How my Aussie property price predictions for 2014 are tracking

Forecasters often back off from their previous predictions, but there's not really too much point in that.

The very concept of accurately forecasting dwelling prices is flawed, since it is not possible to anticipate future event which impact the economy.

In the absence of much interesting local news, I'll take a look at how Aussie property prices are tracking against our 2014 forecasts, by benchmarking against RP Data's Daily Home Value Index for the year-to-date.

Below is what we came up with for 2014. It may also be worth reading here the rationale behind our predictions, in particular why we came in lower than most, if not all, other forecasters.

2014 forecasts

Hobart -1% to 2%

Canberra -1% to -4%

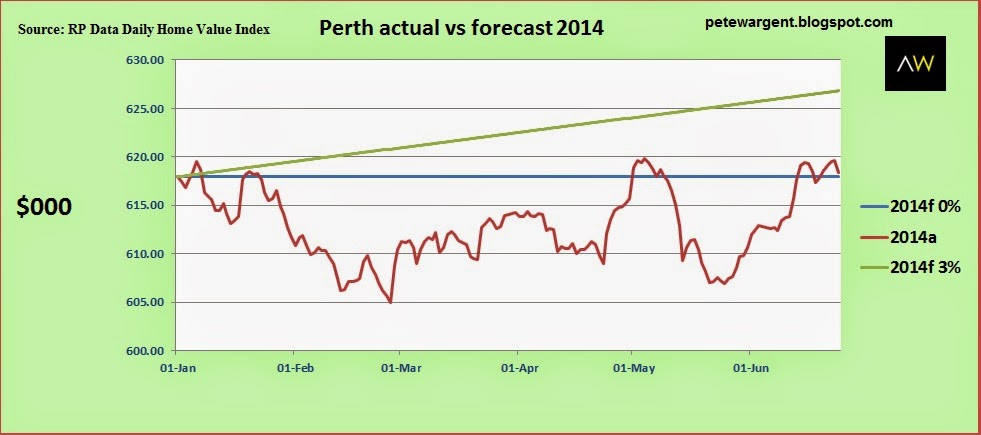

Perth 0% to 3%

Adelaide 0% to 3%

Brisbane 2% to 5%

Melbourne 2% to 5%

Sydney 6% to 9%

The year to date...

The RP Data Daily Home Value Index does not cover daily figures for Hobart or Canberra, but we note that according to Residex prices have been flat or falling moderately, in line with expectations.

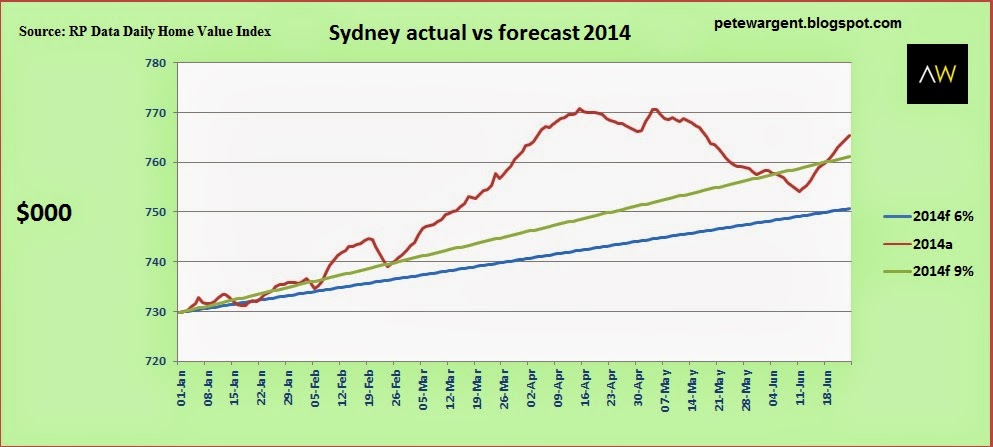

Sydney

Our strongest 2014 forecast was for 6% to 9% capital growth in Sydney.

The home value index has historically recorded seasonal dips in May, the reasons for which have been well documented elsewhere.

We should now be through that seasonal dip and the outlook for Sydney suggests further price growth in 2014, 2015 and 2016 according to BIS Shrapnel.

I tend to agree that we'll likely ongoing growth for Sydney but at a slower pace than has been seen in the last 12 months.

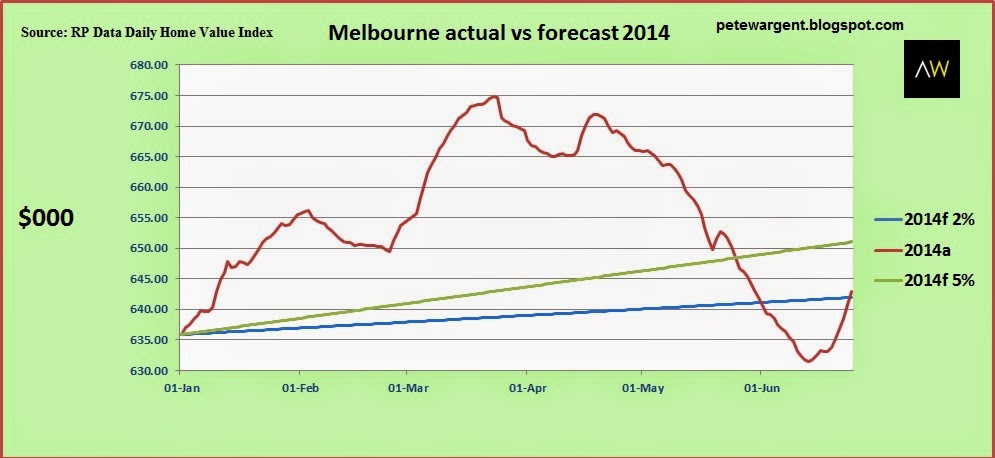

Melbourne is a tricky one, the data always seems to imply higher vacancy rates and plenty of stock, and yet dwelling prices have often defied the data in this regard, presumably due to much of the new stock being less sought after.

We opted for 2% to 5% capital growth om the grounds that the market has already been heated for some years now. Our prediction was lower than what others expected.

The daily home index has been a wild ride for Melbourne, first "booming" and then "busting" in 2014.

The net position is that the market is tracking at around a 2% annualised pace in 2014, which is consistent with the bottom end of our forecast range.

Some talk of the Melbourne market having peaked around in media circles. Watch this space.

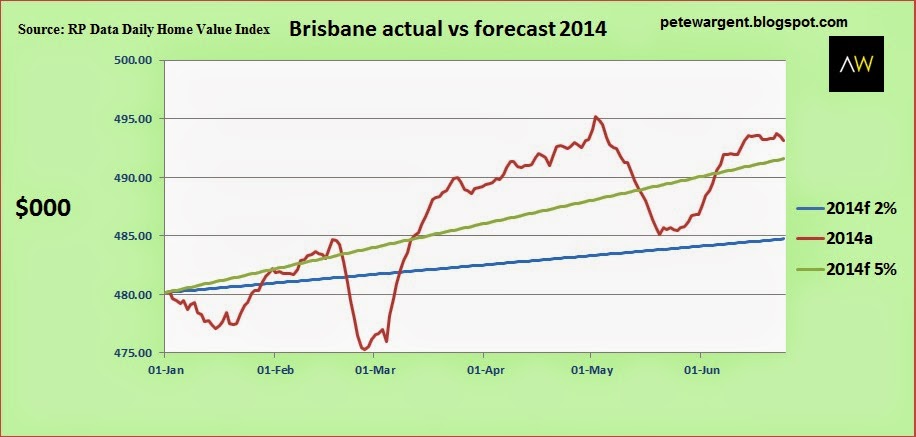

Brisbane

The market with the strongest three year prospects according to BIS Shrapnel who forecasts 17% capital growth over that time.

For similar reasons we plumped for 2% to 5% growth in 2014 for Brisbane and Gold Coast.

Tracking quite nicely.

Adelaide

It's been a recurring theme in Australia that every year the experts predict a "boom" in Adelaide but it never comes to pass.

To be blunt, I'm not a fan myself due to the weak and faltering local economy, a brain drain to other states, weak state population growth and rising unemployment, as documented here many times.

In fact, I will always be wary of experts recommending that you invest into an economy where unemployment is rising towards 7%, particularly if they are vested interests in that market.

If net jobs growth returns then fair enough, but until that time...pass.

For these reasons, our forecast was only for 0% to 3% capital growth, which may have been unpopular, but with the local press reporting an increasing number of foreclosures, I doubt we'll be too far off track with that prediction.

Perth

2013 was a great year for Perth, driven by the strongest rate of population growth in Australian capital cities.

You can visit AllenWargent property buyers (London, Sydney) or Pete's blog.

His latest book 'Four Green Houses and a Red Hotel' is out now.