Unemployment rate down, but participation also falls: HSBC's Paul Bloxham

GUEST OBSERVER

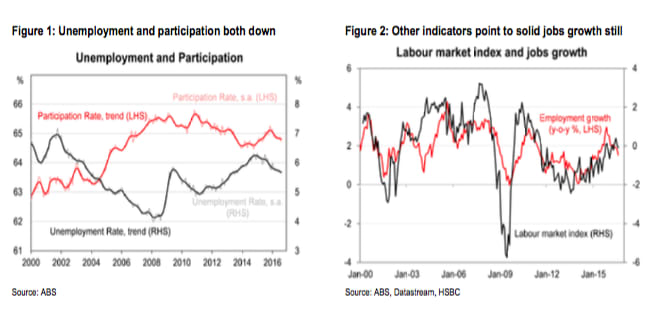

Australian employment numbers surprised to the downside in August, with a fall of -4k jobs (market had 15k jobs), but the unemployment rate was better than expected, falling to a new cyclical low of 5.6 percent (market had 5.7 percent).

The factor that reconciles these divergent trends is a noticeable decline in the participation rate, from 64.9 percent to 64.7 percent.

This survey has been subject to measurement issues for some time now and the August numbers have often been problematic. We are therefore cautious about reading too much into the numbers. The other timely indicators of the labour market are consistent with ongoing jobs growth of about 2 percent y-o-y, which is enough to see the unemployment rate gradually edge lower. We see the RBA on hold in coming quarters.

Facts

- Employment fell by 4k in August (market expected +15k, HSBC expected +20k). Over the past six months, jobs growth has averaged +13k a month. Annual employment growth stands at 1.5 percent, down from 1.9 percent previously.

- Full-time employment rose by 11k in August, but is just 0.4 percent higher than a year ago. Part-time employment fell by 15k but is up 4.1 percent from a year ago.

- The participation rate fell from 64.9 percent to 64.7 percent, the lowest since May 2015.

- The unemployment rate was 5.6 percent, down from 5.7 percent in July. That is the lowest unemployment rate recorded since September 2013.

- The employment-to-population ratio was 61.1 percent, down 0.1 percent from July.

- Total hours worked fell by 0.2 percent m-o-m. Trend annual growth in hours worked stands at 0.5 percent y- o-y, having hit 2.8 percent y-o-y in November 2015.

Implications

The unemployment rate fell to the lowest level in around three years in August, although not for positive reasons. Total employment was actually down slightly, partly due to sample rotation. But this was more than offset by a lower participation rate, which meant that the overall labour force shrank. A drop of 0.2ppts in the participation rate may not sound like much, but if participation had held steady the unemployment rate would actually have climbed to 5.9%, by our calculations.

Overall then, the monthly result is a weak one. But as always, we treat a single month’s labour market data with a great degree of caution, especially in light of the disruptions seen in the seasonal pattern in recent years (particularly in the August and September months). It is trends that emerge over several months that matter, and for now there is little evidence to suggest a material slowdown in employment growth from a pace of around 2 percent y-o-y (equivalent to around 20k jobs per month). Other indicators, such as job advertisements and business conditions, also point to continued growth at around that rate.

Ordinarily, annual employment growth of 2 percent or just below would be enough to offset growth in the labour force and keep the unemployment rate broadly steady. Over the past year, we have seen slightly lower participation – unusual given solid employment growth – and if that continues unemployment may continue to ease gradually lower. We also see potential for the labour market to strengthen from around mid-2017 as the drag from mining investment diminishes and domestically-driven growth picks up.

PAUL BLOXHAM IS CHIEF ECONOMIST (AUSTRALIA AND NEW ZEALAND) FOR HSBC.