The global weight of money and US housing: Westpac's Elliot Clarke

GUEST OBSERVER

Typically one would expect a rate hike cycle to cause mortgage rates to rise, at least at the margin.

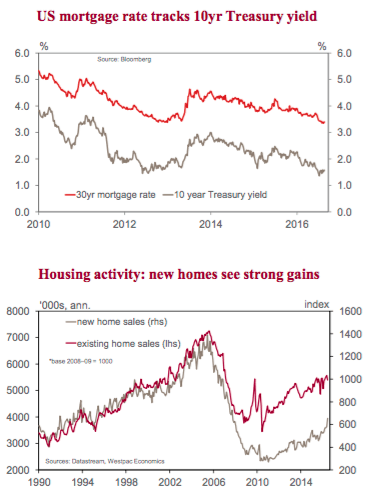

In a nation such as the US, where the mortgage rate is a long-term fixed rate, this should occur as market interest rate expectations firm. Yet for the US hiking cycle that began in late-2015, this has proven to not be the case.

Not only did the US’ 30-year mortgage rate remain largely unchanged before and after the first rate hike (near 3.90 percent). But eight months on, the prime mortgage rate now stands at just 3.40 percent, having reached a cycle-low of 3.35 percent in early August.

Taking a longer-term perspective, it is apparent that this decline is not a one off. Instead it is the continuation of a multi-year trend: the 2015 average 30-year mortgage rate of 3.90% also being well below 2014’s 4.21%.

What is behind this downtrend in the mortgage rate? Weaker long- term Fed Fund Rate expectations have certainly played a part. Note that even the FOMC’s own longer-run Fed Funds expectation has been materially marked down over the past year, from 3.75% in mid- 2015 to 3.00% currently. But the relationship between the 30-year mortgage rate and the US 10-year Treasury yield adds a further element to consider: the impact of global liquidity.

Simply, global liquidity has not only reduced borrowing costs for the US government (like many other nations across the globe),

but thanks to the strong link between the US mortgage rate and Treasury rates, the benefit has also flowed to US households. Indeed, households who meet bank credit criteria have never been able to borrow so cheaply.

Given continued robust job gains and a burgeoning improvement in wages growth, it is not surprising that not only has price momentum been sustained, but so too has sales activity. Indeed, abstracting from the monthly noise, recent months have shown evidence of strengthening real momentum in new home sales.

The three-month average sales pace for new homes is 22% higher than its year-ago level; for 2016-to-date, the gain from 2015 to 2016 is a more modest (but still robust) 12%. A recent operational update from major US builder Toll Brothers also points to a robust pipeline of sales activity, with reservation deposits for the first three weeks of August reported to be up 23%yr versus 18%yr growth in contracts in Q2. Gains in activity were reported to be broad based across the firms many product lines and geographic regions.

For existing home sales, having already experienced a material improvement through 2010–2015, recent gains have been much more muted. That said, the level of sales continues to slowly trend higher, which is indicative of robust, broad-based belief in housing as an asset class.

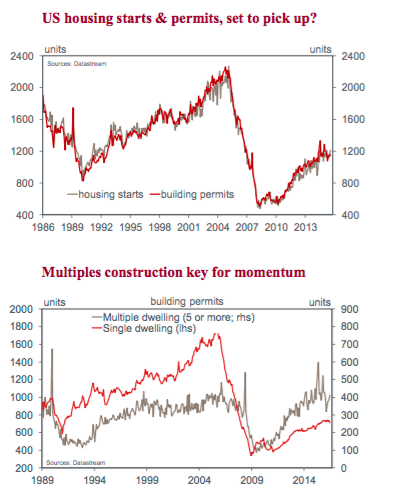

If new home sales and the lead provided by the Toll Brothers update proves an accurate representation of current activity, then we are likely to see renewed momentum build in dwelling construction through the second half of 2016. This contribution is likely to be marginal, but nonetheless positive. Permits data points to much of this growth coming in the form of medium-to-high rise multiple dwelling buildings. As such, the activity is likely to be concentrated geographically but have a prolonged life, well into 2017.

With regards to policy, the momentum building is not cause for alarm, but it does highlight a need for the FOMC to be conscious of their ability to control market interest rates given rapidly growing global liquidity and all-important long-term market expectations.

Elliot Clarke is director and senior economist, Westpac Institutional Bank, and can be contacted here.