Mining dependent WA and NT pace of price decline has slowed: Residex

The Australian property market generally performed well in the June quarter, according to the Residex research group.

The Sydney, Melbourne and Brisbane markets saw strong gains over the June quarter, with the exception of Brisbane units.

The resource markets in WA and NT continued their decline, however the pace of the declines has slowed.

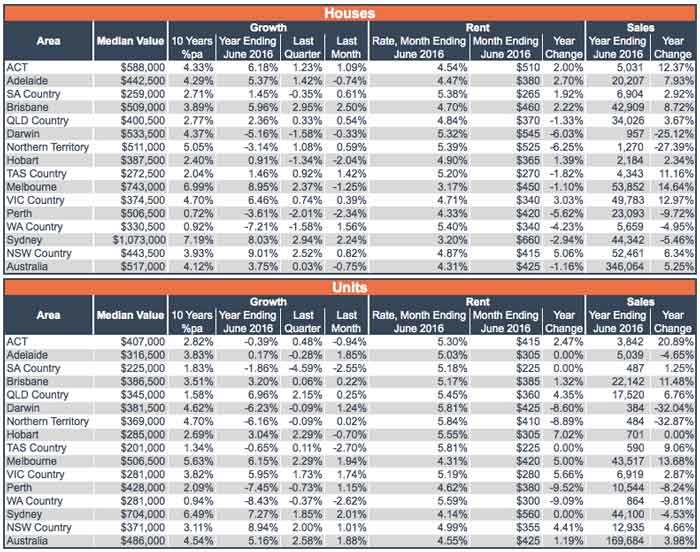

Table 1: June 2016 Summary

Source: Residex

Australia wide, the median house increased in value by a very modest 0.03 percent during the June quarter, while units increased by 2.58 percent.

However, the strong growth in the unit market follows a 1 percent decline in the previous quarter. Graph 1 shows quarterly growth over the last 10 years.

Graph 1: Quarterly Growth in Australian Houses & Units

Source: Residex

"Recent divergence between the performances of the different dwelling types may be partially explained by the growth cycles of houses and units being unsynchronised," Eliza Owen, market analyst for Onthehouse.com.au/Residex said.

"At times, the unit market appears to have led the house market.

"This can be seen in Graph 1 in the upswing of 2009 and again in 2012-2013.

"As property has become increasingly used for investment purposes, and units become popular amongst investors, unit investment from speculators may provide first movement in the market.

"This early signal may then flow through to other segments of the market, adding to momentum and overall demand," she said.

Other explanations for the divergence may be the relative affordability of units, or units becoming an increasingly preferred dwelling for locations in cities.

"In Sydney, the house market saw strong growth of almost 3% in the June quarter – largely driven by capital gains in June," Eliza Owen said.

Sydney houses grew 8.02% in the 12 months to June, increasing the median value by $55,000. However, this annual growth rate is down from a peak in the growth cycle of 21.95% in September 2015 when the median Sydney house increased $172,000 over the year. Growth in Sydney may ease further as dollar rents are stagnating in units and falling in houses.

A similar surge in the June quarter occurred in Brisbane houses, which had the strongest quarterly capital growth rate at 2.95%.

Quarterly growth in Hobart houses began to subside, with values falling 1.34% over the June quarter.

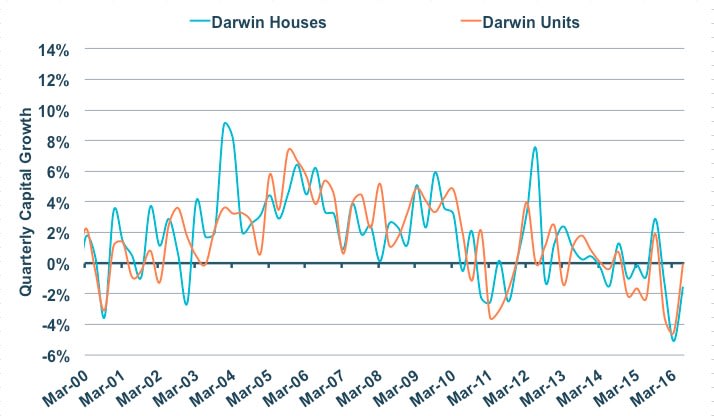

In Darwin, median values continue to fall with houses losing 5.16% over the year to June while units declined in value by 6.23%. However, the data suggests that the pace of losses have started to ease as the dwelling growth cycle may have entered a cyclical trough. In the short term, growth may come into a cyclical upswing, though this is somewhat dependent on the amount of investment and interest in the Northern Territory.

Graph 2: Quarterly Growth in Darwin Houses & Units

Source: Residex

"There was a cyclical trough in growth reached in early 2011 and again in early 2016.

"The growth patterns show that a trough does not signify the end of a downward trend in these dwellings.

"With completion of the Ichthys project expected in early 2017, as well as ongoing declines in rental rates and transaction numbers, it is uncertain whether this market has fully corrected," Eliza Owen, market analyst for Onthehouse.com.au said.