervision) Act 1993 (SISA) would occur.

How are unrestricted non-preserved benefits related to a condition of release?

The most common conditions of release for paying benefits to a member are when the member has:

- reached their preservation age and retires

- reached their preservation age and begins a transition-to-retirement income stream

- turned 65 (even if they haven't retired)

- died

When you meet a condition of release with no cashing restrictions, your preserved benefits become unrestricted non-preserved benefits (UNPB).

Under the rules for voluntarily cashing benefits, UNPBs may be cashed at any time.

Can you set up an SMSF with a corporate trustee?

Under paragraph 19(3)(a) of the SISA, the trustee of the fund must be a constitutional corporation pursuant to a requirement contained in the governing rules.

This means you need to set up a company incorporated under law and obtain a certificate of registration in order to have the company act as trustee of a fund. Registering a company incurs immediate costs and there is also an annual fee depending on the purpose of the fund.

The company must be registered before the SMSF is established.

How do I amend my SMSF annual return?

To amend your SMSF annual return you need to resubmit the whole return and answer ‘yes’ in Section A question 5.

You cannot request amendments by:

- writing to us with the correct details

- submitting a partially completed SMSF annual return

- submitting a Request for an amendment of an income tax return form.

Can I make salary-sacrificed contributions to my SMSF and at the same time access retirement money to make mortgage payments?

There are very limited circumstances when you can access your retirement savings early. Strict criteria must be met to do so.

A release on compassionate grounds must be applied for through the Department of Human Services. In these circumstances, superannuation savings will only be released to make mortgage payments if you do not have the financial capacity to pay and your mortgagee is threatening to repossess or sell your home.

If you are voluntarily salary sacrificing into your super fund, instead of paying your mortgage, you will not qualify for compassionate grounds because you have the financial capacity to make your mortgage repayments by accessing your employment income.

You are only able to withdraw super under severe financial hardship if you have received Australian Government income support payments continuously for 26 weeks and are unable to meet reasonable and immediate living expenses. Payments from your super fund are limited to a maximum of $10,000 every 12 months.

Improper early access to your super is illegal – there are severe consequences for you and your fund if you access your super before you are legally entitled to do so. These include disqualification of trustees, the fund being made non-complying, imposition of administrative penalties, and prosecution.

Any money accessed illegally will also be assessed as income for the individual and taxed at the applicable marginal tax rate.

Can an SMSF take out insurance on a cross-insurance basis?

Regulations that came into operation on 1 July 2014 do not allow SMSFs to provide insurance for a member unless the insured event is consistent with one of the following conditions of release:

- death

- terminal medical condition

- permanent incapacity

- temporary incapacity.

The Explanatory Memorandum associated with the amended regulations makes it clear that the proceeds of an insurance policy must be released to the member who is the insured under the policy. This means that cross-insurance arrangements where the proceeds of an insurance policy are paid to someone other than the insured under the policy are not permitted.

Does the temporary budget repair levy apply to SMSFs?

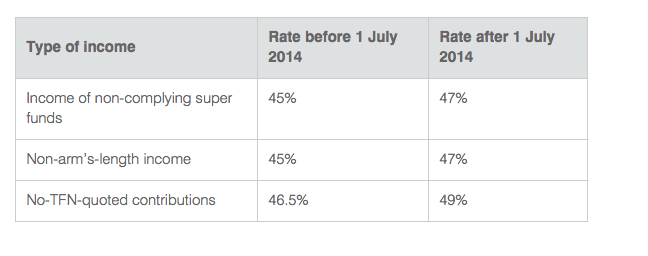

The Temporary Budget Repair Levy started on 1 July 2014. It is a 2 percent levy that applies if your income is taxed at the highest marginal tax rate. Super fund tax rates that match the top marginal tax rate for individuals have been increased by 2 percent. These tax rates are:

Click to enlarge

For more information from the ATO, click here.