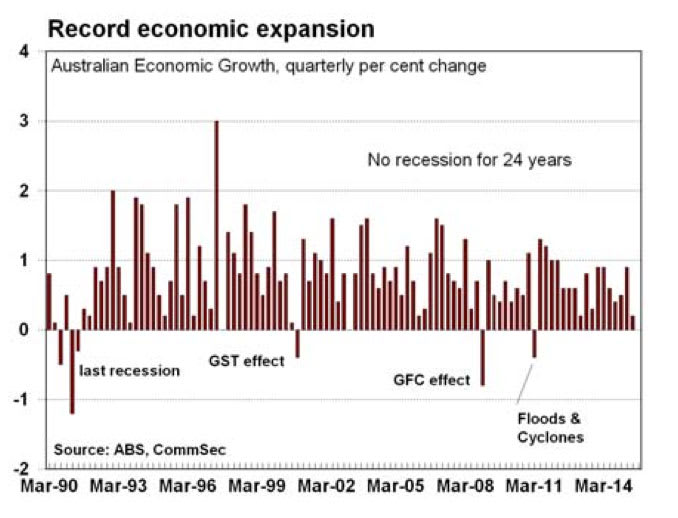

Australia's 24th consecutive year of growth: CommSec's Savanth Sebastian

The headline growth figures certainly look a bit on the soft side. But the breakdown of the growth components provides a much more interesting picture.

Government consumption provided the biggest contribution to growth while household consumption held up relatively well. The biggest drag was net exports which detracted 0.6 percentage points from growth. In addition the drawdown in inventories also crimped growth by 0.2 percentage points. Overall, not an “ideal” mix of growth drivers, but close enough for this point in the cycle.

The good news is that productivity is still rising while wage costs are falling and price pressures are restrained.

The economic growth figures are largely important as an historical record. But the data can’t tell us much about the here and now. And certainly the figures have limited use in telling us where the economy is going. But for the Reserve Bank the data serves as a base for its forecasts. It’s a case of ticking the figures off to ensure that there are no surprises.

While media commentary is likely to focus on the fact that growth is a touch on the soft side the key point is that Australia has completed 24 consecutive years of growth. It is an achievement to be celebrated. And interestingly the drawdown in inventories in the quarter may be as a result of the lift in domestic demand, and it does mean that businesses will be re-stocking shelves in coming quarters – supporting the overall growth figures.

Looking forward growth will continue to remain mixed over the next few months. The transition from mining to housing-led investment continues to be the dominant driver of activity. Although somewhat encouragingly the ongoing lift in consumer and business confidence is now translating through to a lift in risk appetite and investment plans.

CommSec tips the economy to grow by 2.75-3.00% over the coming year. CommSec believes that given the ongoing below trend growth outcomes, the Reserve Bank is unlikely to lift interest rates over the next year.

National Accounts:

Economic Growth: The economy grew by 0.2 per cent in the June quarter after a 0.9 per cent increase in the March quarter.

The non-farm economy grew by 0.2 per cent in the June quarter after a 0.9 per cent lift in the March quarter. Annual growth stands at 1.9 per cent.

Inflation: In terms of domestic price pressures, the household consumption implicit price deflator rose 0.7 per cent in the June quarter after a 0.3 per cent lift in the March quarter. Annual growth stands at just 1.4 per cent. Real non-farm unit labour costs rose by 1.1 per cent in the June quarter after falling by 0.6 per cent in the March quarter. Real non-farm unit labour costs rose by just 0.9 per cent over the year.

Industry sectors: Thirteen of the 19 industry sectors expanded in the June quarter. Rental, hiring and real estate services grew by 2.7 per cent, contributing 0.1 percentage points (pp) to growth in the quarter. Five other sectors contributed 0.1 percentage points to growth. The weakest sectors were Mining (down 3.0 per cent and removing 0.3pp from growth) and Agriculture, forestry and fishing (down 2.3 per cent).

Other points:

Household savings ratio rose. The household saving ratio lifted from 8.3 per cent to 8.8 per cent in seasonally adjusted terms in the June quarter. In trend terms household saving held steady at 8.6 per cent in the quarter.

Imports ease as a share of spending. The imports to sales ratio fell from 0.394 in the March quarter to 0.392 in the June quarter.

What are the implications for interest rates and investors?

The national accounts data is backward looking. But the data is taken into account by the Reserve Bank, serving as a base for forecasts. The Reserve Bank uses six-month annualised growth figures to ascertain how the economy is travelling. And in that context growth looks more robust annualising at around 2.2 per cent.

Importantly business confidence and conditions remain healthy and should support a lift in activity over the latter part of 2015.

At present there is no rush to lift or cut interest rates although the risks lie with another rate cut given the patchiness in the economy. CommSec believes interest rates will remain unchanged over the rest of 2015.