NAB the last of the big four to announce credit card support: Finder.com.au

National Australia Bank is the latest lender to announce changes to help Australians impacted by COVID-19, dropping its Low Rate Classic Card by 100 basis points to 12.99%.

It also announced other support measures including waiving late payment fees and reducing the minimum monthly payments on all cards for the next three months.

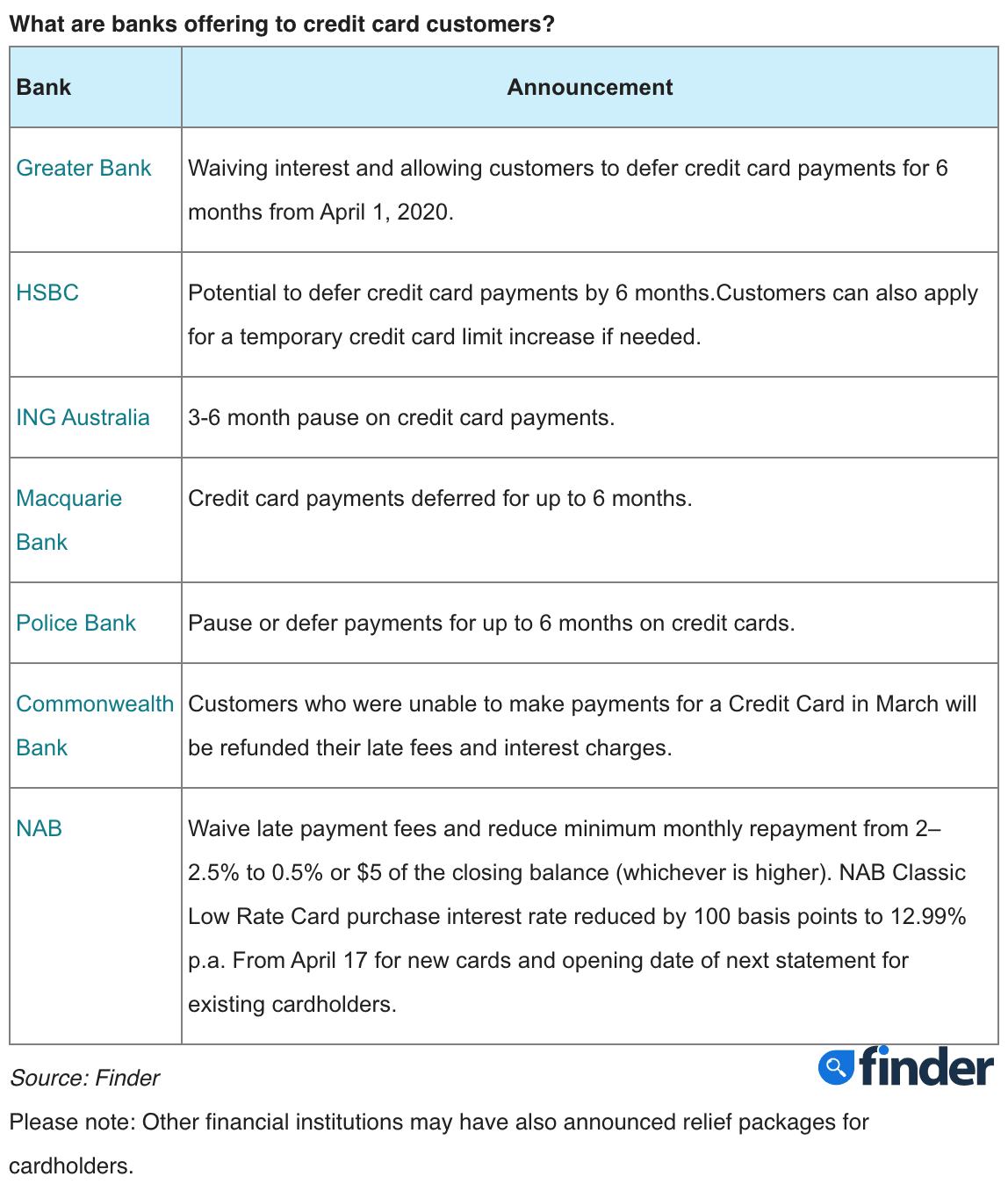

NAB joins at least six other lenders that have announced support to credit card customers including the Commonwealth Bank. Westpac and ANZ have not announced specific measures for credit card customers.

Despite some lenders announcing credit card support, credit card holders are still the hardest hit as lenders hold onto rate cuts.

Since the GFC in 2008, the cash rate has fallen by 6.5 percentage points to 0.25%, while standard credit cards have increased by 1.37 percentage points on average, and low rate cards have increased by 1.22 percentage points (according to RBA data analysed by Finder).

While the cash rate has been falling since 2011, standard credit cards have increased on average by 0.25 percentage points, and low rate cards fell by just 0.26 percentage points. This is compared to the cash rate falling by 4.50 percentage points since November 2011.

Bessie Hassan, Money Expert at Finder said, “While it’s great to see more help by our big banks and other lenders, it’s only a short term fix for a major debt issue in Australia."

“We currently have a combined $48.7 billion in credit card debt and this number is expected to rise as millions of Australians are being financially impacted by the coronavirus."

“The Finder app shows that Australians are spending more money using their credit cards while paying less of the balance off. This is a worrying trend. Short term relief is a great start but cardholders need to remember that it’s not free money and they will need to pay it back eventually."

“With insights from the Finder app also showing Australians have spent an extra $13.5 billion in March alone from panic-buying, now more than ever we need to control our spending."

“If you do have credit card debt that you’re struggling to pay off, interest-free balance transfers could still be a better value option than relying on your lender’s relief package. Download the Finder app and it will work out how much you can potentially save with a balance transfer," Hassan concluded.