Confident Aussies, RBA Governor “unplugged”: CommSec's Craig James

GUEST OBSERVER

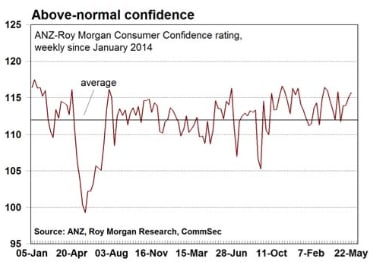

An election may be just over a month away, but it is so far, so good for the economy. Consumer confidence hasn’t fallen in the past four weeks, and hopefully that means that people are just quietly getting on with life. Usually election periods are viewed with suspicion – with uncertainty about the likely outcome causing people to delay spending, investing or hiring staff.

But consumer sentiment remains positive and above long-term averages. Importantly, the outlook for family finances remains well above long-term averages.

In terms of consumer confidence, the Reserve Bank is keenly focussed on the outlook for family finances. Simply, if the outlook for finances is positive, consumers are more likely to spend. The good news is that Aussie consumers positively view the outlook for their finances with the latest survey result not far off the best level seen in six years.

The Reserve Bank Governor covered a lot of ground at today’s question and answer “unplugged” session. Amongst the topics discussed were inflation and inflation targeting; China’s economic transition; industries of the future; household finances; and the supply of housing and home prices. The key takeaway is that while growth is good – but could be better – and unemployment has come down, inflation is too low. That by itself doesn’t point to lower rates ahead. The Reserve Bank Governor also indicated his belief that inflation will eventually lift and be back in the 2-3 percent target band.

The Reserve Bank Governor noted that ‘leverage’ was a factor being monitored closely when assessing the state of the housing market. While households were holding more debt and were doing a good job with managing their finances, the Reserve Bank Governor indicated that debt couldn’t continue to rise much further from current levels.

Asked about what industries will provide future economic growth, Governor Stevens said that growth would come from a variety of places. He indicated for that to happen it was important to have the “right overall policy settings”. Policy settings include the labour market, competition policy as well as those encouraging innovation and risk taking.

What do the figures show?

Consumer confidence

The ANZ/Roy Morgan consumer confidence rating rose by 0.5 per cent to 115.7 in the week to May 22. Confidence is up 1.9 per cent over the year, up 3.6 per cent over the past four weeks and above the average of 112.1 since 2014. Three of the five components of the index rose in the latest week:The estimate of family finances over the next year was up from +26 to +29;

Economic conditions over the next 12 months was unchanged at +3;

Economic conditions over the next 5 years was down from +10 to +7;

The appearance by the Reserve Bank Governor was termed an “unplugged” session – involving him answering questions from a facilitator as well as the audience.

The Reserve Bank Governor reiterated his defence of the current 2-3 per cent inflation target band.

Governor Stevens suggested there would be “quite some years of hard repair work ahead” for the Federal Budget.The Reserve Bank Governor said that China was "making reasonable progress" with the shift from manufacturing to services and consumption-led growth.

The Aussie dollar was currently "doing what you expect it to do". The Governor seemed comfortable with the current level of the currency.

The Reserve Bank Governor noted that leverage was a key issue when assessing the current state of the housing market.

What is the importance of the economic data?

The ANZ/Roy Morgan weekly survey of consumer confidence closely tracks the monthly Westpac/Melbourne Institute consumer sentiment index but the former measure is a timelier assessment of consumer attitudes and is now closely tracked by the Reserve Bank.

What are the implications for interest rates and investors?The encouraging readings on the outlook for family finances are positive for retailers and other consumer- focussed businesses.

The Aussie dollar broadly fell from US72.20c to US71.95c in response to the Governor’s remarks. The Governor didn’t close the door on future rate cuts.