No great interstate rush to Brisbane so no runaway price growth in near future

The Brisbane residential market historically lags behind the Sydney and Melbourne markets valuation firm Herron Todd White recently noted.

The affordability plays as large numbers of southern state residents find their higher priced capitals are becoming hard work.

"Then a few pioneering souls realise if they sell their Surry Hills renovatable terrace for a very princely sum, they can move to our sunshine city and purchase a magnificent suburban abode within a short commute of the CBD – and still have plenty of change leftover for a very shiny car, boat, trip or local investment property," HTW suggested.

"There’s a bit of a chicken-or-egg with this movement.

"Some say employers drive the move first - which was mostly true during the mining boom where we felt the benefits – particularly if there were FIFO residents and/or the headquarters of mining companies set up in our town.

"Another theory is that relative affordability drives demand from southern residents first, and companies follow.

"This seems feasible too.

"It’s hard to retain workers, even those on a great wage, when rent and mortgage costs are taking a fair chunk of your weekly wage out of your pocket.

"Many big employers will recognise this, as well as the comparably better commercial costs of living in our well-connected capital, and will seek to set up an office where the sun shines."

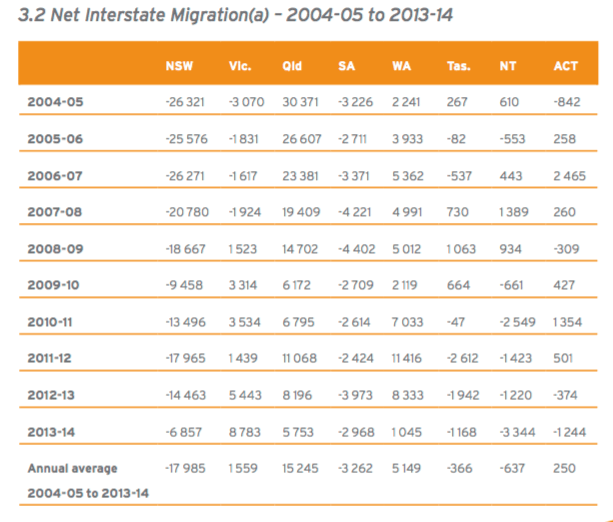

This momentum builds with more employment in a great location and property costs that won’t ruin your savings account, the firm added, though currently the interstate migration "isn’t great" at present, as you can see from the ABS chart (3.2).

The state’s average annual since 2004 is around 15,000 persons.

As at 2014, we recorded an annual number short of 6,000.

The issue is that while there is a sizeable gap in property values between Brisbane and Sydney/ Melbourne, job numbers are down and our property prices have remained relatively uneventful.

"Iinterstate migration has been in negative territory over the past 12 months to two years and while inner city blue-chip property has seen attractive gains, mid-priced, mid-distance suburbs have seen their homes remain fairly steady in value.

"If you travel further afield to the high-rent fringes of our capital, then these markets are even softer.

"When we do start to see numbers of residents increase, the rising tide floats all boats," HTW forecast.

"Given the relatively small size of the Brisbane property market, everyone gets a boost, although we traditionally see prices rise fastest in those suburbs close to town first with our pebble-in-the-pond approach becoming firmly established over the past few cycles now.

"As far as we can tell, there’s no great interstate rush to Queensland as yet, and while we continue to be a steady, solid performer compared to other property markets in the nation, not many are predicting runaway price growth in the near future.

"If a major infrastructure project were to get off the ground, such as Cross River Rail, this may improve the performance of the economy however, this is still considered to be some time away.

"Probably best to just buy safe and wait for long-term gains," it concluded.