Annual growth in total hours worked negative for April: Westpac's Justin Smirk

GUEST OBSERVER

The emerging new trend for slightly softer participation is something we are watching closely. Also note that annual growth in total hours worked was negative this month.

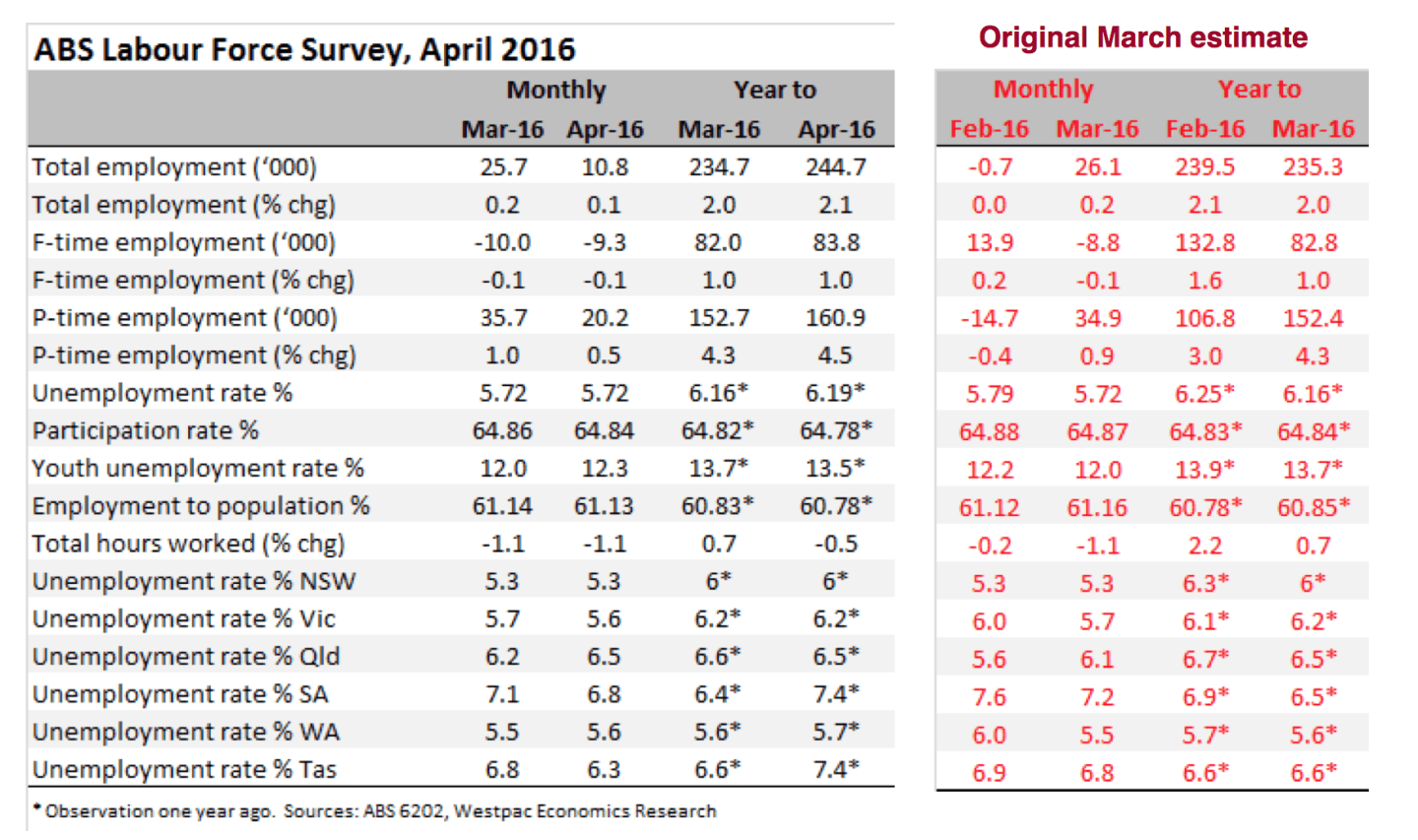

There was not much excitement in the 10.8k rise in total employment in April as was enough to lift the annual pace to 2.1 percent/yr from 2.0 percent/yr and hold the unemployment rate flat at 5.72 percent.

On these two headline numbers there is not much to make you want to alter neither your trajectory for the Australian labour market nor how you think about the outlook for monetary policy.

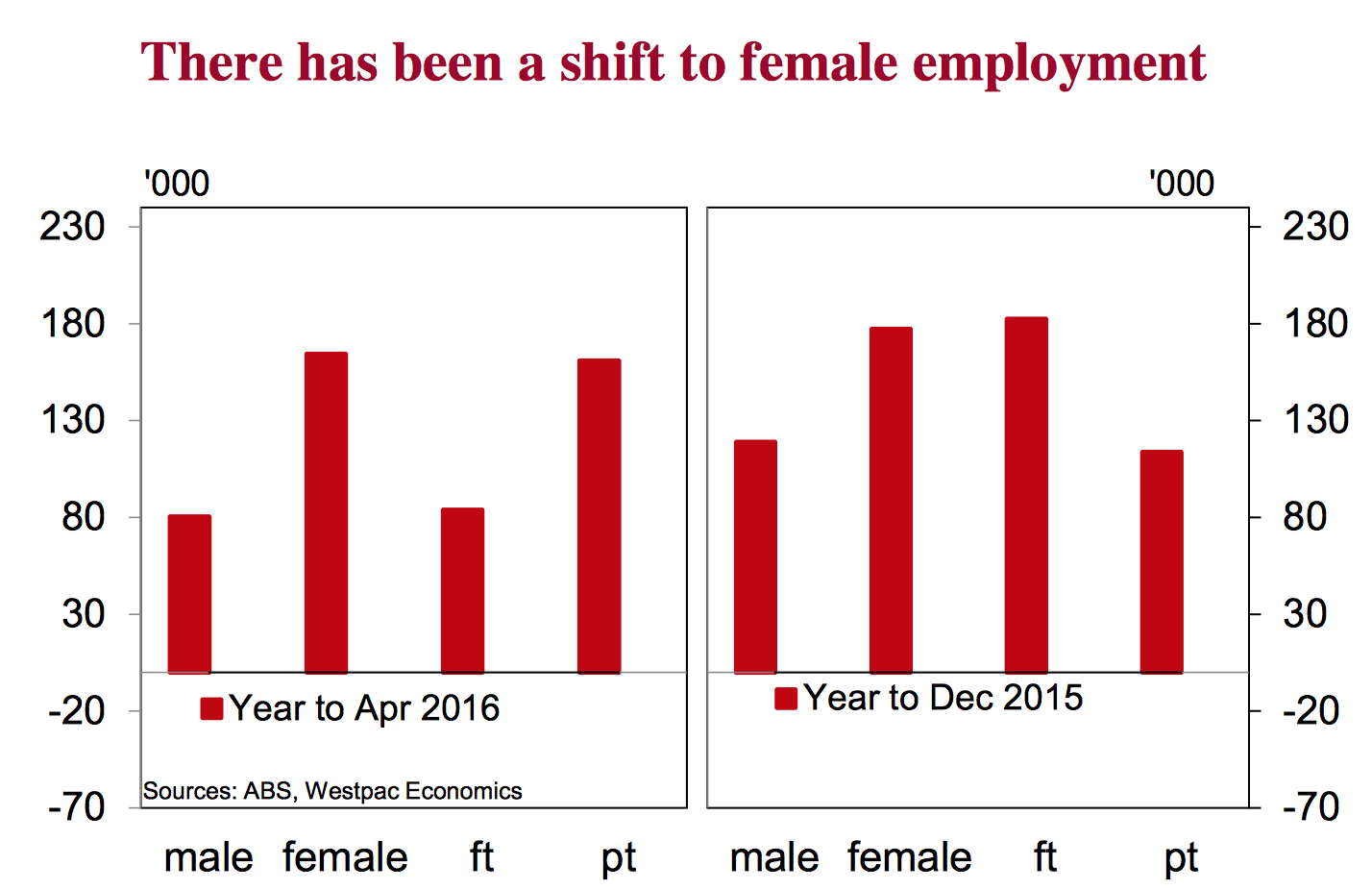

However, there are still some key issues that come to light from the current survey. First is further confirmation that employment growth is concentrated in female and part-time employment.

In the year to April, part-time employment has grown 160.9k (4.5 percent/yr) while full-time employment has growth 83.8k (1.0 percent/yr).

Given that full-time employment represents 69 percent of total employment that in the last year we have added twice as many part-time employees as full-time employees it really highlights the significant shift the economy is experiencing. Furthermore, female employment has grown 164.4k (3.1 percent/yr) in the year to April which is more than double the 80.3k gain (1.3 eprcent/yr) in male employment. As we have noted previously, this highlight the big shift in employment growth from the previously booming resources sectors to the more modestly growing services sectors as these sectors have a much higher proportion of female and part-time workers in their labour force.

The second key issue is that the participation rate was flat in April. From January 2014 there has been a trend rise in participation which has been driven mostly by a rise in female participation and in particular, a rise in female participation in NSW. However, participation appears to have peaked in the last quarter of 2015 averaging 64.1 percent, up from 65.0% in Q3, then moderate to 64.9 percent in the first quarter of 2016. Printing 64.9 percent in April is does look as if participation is holding around these new levels rather than drifting higher.

It is also worth noting that a return of a small trend decline in male participation has been key to this moderation. Female participation has been volatile of late but the trend appears to be holding the new higher level.

There was one indicator that suggests we should be cautious about being too optimistic about the near term employment outlook. Total hours worked fell 1.1 percent in April, following a –1.1 percent print in March, to be down 0.5 percent in the year. Compare this to the 2.1 percent/yr gain in total employment. As we illustrate in our chart, a negative print from growth in hours worked has tended to, but not always, been consistent with either softer growth in total employment and/or marginally led a dip in total employment. That is it could be a potential signal for softer employment numbers sometime in the next few months.

ustin Smirk is senior economist, Westpac Group and can be contacted here.