Employment trends a precursor to property market trends: Simon Pressley

Employment trends can be a precursor to property market trends.

Having spent much of the last week analysing the latest employment data for locations right across Australia we’ve found some interesting discoveries which might shape property market performance over the next year or two.

At a base level knowledge of becoming an astute property investor is recognising that property is shelter. Wherever there is demand for a job there is demand for shelter. It is thereby logical to expect that wherever there is demand for more jobs in the future there will be demand for more shelter. This simple philosophy is something which is engrained in Propertyology’s research mindset and why we are full-time students of Australia’s economy.

Actual job numbers (as opposed to unemployment rates), drilling down to individual cities (as opposed to generic state data), and observing data trends over a time series provide us with interesting insight in to probable future performance of property markets.

There can often be a lag of 12-18 months before what’s occurring on the jobs front produces a material impact in real property data. In addition to economic development (jobs), the factors which have the biggest influence on property prices are affordability, sentiment, and supply.

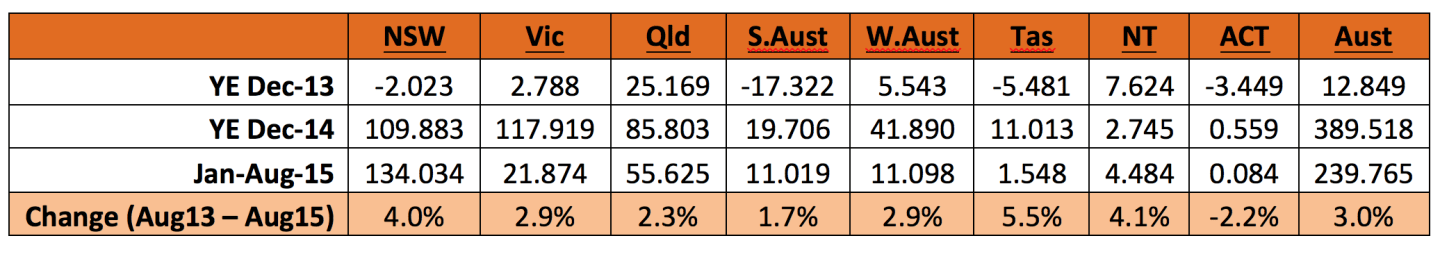

At a national jobs level, the data paints a much rosier picture than what the doomsayers elect to report. After creating a meagre 12,849 extra jobs during 2013, a credible 389,518 jobs were created during the 2014 calendar year. This has been backed up this year with 239,765 new jobs for the eight months to August (annualised 359,647). There has been an increase in total Australian jobs over the two years to August 2015 of 3%.

Against this national benchmark, it would surprise few to learn that New South Wales has outperformed with a 4.0% increase in jobs over the last two years. On the back of a raft of positive economic news over the last couple of years, Tasmania was easily the best performed state with a 5.5% increase in jobs growth. Northern Territory (4.1%) was the other state / territory to bat above the average.

After a strong job recovery year in 2014, Brisbane had a sluggish start to 2015 however, figures from the last few months suggest that momentum might be back. Propertyology’s forward estimate for Brisbane is for a steady performance although there is nothing suggesting that a boom is on the immediate horizon.

After a strong job recovery year in 2014, Brisbane had a sluggish start to 2015 however, figures from the last few months suggest that momentum might be back. Propertyology’s forward estimate for Brisbane is for a steady performance although there is nothing suggesting that a boom is on the immediate horizon.

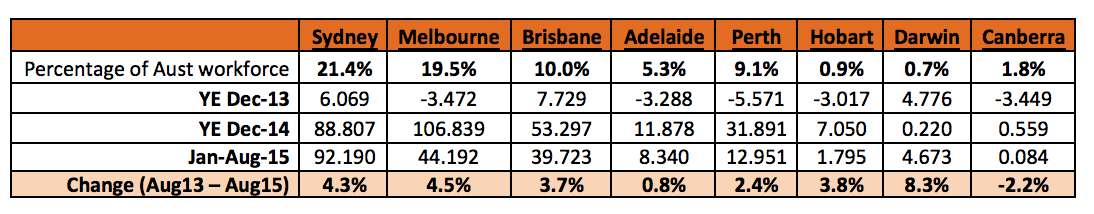

Darwin produced the biggest jobs growth of Australia’s eight capital cities with an 8.3% increase over the last two years. It is worth noting that much of this growth occurred during first half of this period and Propertyology’s research suggests that the trend could be reversed in the next year or so when construction on the Ichthys LNG project finishes. Perth (2.4% growth) and Adelaide (0.8%) were both below the national benchmark while Canberra has 2.2% less jobs now than two years ago.

The truly astute property investors don’t have the blinkers on and they recognise that 8 million Australians elect to live and work in alternative locations to capital cities. There are some really interesting job numbers unfolding in regional cities. Oh, and for those who missed the memo, housing is much more affordable in these locations.

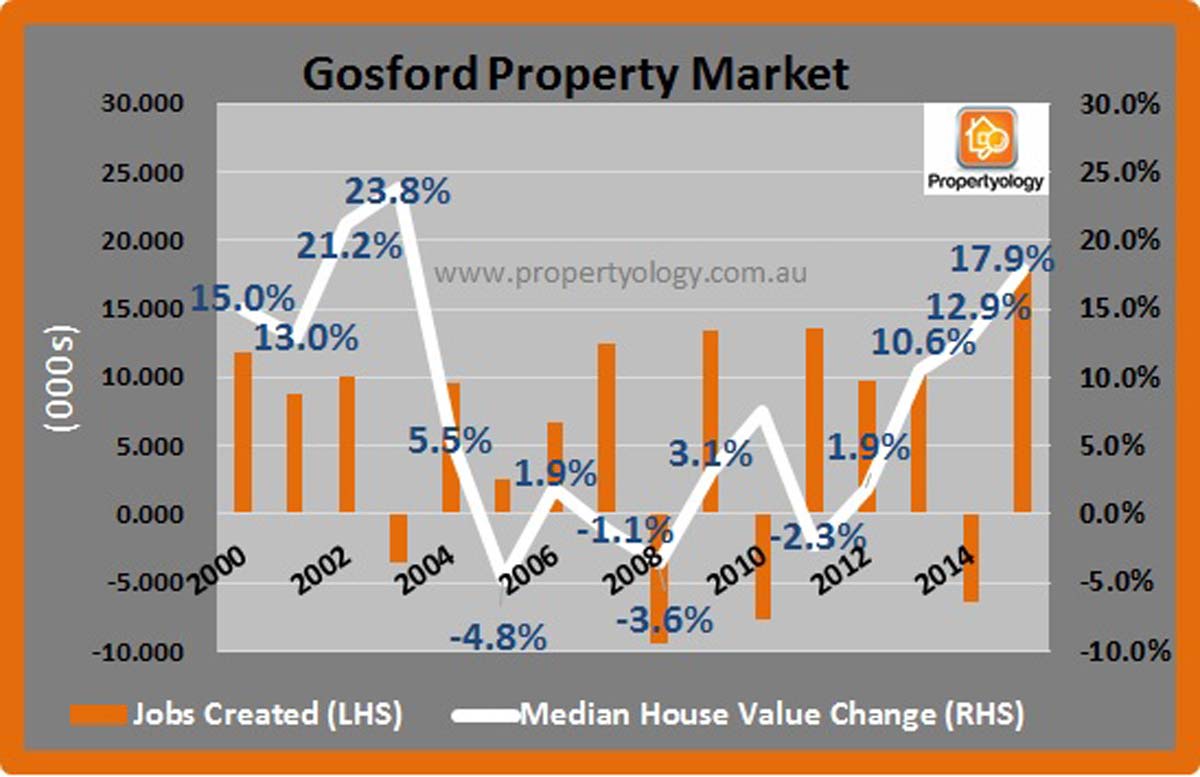

In New South Wales, Coffs Harbour (13.8%), Central Coast (12%), Illawarra (8.7%), the Mid-North Coast (8.0%), and Richmond / Tweed (5.0%) have all been superior to the State’s capital. And if you think they are impressive numbers, the biggest jobs growth in all of Australia over the last two years was in the Orana region with a 32.6% increase.

With 5.6% more jobs now than two years ago, the Hume region has been Victoria’s biggest improver. Most of regional Victoria is struggling though, with a decline in total job numbers over the last two years in the North West (19.2%), Bendigo (12.6%), Geelong (10.9%) and Ballarat (2.9%). In Tasmania’s North West zone, which includes Burnie and Devonport, there was a 16.7% increase in jobs while the North East (Launceston) has increased by 4.6%. Go Tassie!

Queensland has produced mixed results. As forecast by Propertyology at the start of this year, the Gold Coast economy is very strong – there’s been a 15% increase in jobs – boom! Ipswich (8.2%), Moreton Bay North and Wide Bay (both 7.7%) have also been solid improvers. A decline in total jobs has occurred in Mackay (9.7%), Logan (9.4%), and Townsville (7.1%).

It won’t surprise anyone that job losses have occurred in Western Australia’s Pilbara and Kimberly regions; Perth (where thousands of mining administration jobs are based) has also felt the brunt. But, WA is a big state and it’s not entirely about iron ore and gas. In the state’s south, tourism and agriculture have been drivers behind 13% jobs growth in Bunbury.

SIMON PRESSLEY IS MANAGING DIRECTOR OF PROPERTYOLOGY, AN REIA HALL OF FAME INDUCTEE, PROPERTY MARKET ANALYST, ACCREDITED PROPERTY INVESTMENT ADVISER, AND BUYER’S AGENT. PROPERTYOLOGY WORKS EXCLUSIVELY WITH PROPERTY INVESTORS TO PURCHASE PROPERTIES IN STRATEGICALLY CHOSEN LOCATIONS ALL OVER AUSTRALIA.