July fall in owner occupier approvals is a little puzzling: Westpac's Matthew Hassan

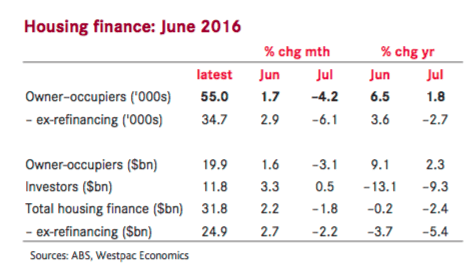

Ex refinance the picture was even weaker with a 6.1 percent fall, the largest monthly decline since May last year.

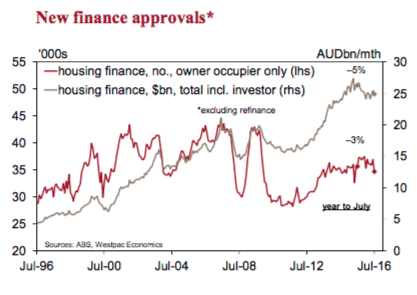

Approvals can be choppy month to month but moves tend to be in the ±3 percent range.

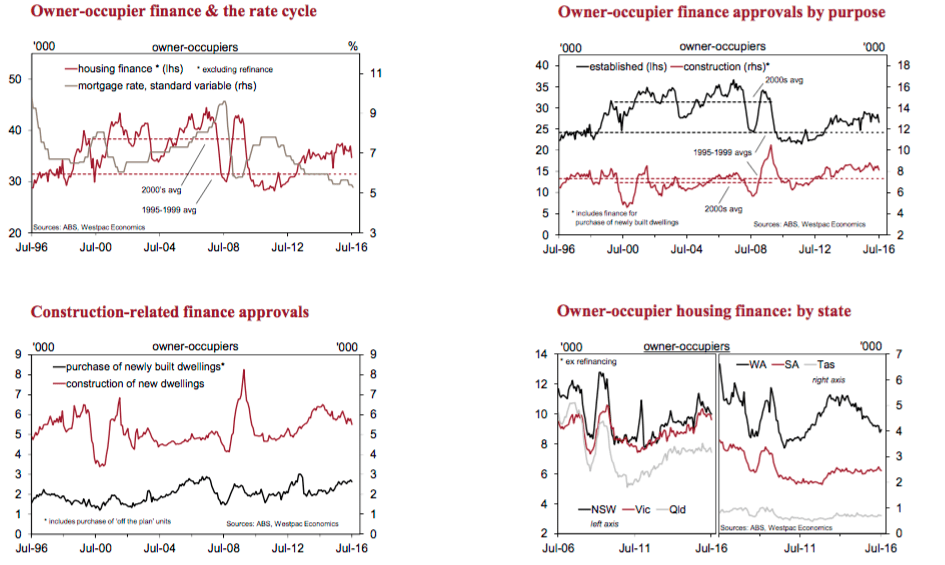

Our estimates (using ABS seasonal factors) suggest seasonally adjusted owner occupier approvals ex refi were down 3-4 percent in NSW, Vic and Qld with, somewhat surprisingly, WA the only state to record a rise (+2.7 percent/mth).

Note that the sum of these estimates across the big five states is firmer than the published national number (down about 2 percent rather than 6 percent).

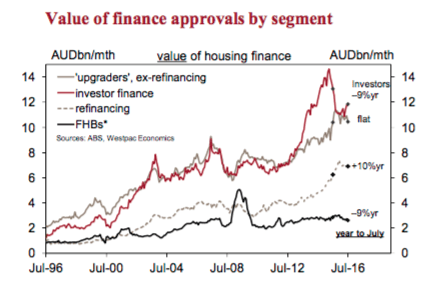

The value of housing finance approvals to investors rose 0.5 percent, building on a 3.3 percent gain in June to be up 9.2 percent since April.

The sharp slowdown associated with the tightening in lending criteria and increases in borrowing rates for investor loans late last year has now clearly run its course.

With loan 'supply' now, arguably, less constrained (particularly given that investor credit growth is tracking at 4.5 percent/yr, well below the regulator's 10 percent ceiling) and some of the uncertainty around potential tax changes easing activity looks to be firming again.

For the total value of housing finance approvals, the rise in investor loans partially offset the weakness in owner occupiers with the total value ex refi down a milder 2.2 percent/mth. The total value of approvals ex refi is down on a year ago, mainly reflecting last year's pull back in investor loans.

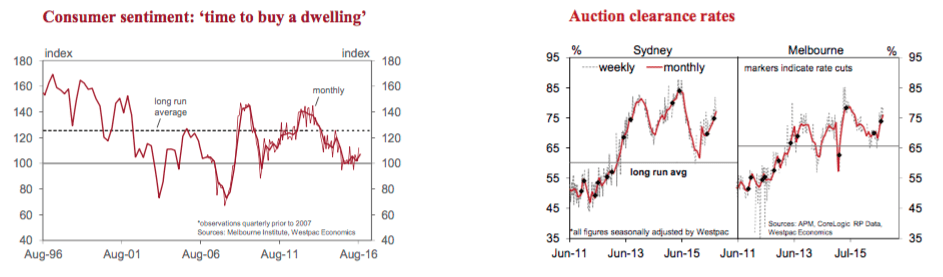

The July fall in owner occupier approvals is a little puzzling given the May interest rate cut and a range of other indicators suggesting both buyer sentiment and market conditions have firmed somewhat in recent months.

It may reflect the tail end of earlier weakness (finance approvals tend to respond to rate moves and sentiment shifts with a 2-3mth lag). There may also be some statistical 'noise' in the monthly data.

Overall, given the better reads coming from other market indicators and the divergence between investor and owner occupier loans we would tend to take the July finance approvals figure with a grain of salt and look to coming months to confirm whether a new weakening is coming through.

Matthew Hassan is senior economist with Westpac.