McGrath Estate Agents is still a buy: Bell Potter

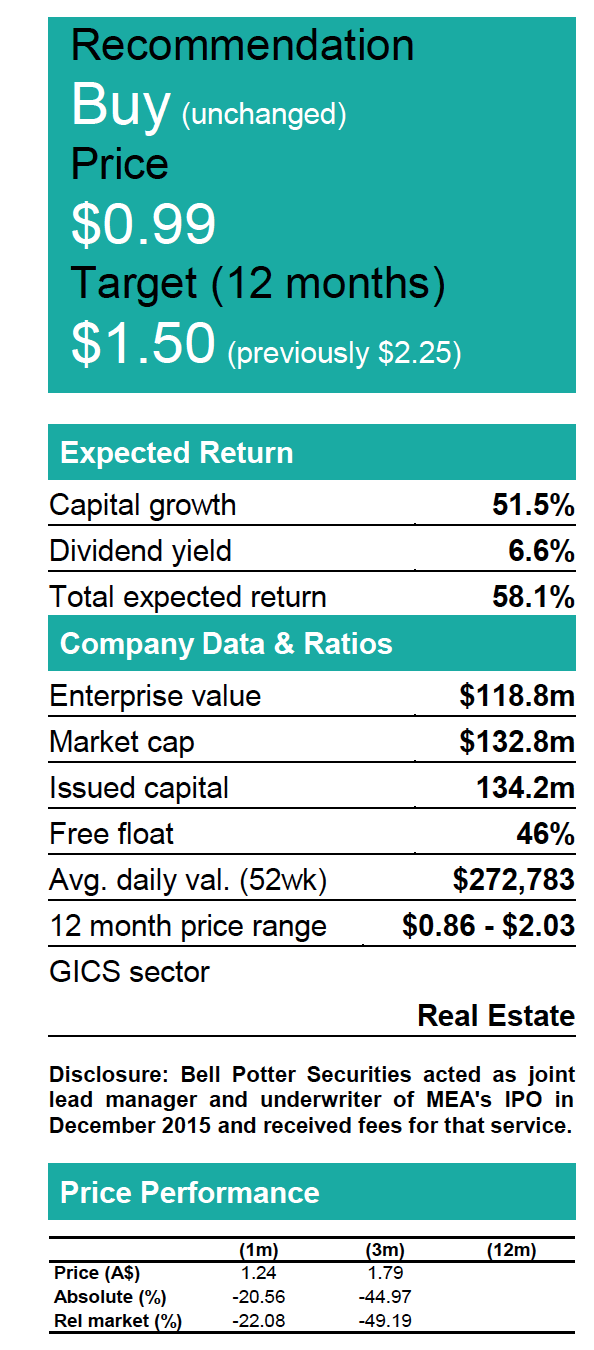

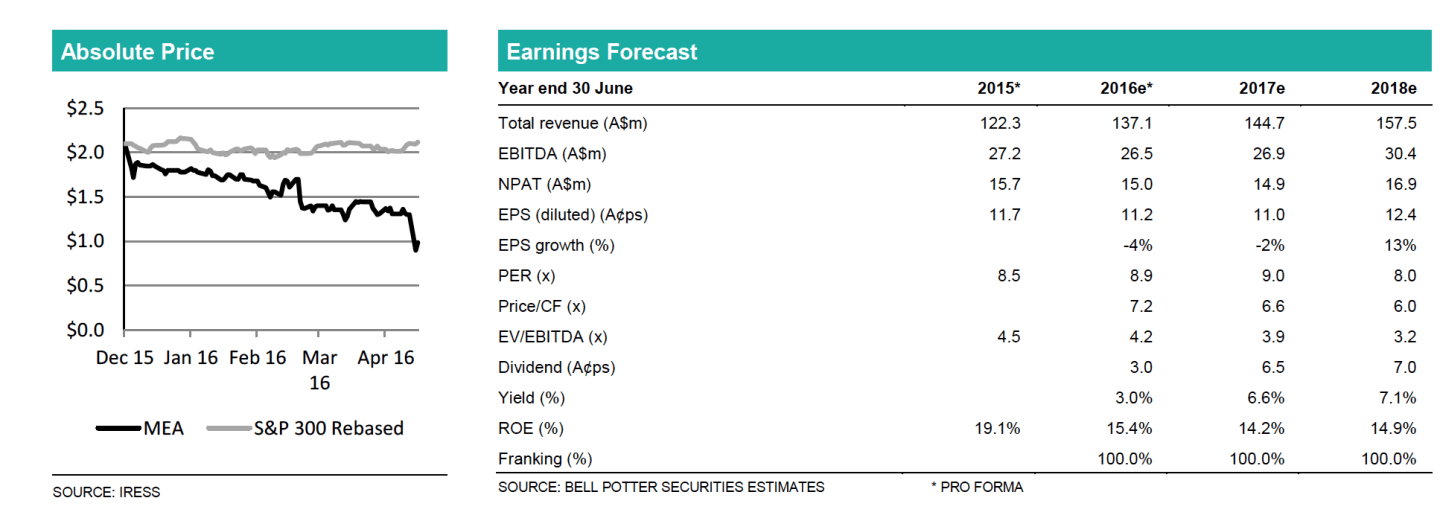

Bell Potter have retained its buy recommendation on its recent sponsored float, McGrath Estate Agents, but now suggest $1.50 is the 12 month price target for the stock that was trading at sub $1 in trade for almost of Tuesday. In Wednesday trade it has been bought at between 99 cents and $1.02.

The prior stock price target suggested only mid-last week by Bell Potter was $2.25, which would have seen it trade at above its December 2015 IPO price at $2.10.

However yesterday McGrath (MEA) downgraded its forecasts on the back of weaker than expected market conditions and now expects EBITDA to be $4-5m lower than the prospectus forecast.

"The downgrade is disappointing given the company was tracking to budget for the first nine months of FY16 and more so given it was largely attributed to the recently acquired Smollen Group," Bell Potter noted.

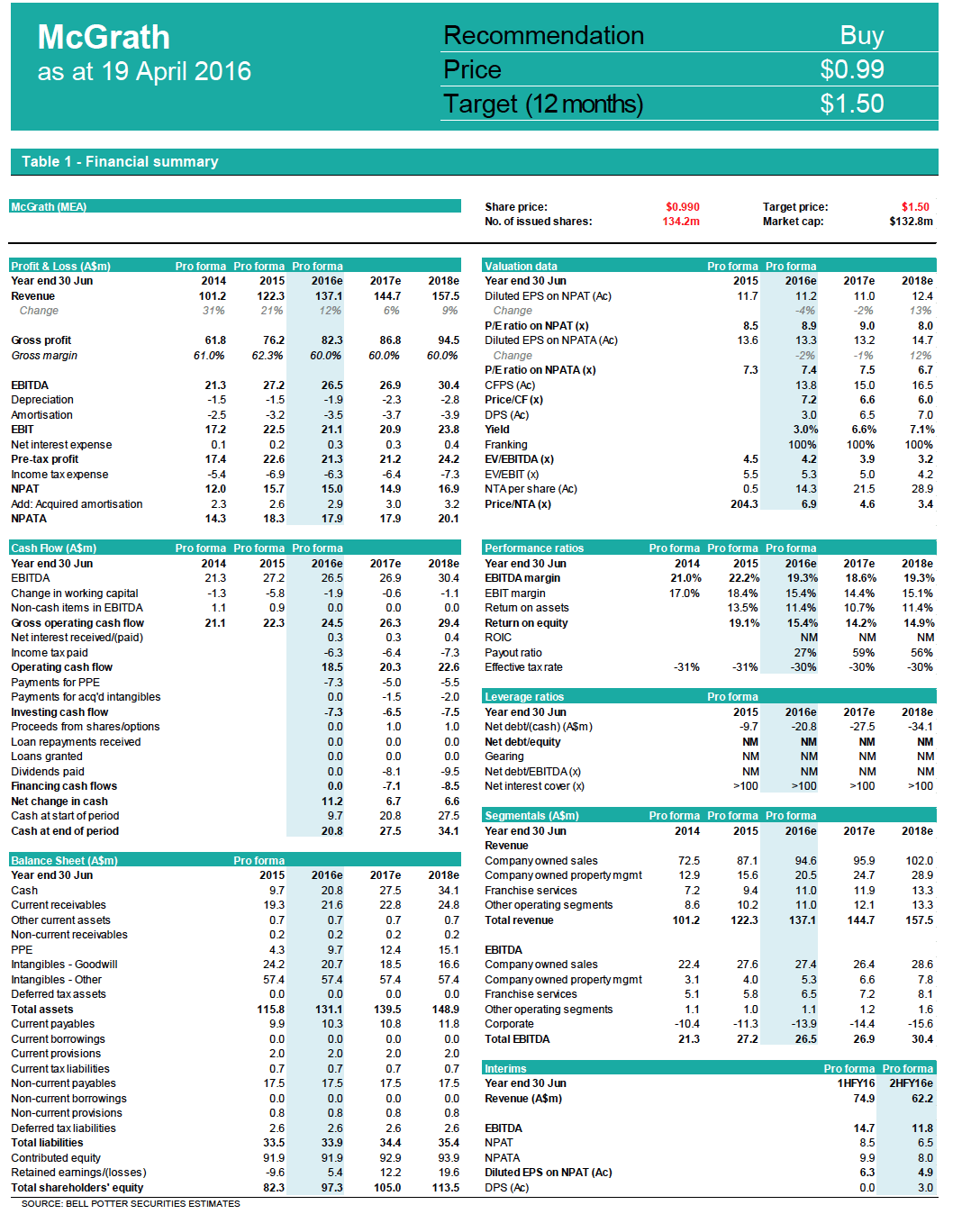

Bell Potter have downgraded its EPS forecasts in FY16, FY17 and FY18 by 15 percent, 25 percent and 24 percent respectively.

"Our revised FY16 EBITDA forecast of $26.5m is within the guidance range of $26-27m.

"Given the severity of the 4Q slowdown our earnings downgrades are higher in FY17 and FY18.

"We now expect FY16 revenue of $137m compared to the revised guidance range of $136-140m, and EBITDA of $26.5m compare to revised guidance of $26-27m.

"We have updated each valuation we use in the determination of our price target for the earnings changes as well as market movements and the time creep.

"We have also increased the discount we apply in the relative valuations from 7.5% to 20% and the beta we apply in the WACC calculation used in the DCF from 1.35 to 1.60.

"The net result is a 33% reduction in our price target from $2.25 to $1.50.

"We retain our BUY recommendation given a 12 month total return of greater than 15%," the stockbroker told clients today.

JP Morgan has also slashed its year-end McGrath share price expectations from $2.20 to $1.60.

The investment bank and broking house Bell Potter were joint lead managers and underwriters on the December McGrath float.

JP Morgan's new target price revalues the company at $215 million, 24 per cent lower than its $282 million December prospectus, which priced shares at $2.10.