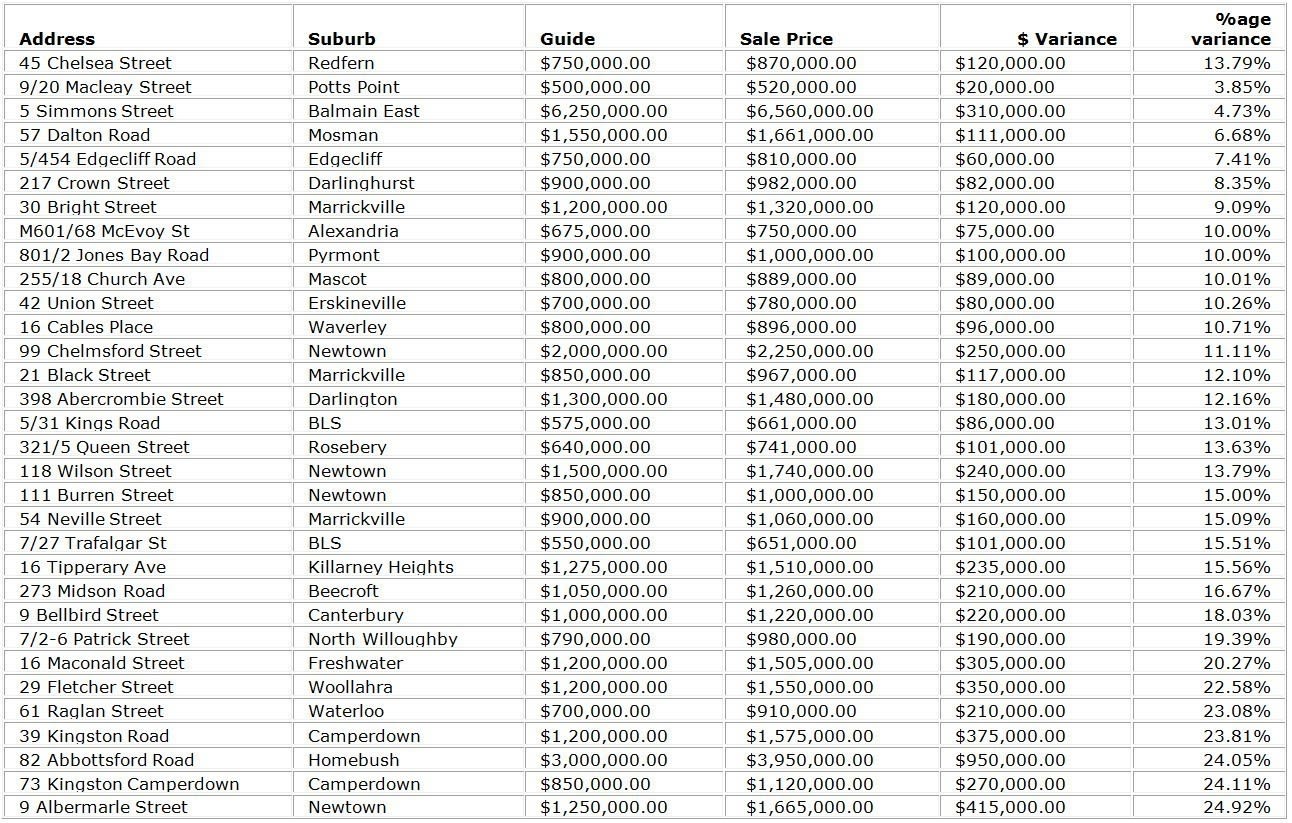

Add 14% to Sydney spring auction price guidance: Intelligent Property Services

GUEST OBSERVATION

The Sydney market shows no signs of slowing down with vendors and buyers showing equal enthusiasm in the nation’s largest property market. Despite the increase in numbers of would-be vendors rushing to schedule a pre-Christmas auction, we are seeing a consistently high clearance rate week after week.

Notwithstanding one weekend failing to reach the magic 80% clearance rate, October continued with some strong individual results across all pockets of the city. Given these strong results it should also be largely unsurprising that the variance between real estate agents’ price guides and the eventual sales prices also remains significant with the trend of underquoting appearing to continue unabated.

Intelligent Property Services (IPS) has reported for several months now on the consistent manner with which prospective buyers are being drawn to properties with enticingly low price guides and October has been no different.

With 32 auctions monitored the stats show an average variance of some 14.34%. Irrespective of the broad geographic spread in this month’s sample (Mosman to Canterbury) there were fairly similar results across the board. While slightly less than last month (we reported a 15.4% variance for September) some results simply demonstrate the depth of pent up demand across the Sydney market.

Whilst others may well simply suggest some creative price guides set by certain selling agents. One property that demonstrates this epidemic can be seen at 7/2-6 Patrick Street, North Willoughby. Despite a comparable unit selling in the block in 2013 for $860,000 it was listed with a price guide of $750,000, which was then revised to $790,000. With an eventual sale price of $980,000 – 19% variance on the agent’s original guide – it’s little wonder that buyers continue to experience frustration at every turn during their property search.

We suspect there’s no easy solution to this. Whilst Queensland may have banned the publication of auction price guides and some in NSW are calling for auction reserve prices to be published prior to auction in order to provide a more transparent process, we’re quite sure that Sydney buyers would welcome a bit more pricing accuracy from the very same sales agents who openly advertise the fact they’re the area “experts”.

Click to open in new window:

In September we noted it should come as little surprise that the level of underquoting by sales agents has continued into the busy spring selling season.

The results are fairly consistent from last month’s findings. In August IPS reported that the average variance between the quoted price and sales price at auction was 17.6%. For September 2014 we have monitored a total of 27 sales and found agents are underestimating their properties by an average of 15.14%.

As always buyers need to factor this into their thinking and, ultimately, conduct their own research as to the likely market value of any property being considered for purchase. We see no particular trend from suburb to suburb (with auctions from Millers Point to Earlwood monitored) and sales agencies, both big and small, are all guilty – inadvertently or by design – of providing enticingly low price guides to prospective buyers.

The biggest variation recorded this month was 42% under for a run-down warehouse at 164-166 Wilson Street, Newtown in Sydney’s inner west. Even towards the tail end of the sales campaign a price guide of $1 million plus was being given despite the property selling for $1,725,000.

Another prime example of unfairly building up buyers’ expectations was at 7/40 Terrace Road, Dulwich Hill. The price guide of “$420,000 plus” for a renovated two bedroom, one bathroom, one car strata apartment in popular Dulwich Hill was always going to attract the crowds. More than 92 people attended the first open house on Saturday and, by Tuesday the agent had received between 15 and 20 written offers from hopeful buyers. Current interest is reported to be around $530,000, which is more than 26% above the original guide.

It just goes to show, unfortunately for buyers, that this experience is not limited to the auction process alone.

With pent up buyer demand increasing off the back of abnormally low spring stock volumes, we expect this practice will continue to frustrate and confuse buyers making the entire buying process all the more challenging.

Ramon Mitchell is the general manager of Intelligent Property Services, a specialist residential property advisory firm with buyers advocacy division.