Wages growth drives expectation for one more RBA rate cut: Shane Oliver

GUEST OBSERVER

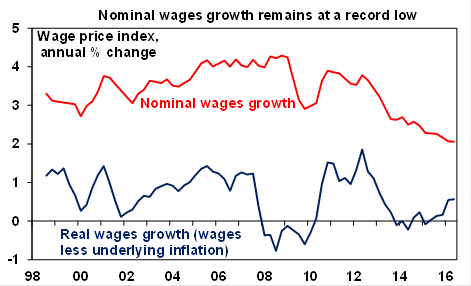

The June quarter Wage Price Index rose 0.5 percent quarter on quarter or 2.1 percent year on year. This was as expected and leaves wages growth at a record low for the Wage Price Index (which dates back to 1997).

Private sector wages are up 2 percent yoy and public sector wages are up 2.4 percent yoy.

By industry, wages growth ranges from just 1.3 percent yoy in the mining sector (the big surprise is that it’s not negative!) to a high of 2.5 percent yoy in the utilities and health care sectors.

By state, wages growth ranges from 1.8 percent yoy in WA to 2.2 percent yoy in NSW and SA.

Source: ABS, AMP Capital

Ultra-low wages growth reflects ongoing spare capacity in the labour market (with unemployment and underemployment at 14.2%) and low corporate revenue growth which is flowing through to low budgets for wages growth.

Continuing record low wages growth means ongoing downwards pressure on inflation as it contains cost pressures for businesses. As such it adds to the risk that inflation will stay below the RBA’s target range for longer than the RBA is currently projecting.

Low nominal wages growth also means ongoing softness in growth in household income which in turn limits consumer spending. Fortunately, real wages are rising because inflation is even weaker, but they are only rising by 0.5 percent yoy and its likely that nominal growth has a greater impact on how households feel.

The continuing weakness in wages growth and the risks it poses to inflation are consistent with our assessment that the RBA will cut interest rates again this year, but probably not until November when we see the cash rate being cut by another 0.25 percent taking it to 1.25 percent.

SHANE OLIVER is head of investment strategy and economics and chief economist at AMP Capital and is responsible for AMP Capital's diversified investment funds.