Nickel could be behind the next mining boom: Here are the areas set to benefit

GUEST OBSERVATION

Rising world demand for gas, iron ore, and coal have already made a mark on several property markets across Australia over the last four to five years. Propertyology’s continuous investment in property economics has us questioning whether another commodity, nickel, might soon create other property investment opportunities.

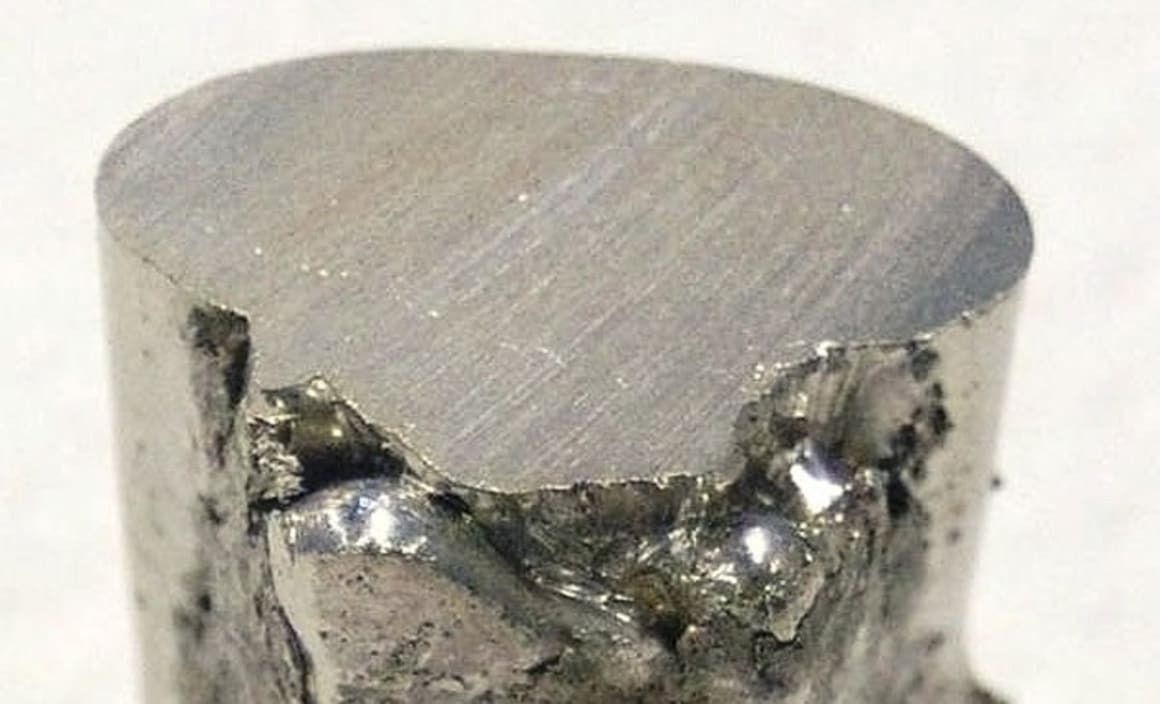

While not as well known as other metals, nickel plays an important role in modern life. When mixed with other metals it helps create strong alloys that won't rust, can withstand high and low temperatures, and can be easily shaped into anything from thin wires to flat sheets.

One such use of nickel is adding it to iron to make stainless steel. Just ponder: with the existing western world and the fast rising Asian middle class, how much extra demand will there be for cooking utensils and kitchen equipment, surgical instruments, marine equipment, the construction industry, crank-shafts and axles in cars, washing machines, aircraft engines? What opportunities will this create for businesses with links to nickel? Where might all the new jobs be created?

Ponder this also: rising petrol prices, a push for cleaner energy and more advanced technology is expected to result in a major ramp up in production of battery-powered cars. It doesn’t require rocket science to figure out that a similar increase in production of portable devices such as smart phones and laptops is also expected to boom. Rechargeable batteries for mobile phones, cars, clocks, kid’s toys, and remote controls require nickel.

Get the picture? Now ponder this...

Australia is currently the world’s fourth largest producer (11.4%) of nickel, behind Russia, Indonesia and Philippines. If world demand for nickel intensifies as forecast, it might become even more prevalent that Australia is ranked number one in the world for nickel resources with 24.4% of known reserves.

Stock market analysts, Credit Suisse, recently placed a couple of Australian-based nickel mining companies on their ‘watch list’. Western Australia (refer Kalgoorlie) has the lion’s share of nickel resources. Other less significant resources are located in the central west of New South Wales, far northern tip of Tasmania, south of Gladstone and near Townsville. Property investors might consider placing a couple of these locations on their watch list, too.

Source: Geoscience Australia, 'Australia's Identified Mineral Resources 2013'.

Buying an investment property in a remote location because of the potential for a single mine is something that Propertyology would consider to be very speculative. However, when we combine economic sustainability with some future upside we often get a really astute investment decision which stands out from the rest of the pack.

Sometimes the best investment results over the longer-term come from buying in the towns nearby to the mines, although an understanding of the higher volatility from commodity price fluctuations is important. In different situations the wisest investment might be in the large city (capital or regional) which will supply most of the goods and services to the smaller towns.

Perth, for example, has one of only two existing major nickel refineries in Australia. The BHP-owned Nickel West refinery at Kwinana processes most of Western Australia’s nickel and you’d have to think that there is considerable potential to increase upon its current 2,000 employees.

QCG Resources has just acquired the Avebury nickel mine in Tasmania for $40 million. The mine closed in 2009 due to floundering nickel prices. Due to the aforementioned rising demand for nickel, the commodity price has increased by a significant 34% since Christmas and QCG clearly see an encouraging outlook for nickel.

Clive Palmer will be as excited as anyone about the forecast demand for nickel. He may be controversial, however he didn’t become a billionaire by chance. Palmer owns the Queensland Nickel Refinery in Townsville. Queensland Nickel imports the commodity from mines in the Pacific, processes it, and then exports it out as a refined product. Whilst nothing has materialised as yet, Palmer has proposed a $1 billion upgrade of the refinery and supporting infrastructure. If that goes ahead there will be significantly more than the existing 1,000 people employed at the Townsville refinery. Townsville already has a lot to offer for property investors.

Palmer is also the major shareholder of Gladstone Pacific Nickel Limited (GPNL) which has proposed the establishment of a $3.5 billion nickel and cobalt refinery adjacent to the existing deepwater Port of Gladstone. GPNL already owns a nickel mine at Marlborough, near Gladstone. In spite of Gladstone’s current property market downturn, population growth forecasts are very strong and the surplus property stock will be soaked up before too long in Australia’s industrial powerhouse.

The future outlook may well be one of those ‘upside’ factors for Gladstone and Townsville – both are very strong regional cities with incredibly strong long-term property investment fundamentals.

Simon Pressley is managing director of Propertyology, a full-time property market analyst, accredited property investment adviser, and Australia’s (REIA) Buyer’s Agent of the Year (2012+2013+2014).

Picture courtesy of Wikimedia Commons.